Financial Planning Prepare For Your Later Years Hmhm

Financial Planning Prepare For Your Later Years Hmhm The financial planning of the bridge of life plan is a very important, but often overlooked area. it’s very beneficial for your financial adviser and elder law attorney to work together. they can craft a plan to take potential future care giving needs into account. stay tuned until next time for more keys to your bridge of life financial plan. How to avoid getting overwhelmed by the process. 060 interview: negotiating family caregiving expectations after hospitalization. 015 interview: practical advice for family caregivers & next step in care. 017 interview: paying for long term care & other family caregiving challenges. 036 – interview: minimizing family conflicts & supporting.

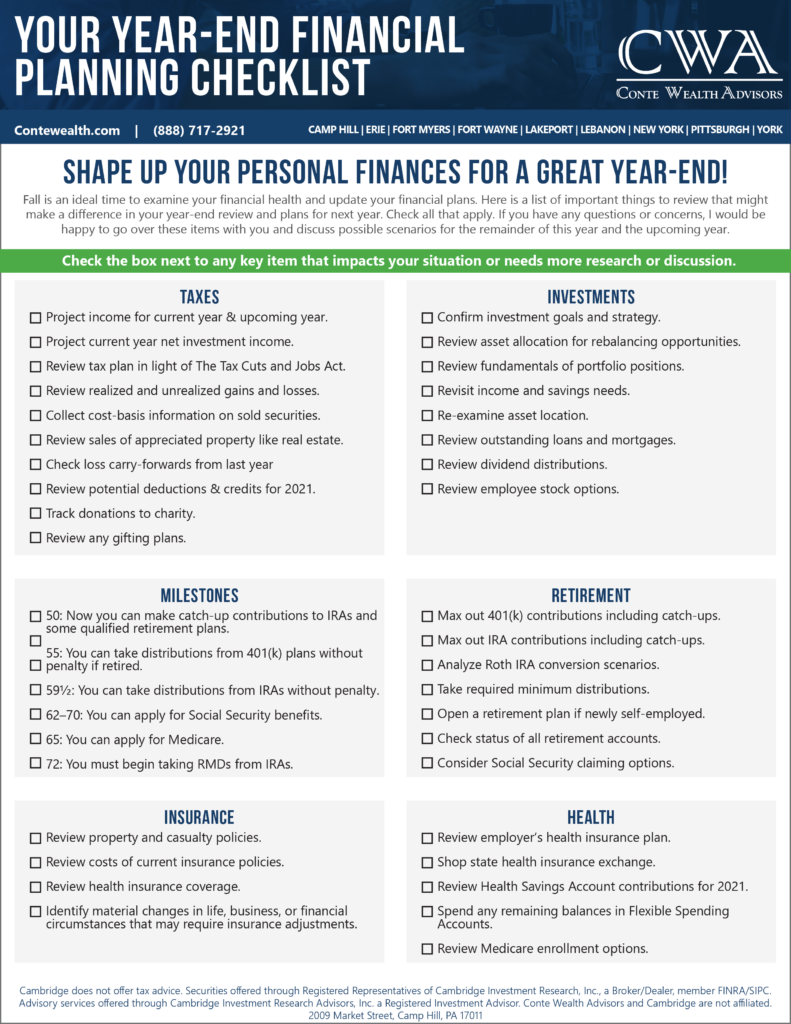

Your Year End Financial Planning Checklist Conte Wealth Retirement planning is all about ensuring financial independence in your later years. it involves estimating your retirement income needs based on your desired retirement lifestyle, healthcare costs, and life expectancy. your financial planner can help devise strategies to build the required corpus through suitable investment and savings plans. A financial plan is more of a marathon than a 50 yard dash. everyone’s financial roadmap is ever evolving. periodic reexamination of your progress can help you make sure you don’t merely react. 1. establish a routine. allocate some time each week or, at minimum, once a month, unfailingly, to do a financial checkup. make it a coffee date with yourself, or put on some nice music, grab a warm cup of tea at home, and spend some time checking in on things. 3. evaluate and refine your financial goals for the new year. with a clear understanding of your assets and cash flow, you can review your goals, assess their attainability and make any necessary tweaks to your plan, including reducing expenses or increasing necessary savings.

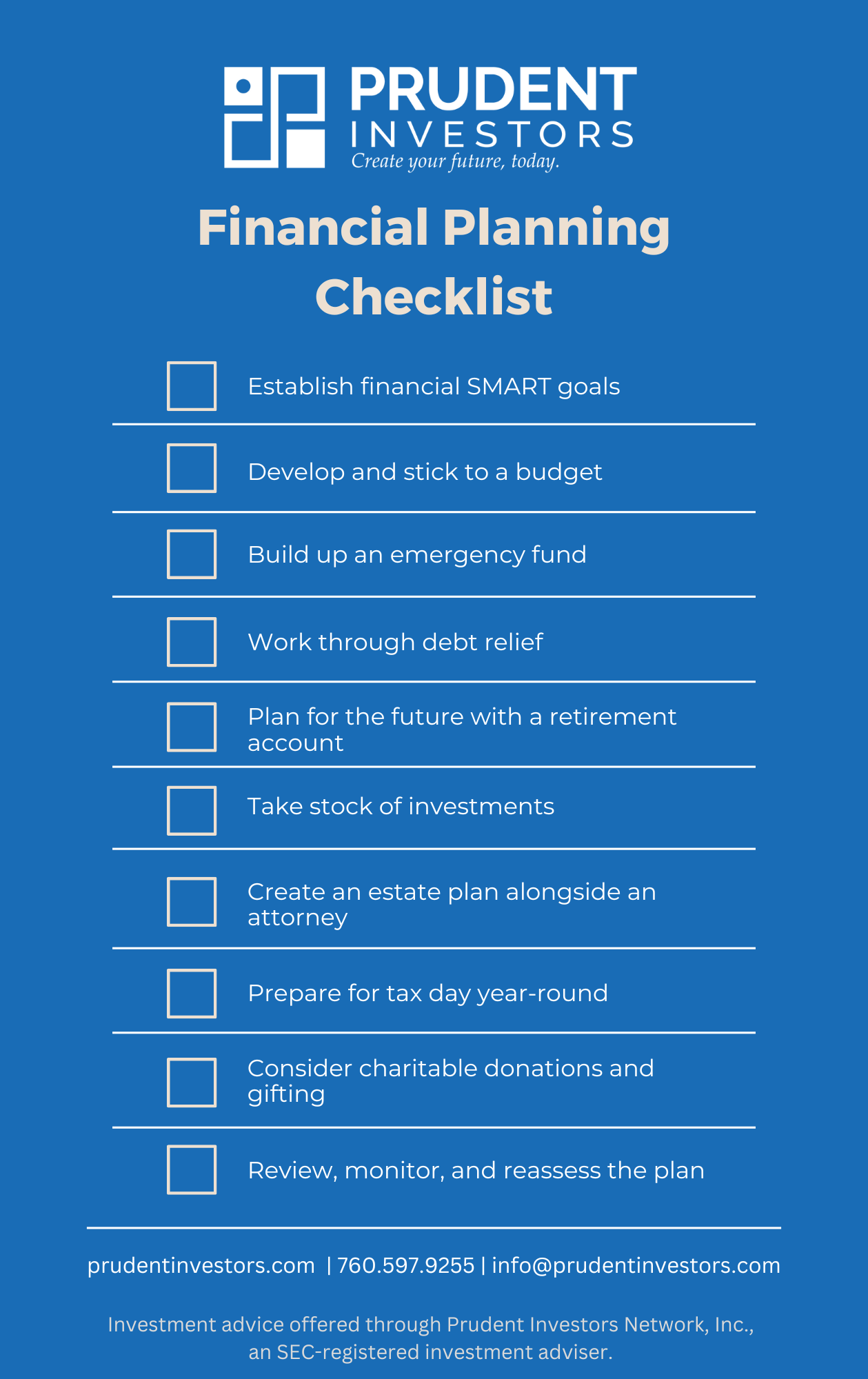

What Are The 5 Steps Of Financial Planning At Carmen Gunn Blog 1. establish a routine. allocate some time each week or, at minimum, once a month, unfailingly, to do a financial checkup. make it a coffee date with yourself, or put on some nice music, grab a warm cup of tea at home, and spend some time checking in on things. 3. evaluate and refine your financial goals for the new year. with a clear understanding of your assets and cash flow, you can review your goals, assess their attainability and make any necessary tweaks to your plan, including reducing expenses or increasing necessary savings. Financial planning involves defining your goals, understanding your financial picture, and taking steps to advance those goals. financial planning professionals can help you with a variety of needs, including budgeting, investment management, and retirement planning. wherever you are on your financial journey, a sound financial plan can give. 3. budget and cash flow plan. your budget is really where the rubber meets the road, planning wise. it can help you determine where your money is going each month and where you can cut back to meet your goals. a budget calculator can help ensure you don't overlook irregular but important expenses, such as car repairs, out of pocket health care.

Financial Planning Brief Definition At Edward Sanders Blog Financial planning involves defining your goals, understanding your financial picture, and taking steps to advance those goals. financial planning professionals can help you with a variety of needs, including budgeting, investment management, and retirement planning. wherever you are on your financial journey, a sound financial plan can give. 3. budget and cash flow plan. your budget is really where the rubber meets the road, planning wise. it can help you determine where your money is going each month and where you can cut back to meet your goals. a budget calculator can help ensure you don't overlook irregular but important expenses, such as car repairs, out of pocket health care.

Your Financial Planning Checklist For The New Year

Comments are closed.