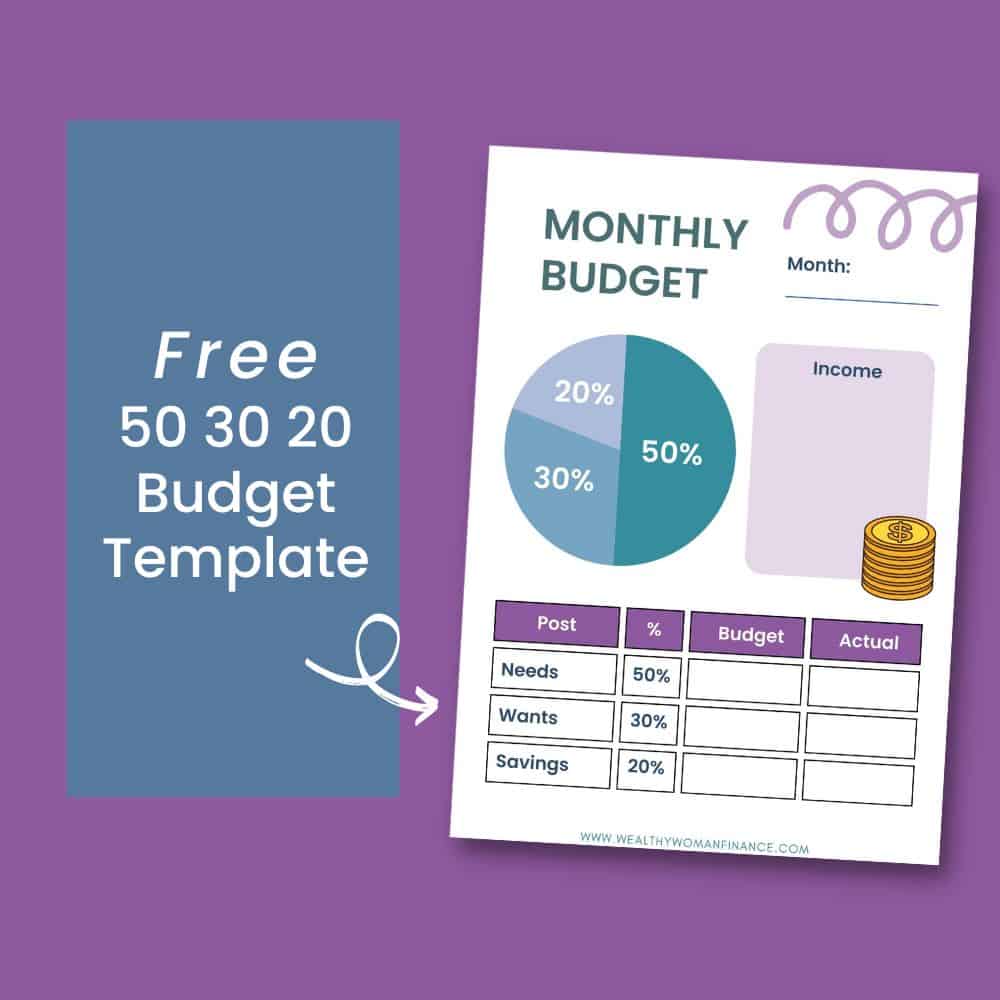

Free Printable Budget Planner 50 30 20 Budget Planner Pdf Shorts

Printable 50 30 20 Budget Template To try this budgeting method out and get your free printable 50 30 20 budget template simply scroll through all the designs and layouts available below and then follow these three steps: click on the image of the template that would work best for you, download the pdf file to your computer, and. print!. Step 2: split your income between the 3 categories. using the percentages, brittney is going to take her $4,000 income, and split it up 3 ways. here’s what her budget is going to look like: $4,000 x 50% = $2,000 for needs. $4,000 x 30% = $1,200 for wants. $4,000 x 20% = $800 for savings debt payoff.

50 30 20 Budget Template Instant Download Printable Here is a list of our partners and here's how we make money. a budget planner is a tool, such as a worksheet or template, that you can use to design your budget. a successful budget planner helps. With the help of a free budget printable and budget spreadsheet, you can create a personalized plan to manage your income, prioritize your expenses, and start saving for your future goals. main points: the 50 30 20 budgeting rule divides your budget into 3 main categories: 50% for needs, 30% for wants, and 20% for debt savings. The 50 30 20 budgeting rule is a popular method that helps you save, invest, and enjoy some of the finer things in life. in this post, you’ll find five pretty & practical printables to create your 50 30 20 budget. just scroll down until you see your favorite design and the download link for the pdf is below each image. table of contents. Monthly 50 30 20 budget worksheet. keep your monthly budget and savings on track and on target with the 50 30 20 approach. designate 50% of your income to needs (mortgage rent, utilities, car payments), 30% to wants (travel, concerts, fashion splurges) and 20% goes directly to your savings account(s) and debts.

Free 50 30 20 Budget Template Pdf Wealthy Woman Finance The 50 30 20 budgeting rule is a popular method that helps you save, invest, and enjoy some of the finer things in life. in this post, you’ll find five pretty & practical printables to create your 50 30 20 budget. just scroll down until you see your favorite design and the download link for the pdf is below each image. table of contents. Monthly 50 30 20 budget worksheet. keep your monthly budget and savings on track and on target with the 50 30 20 approach. designate 50% of your income to needs (mortgage rent, utilities, car payments), 30% to wants (travel, concerts, fashion splurges) and 20% goes directly to your savings account(s) and debts. Ok, so let’s say you get paid approximately $1,200 twice a month. that’s $2,400 total per month. now split that three ways according to the 50 30 20 rule. 50% of $2,400 is $1,200. 30% is $720. 20% is $480. if 50% does not cover your living expenses, which is unfortunately the case for many people, then you can take some from your “wants. First, the 50 30 20 model is the most well known model for managing your budget. with this rule, you’ll start with your monthly after tax income. then, divide the money into 50% for needs, 30% for wants, and 20% for savings. with the 50 30 20 rule, you’ll be seeing exactly where your money goes, and if you’re overextending in certain areas.

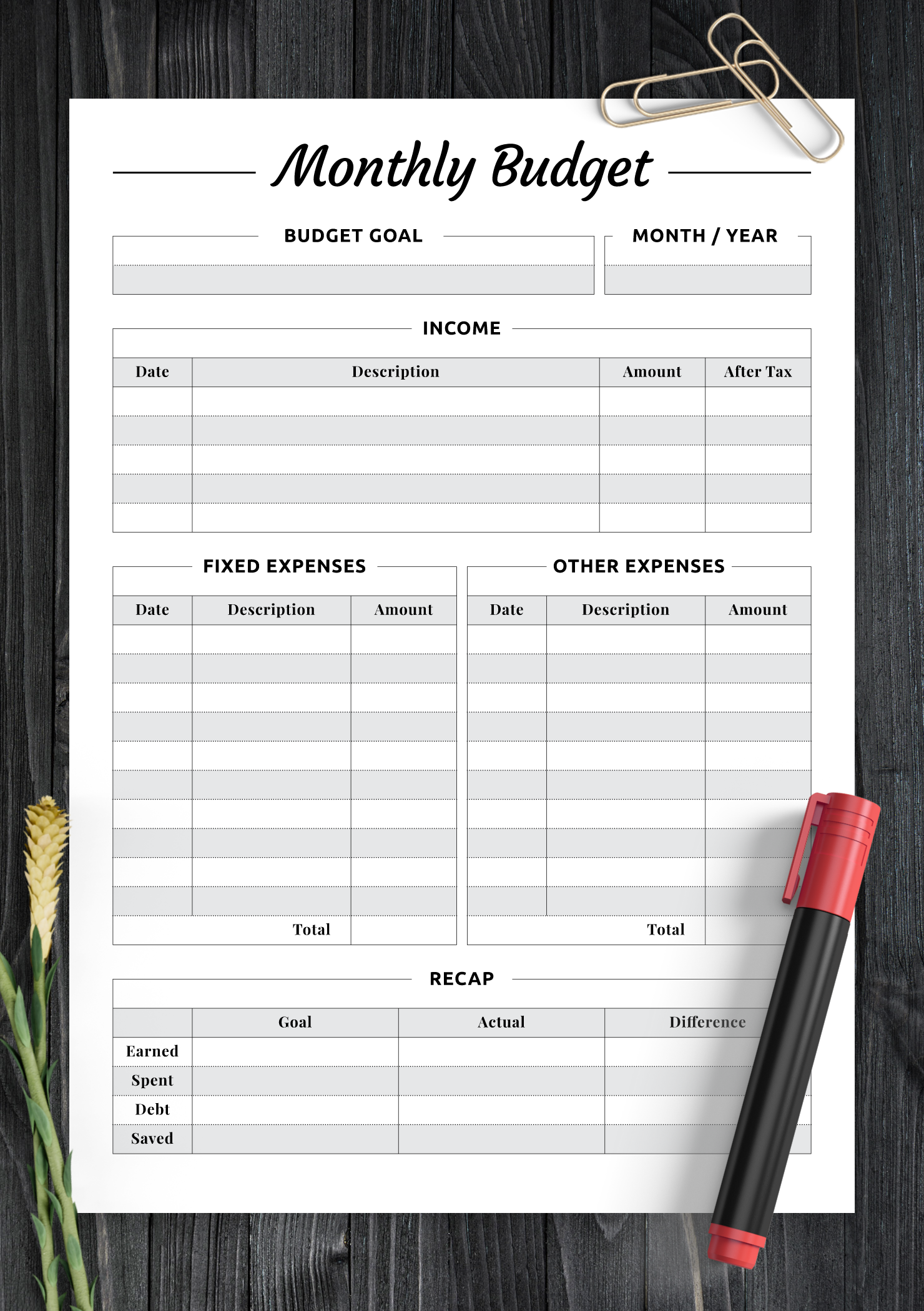

Download Printable Monthly Budget With Recap Section Pdf Ok, so let’s say you get paid approximately $1,200 twice a month. that’s $2,400 total per month. now split that three ways according to the 50 30 20 rule. 50% of $2,400 is $1,200. 30% is $720. 20% is $480. if 50% does not cover your living expenses, which is unfortunately the case for many people, then you can take some from your “wants. First, the 50 30 20 model is the most well known model for managing your budget. with this rule, you’ll start with your monthly after tax income. then, divide the money into 50% for needs, 30% for wants, and 20% for savings. with the 50 30 20 rule, you’ll be seeing exactly where your money goes, and if you’re overextending in certain areas.

Comments are closed.