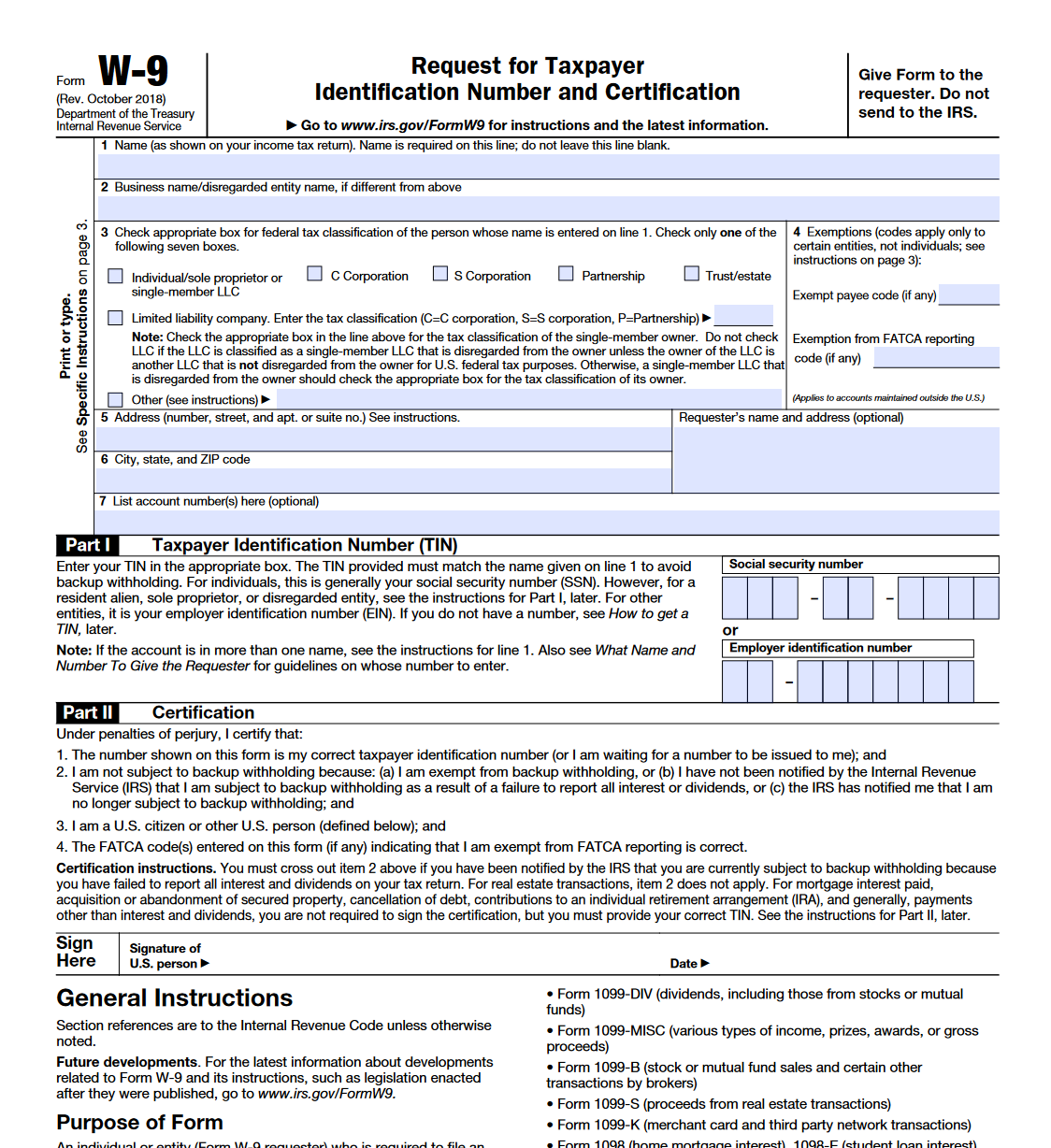

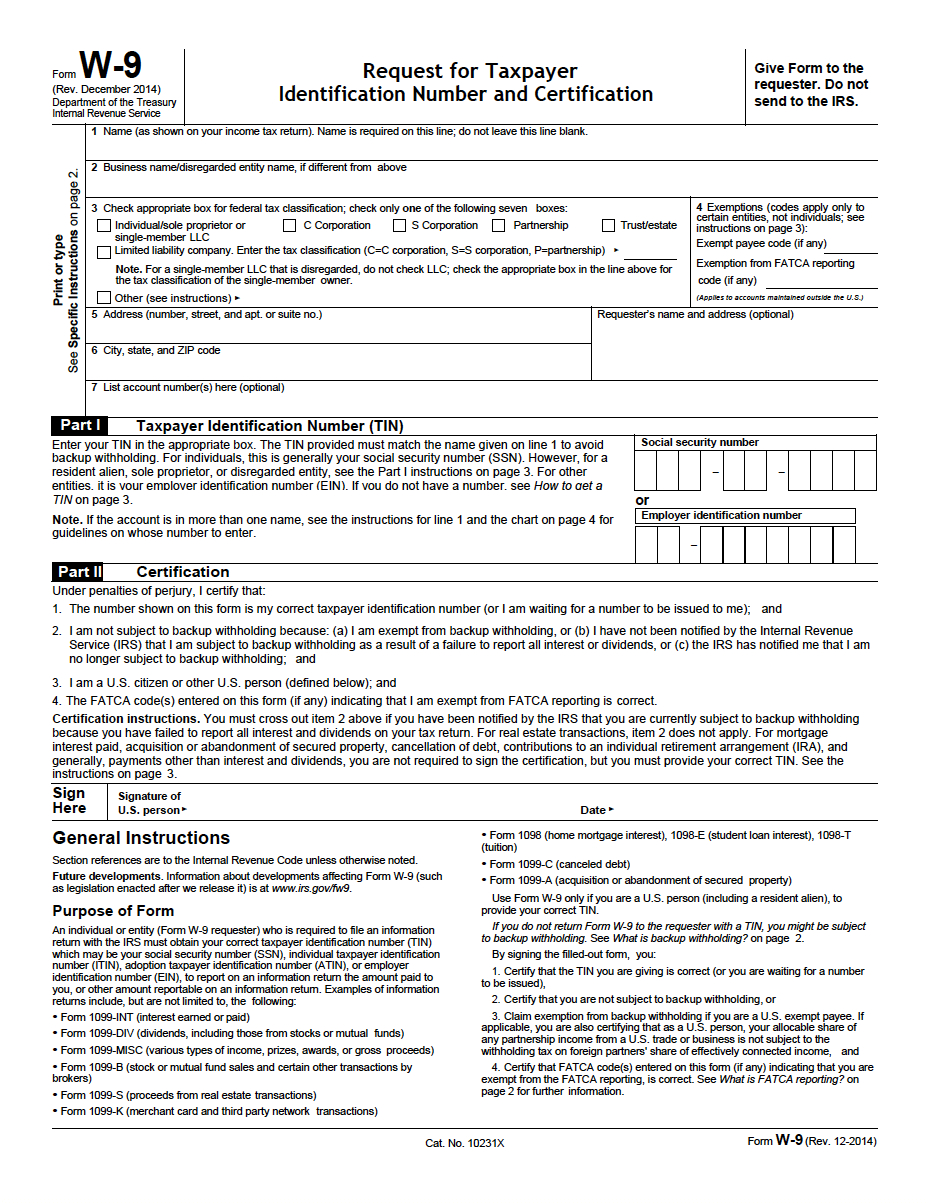

Fillable Online Form W 9 Request For Taxpayer Identificati

Irs Form W 9 Request For Taxpayer Identification Number And See pub. 515, withholding of tax on nonresident aliens and foreign entities. the following persons must provide form w 9 to the payor for purposes of establishing its non foreign status. in the case of a disregarded entity with a u.s. owner, the u.s. owner of the disregarded entity and not the disregarded entity. Information about form w 9, request for taxpayer identification number (tin) and certification, including recent updates, related forms, and instructions on how to file. form w 9 is used to provide a correct tin to payers (or brokers) required to file information returns with irs.

W 9 Request For Taxpayer Identification Number And Certification Pdf Chapter 4. for chapter 4 purposes, form w 9 is used to withhold on payments to foreign financial institutions (ffi) and non financial foreign entities (nffe) if they don't report all specified u.s. account holders. if an account holder fails to provide its tin, then the withholding rate is 30%. tin matching e services. Form w 9 is one of the easiest irs forms to complete, but if tax forms make you nervous, don’t worry. we’ll walk you through the proper way to complete it. step 1: enter your name as shown on. The w 9 is an internal revenue service (irs) form in which a taxpayer provides their correct taxpayer identification number (tin) to an individual or entity (form w 9 requester) who is required to file an information return to report the amount paid to a payee, or other amount reportable on an information return. The first section of form w 9 is where you must provide information about yourself and your federal tax classification, including details of exemption if it applies to you. line 1: enter your name as it appears on your income tax return. line 2: enter your business name or disregarded entity name if it is different from the name that you.

Comments are closed.