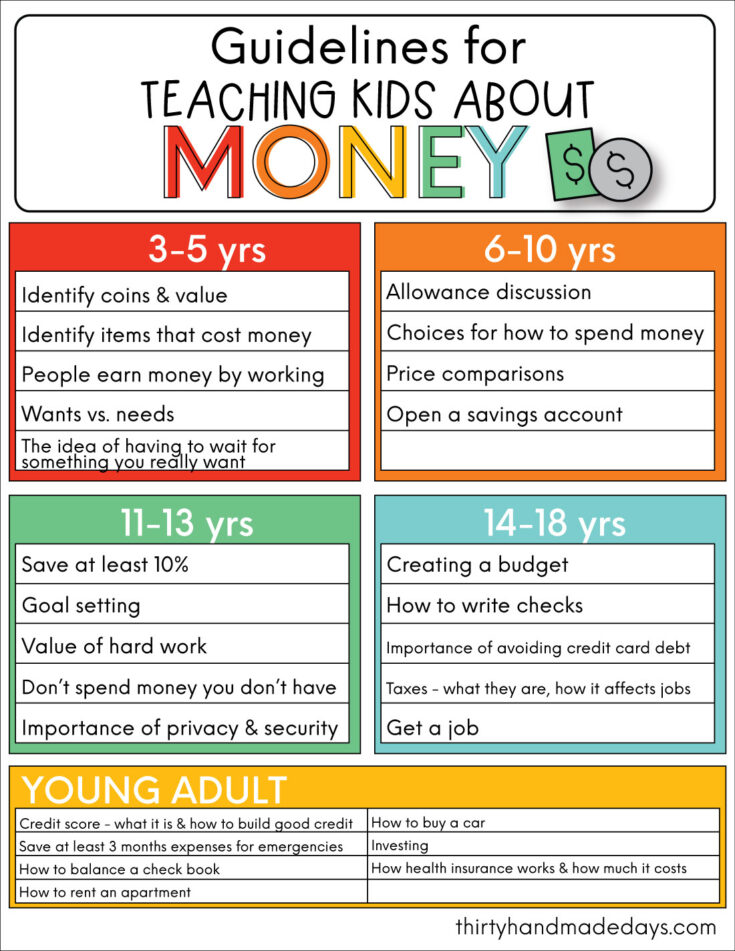

Guidelines For Teaching Kids About Money From Thirty Handmade Days

Guidelines For Teaching Kids About Money From Thirty Handmade Days That’s why my goal is to help my kids understand the importance of being financially savvy. the main things i want my kids to know are: wants vs. needs. money basics denominations and value. learning how to account for money. how to save money. how to budget. credit cards and credit reports. People earn money by working wants vs. needs. the idea of having to wait for something you really want. allowance discussion. 11 13 yrs. save at least 10% goal setting value of hard work. don’t spend money you don’t have. importance of privacy & security. 14 18 yrs.

Tips For Teaching Children About Money Uf Ifas Extension Manatee County The best thing to do is sit down and put pen to paper with them. help them see exactly how their money is coming in (ie: chores, babysitting, a job, birthday money) and where it is going (ie: shopping, entertainment, saving for something). you can use my budget binder as a guideline and i’ve included a “money tracker” and “savings sheet. According to the president's advisory council, by the age of 5, your child needs to know the following four things to be on track to living a “financially smart” life: you need money to buy things. you earn money by working. you may have to wait before you can buy something you want. Teaching ages 2 and 3 about money. very young children won't fully understand the value of money, but they can start getting introduced to it. a fun way to do this is to learn the names of coins. Utilizing charts is one of the most effective methods to teach children about personal finance. 3. demonstrate banking basics – deposits, withdrawals, borrowing, and lending. help your kids learn how how banks operate, the types of services they offer, and the importance of saving money for future needs or emergencies.

Teaching Kids About Money 12 Best Ways For Homeschool Parents Teaching ages 2 and 3 about money. very young children won't fully understand the value of money, but they can start getting introduced to it. a fun way to do this is to learn the names of coins. Utilizing charts is one of the most effective methods to teach children about personal finance. 3. demonstrate banking basics – deposits, withdrawals, borrowing, and lending. help your kids learn how how banks operate, the types of services they offer, and the importance of saving money for future needs or emergencies. The amount parents give their kids varies, but the survey found that it closely correlates with age: 4 year olds get an average of $4.18, 5 year olds get an average of $4.79 and 6 year olds get an average of $5.82. 6. play games to build skills. introducing family games like life and monopoly is a fun way to teach older kids about money. How we teach our kids about money. chores, allowance, and kids. five suggestions for teaching young kids about money. focus on core lessons. make it fun. provide lots of structure with just a little flexibility. let the children take ownership. watch for teachable moments.

Comments are closed.