Five Reasons To Have Life Insurance

Five Reasons To Have Life Insurance According to a recent nerdwallet study, the most common reason americans buy life insurance is to cover final expenses. the second most commonly selected reason is to leave an inheritance. If you’re worried about your loved ones getting hit with a big tax bill, a life insurance policy can help cover these added costs. 9. coverage is affordable. one of the excuses people tend to make for not buying life insurance is the cost. but truthfully, coverage often ends up pretty affordable for most people.

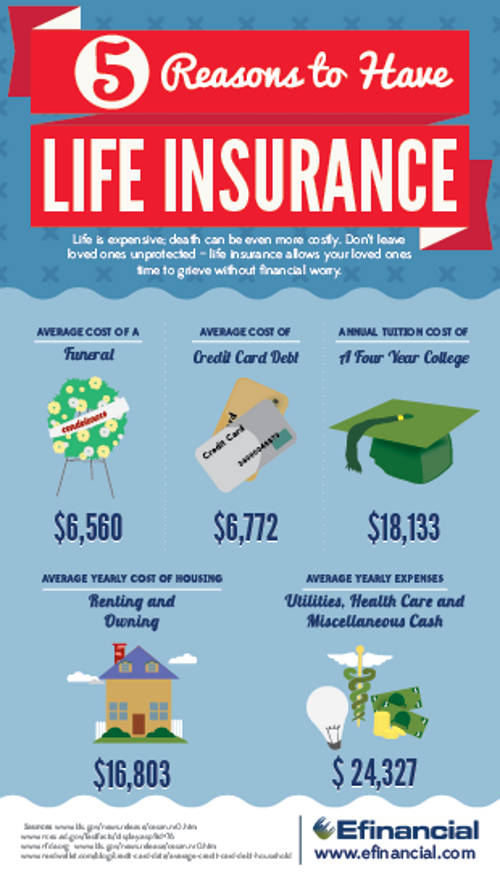

Infographic Top 5 Reasons To Buy Life Insurance Life Insurance C Benefits of term life insurance. term life insurance lets you lock in a level rate for a set number of years. after the term is up, the policy expires unless you renew (at a new, higher rate). a. In fact, nearly half of american adults do not have life insurance, according to a 2023 survey. one reason is that people assume life insurance is more expensive than it is. for example, 8 out of. Here are five big reasons to buy life insurance asap for anyone who doesn't have a plan in place already. 1. it provides crucial protection for loved ones. no one wants to leave their dependents. 30 year term life. $30. $357. source: forbes advisor research, based on a 30 year old male in good health. the average cost of life insurance will vary dramatically depending on your health and.

5 Benefits Of Life Insurance Benefits Of Universal Life Insurance Here are five big reasons to buy life insurance asap for anyone who doesn't have a plan in place already. 1. it provides crucial protection for loved ones. no one wants to leave their dependents. 30 year term life. $30. $357. source: forbes advisor research, based on a 30 year old male in good health. the average cost of life insurance will vary dramatically depending on your health and. With whole life insurance, you can help make sure that your loved ones have the money they need to help: 3. tax free benefit. your beneficiaries will be able to enjoy every penny you leave them. that’s because the benefit of a life insurance policy is generally passed along federal income tax free. 4. Reasons to buy life insurance. buying life insurance offers financial security for your loved ones by covering final expenses, replacing income and ensuring care for dependents. experts note how it can also help with estate planning and debt clearance. enter your zip code to get started. compare rates.

Five Solid Reasons To Get Life Insurance Lifeinsurance With whole life insurance, you can help make sure that your loved ones have the money they need to help: 3. tax free benefit. your beneficiaries will be able to enjoy every penny you leave them. that’s because the benefit of a life insurance policy is generally passed along federal income tax free. 4. Reasons to buy life insurance. buying life insurance offers financial security for your loved ones by covering final expenses, replacing income and ensuring care for dependents. experts note how it can also help with estate planning and debt clearance. enter your zip code to get started. compare rates.

Five Reasons To Have Life Insurance Univista Insurance

Comments are closed.