Financial Planner Definition Steps Roles Examples Vs Advisor

Financial Planner Definition Steps Roles Examples Vs Advisor A financial planner is a professional who helps individuals attain medium and long term financial goals over a predetermined period. there are seven steps involved in the planning process: understanding, identifying, analyzing, developing, presenting, implementing, and monitoring the clients' goals. financial advisors are professionals who. Key takeaways. a financial planner is a professional who helps individuals and organizations create a strategy to meet long term financial goals. "financial advisor" is a broader category that can.

Financial Advisor Vs Financial Planner Overview Differences A financial planner generally takes a more comprehensive, long term approach to money management. while they often hold the same licenses and carry out the same functions as financial advisors. A financial planner is a special type of financial professional who leverages advanced knowledge and tools to create personalized financial plans for clients. these encompass everything from. A financial advisor manages a client’s investment portfolio. a financial planner provides more comprehensive financial services. look for an advisor or planner who is a fiduciary. there may come. Key takeaways. 1. any financial expert giving advice can call themselves “advisor”—but many also specialize in specific areas of finance. 2. a financial planner develops a plan to help you meet specific financial objectives. 3. which professional you choose depends on your goals and their services.

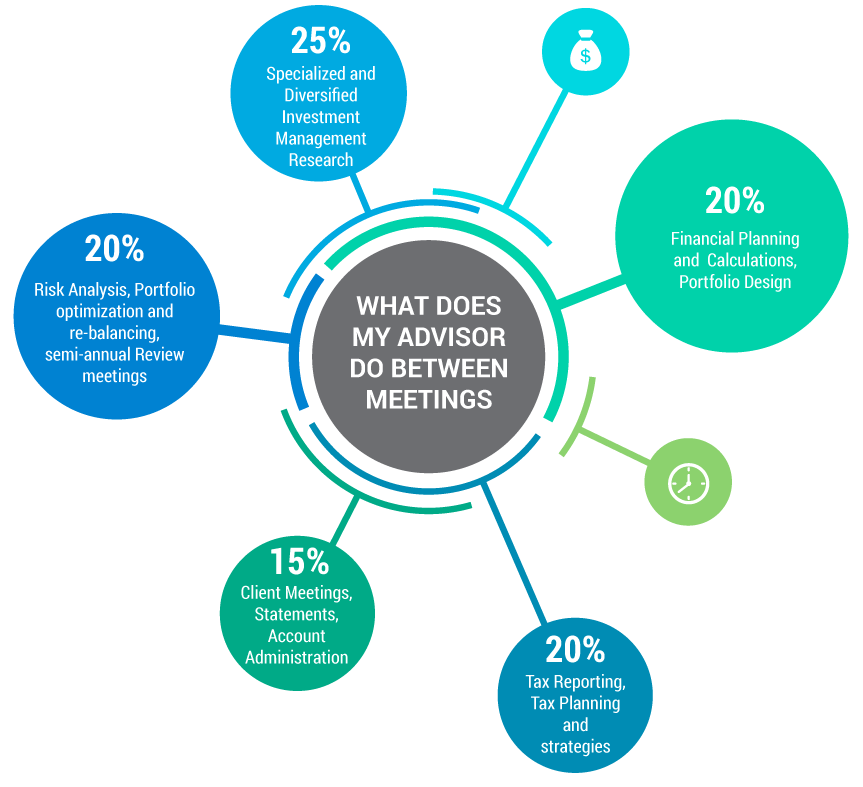

Financial Advisor Or Financial Planner What S The Difference A financial advisor manages a client’s investment portfolio. a financial planner provides more comprehensive financial services. look for an advisor or planner who is a fiduciary. there may come. Key takeaways. 1. any financial expert giving advice can call themselves “advisor”—but many also specialize in specific areas of finance. 2. a financial planner develops a plan to help you meet specific financial objectives. 3. which professional you choose depends on your goals and their services. Financial planners may typically receive payment with a flat fee, commission or bonus, while financial advisors may receive an hourly rate, commission, a quarterly or annual retainer, percentage. A financial advisor may specialize in specific product offerings, such as stocks or bonds, and help clients invest accordingly. on the other hand, a financial planner provides advice by looking at all aspects of an individual’s finances, including budgeting, taxes, investments, estate planning, and insurance.

Financial Planner Vs Financial Advisor By Fabio Ventolini Medium Financial planners may typically receive payment with a flat fee, commission or bonus, while financial advisors may receive an hourly rate, commission, a quarterly or annual retainer, percentage. A financial advisor may specialize in specific product offerings, such as stocks or bonds, and help clients invest accordingly. on the other hand, a financial planner provides advice by looking at all aspects of an individual’s finances, including budgeting, taxes, investments, estate planning, and insurance.

Financial Planner Vs Financial Advisor Youtube

Comments are closed.