Frm Part Ii The Science Of Term Structure Models Part 1of 4

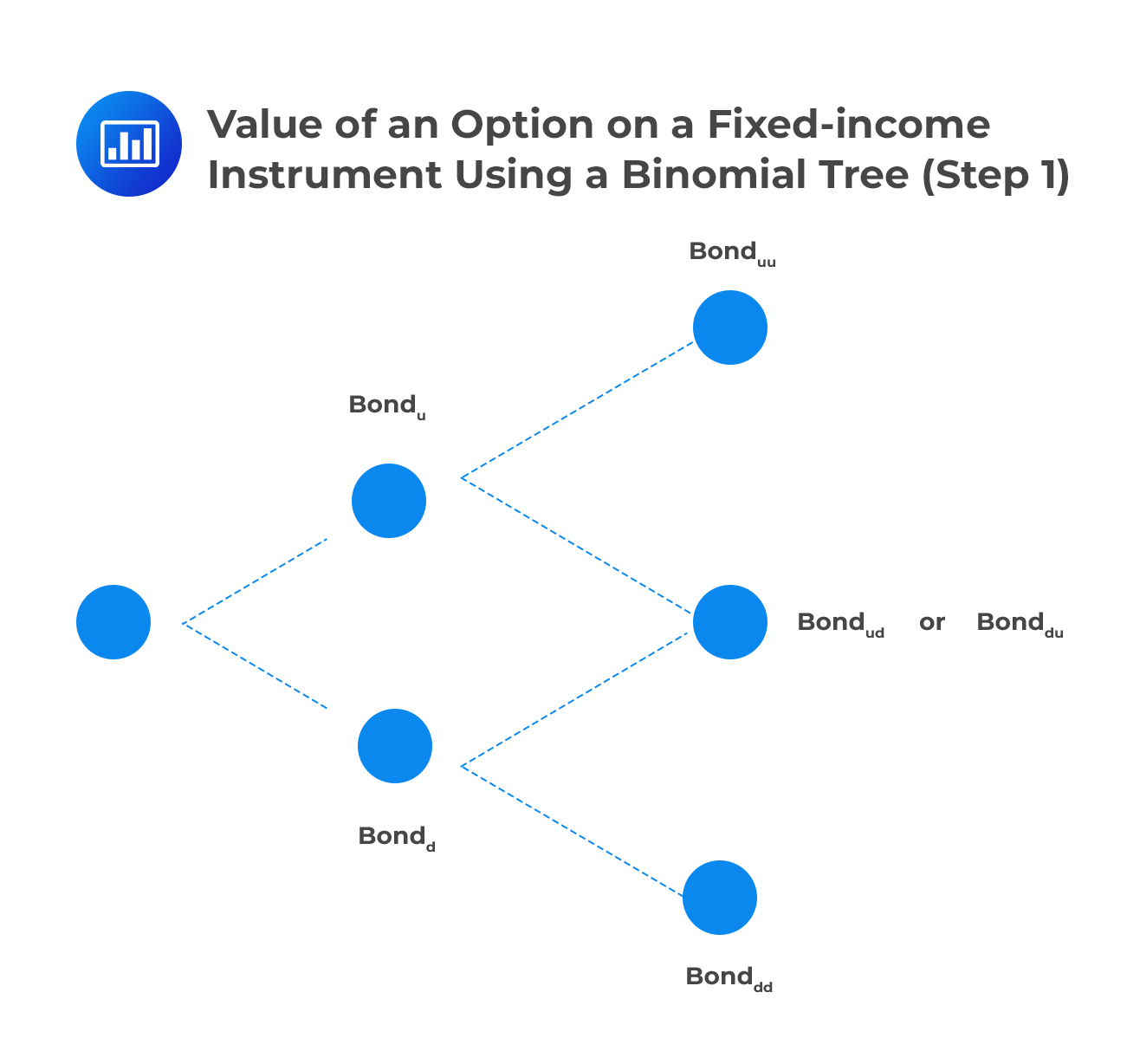

Frm Part 2 Market Risk The Science Of Term Structure Modelsођ To know more about cfa frm training at fintree, visit: fintreeindia for more videos visit: c fintreeindia?sub confirmat. Step 1:price the bond value at each node using the projected interest rates. step 2:calculate the intrinsic value of the derivative at each node at maturity. step 3:calculate the expected discounted value of the derivative at each node using the risk neutral probabilities and working backward through the tree.

Frm Part Ii The Science Of Term Structure Models Partођ 11. the science of term structure models 12. the evolution of short rates and the shape of the term structure 13. the art of term structure models: drift 14. the art of term structure models: volatility and distribution 15. volatility smiles. credit risk measurement and management. 1. the credit decision 2. the credit analysis 3. In this video, gurmeet katar, frm, caia sir (founder and lead faculty with finlearning) has discussed "the science of term structure models" from "market ris. Term structure model with drift (model 2) in practice, the term structure of interest rates takes on an upward sloping yield curve. this is at odds with model 1 which assumes zero drift. the alternative is to add a positive drift term which is essentially a positive risk premium associated with longer time horizons. This is "the science of term structure models frm part 2 the wallstreet school" by the wallstreet school on vimeo, the home for high quality videos….

The Science Of Term Structure Models Frm Part Ii Analystpr Term structure model with drift (model 2) in practice, the term structure of interest rates takes on an upward sloping yield curve. this is at odds with model 1 which assumes zero drift. the alternative is to add a positive drift term which is essentially a positive risk premium associated with longer time horizons. This is "the science of term structure models frm part 2 the wallstreet school" by the wallstreet school on vimeo, the home for high quality videos…. Frm exam part ii study modules. 1. analyzing market risk and correlation risk. (p 1 16) kevin dowd, measuring market risk, 2nd edition (west sussex, england: john wiley & sons, 2005). chapter 3. estimating market risk measures: an introduction and overview. (p 17 34) kevin dowd, measuring market risk, 2nd edition (west sussex, england: john. Tuckman, the science of term structure models, is a one hour instructional video analyzing the following concepts: * calculate the expected discounted value of a zero coupon security using a binomial tree. * construct and apply an arbitrage argument to price a call option on a zero coupon security using replicating portfolios. * define risk neutral pricing and explain how it is used in option.

The Science Of Term Structure Models Frm Part Ii Analystpr Frm exam part ii study modules. 1. analyzing market risk and correlation risk. (p 1 16) kevin dowd, measuring market risk, 2nd edition (west sussex, england: john wiley & sons, 2005). chapter 3. estimating market risk measures: an introduction and overview. (p 17 34) kevin dowd, measuring market risk, 2nd edition (west sussex, england: john. Tuckman, the science of term structure models, is a one hour instructional video analyzing the following concepts: * calculate the expected discounted value of a zero coupon security using a binomial tree. * construct and apply an arbitrage argument to price a call option on a zero coupon security using replicating portfolios. * define risk neutral pricing and explain how it is used in option.

Comments are closed.