Heloc Vs Personal Loan What S The Difference New Silver

Heloc Vs Personal Loan What S The Difference New Silver The biggest difference between a heloc vs personal loan is that a personal loan is typically unsecured – meaning the borrower does not have to provide any collateral to be approved. therefore, the underwriting standards of a personal loan are based solely on the credit score and income of the borrower. a heloc also requires the borrower to. When deciding between a home equity line of credit (heloc) and a personal loan, consider how much money you need, the risk each type of loan presents and how you're going to spend the funds. a heloc gives you access to a credit line and may offer tax advantages. a personal loan, on the other hand, could be a better option for one time expenses.

Heloc Vs Personal Loan What S The Difference New Silver A heloc is a type of revolving credit available to homeowners with ample equity, while a personal loan is a fixed sum financing option available to all qualified borrowers. a home equity line of. The short version. you need a certain amount of equity in your home to qualify for a heloc, while personal loan applications will review your credit score, debt to income ratio and income history. helocs can be worth up to 85% of the value of your home, while unsecured personal loans usually max out around $45,000. A home equity loan is similar to a heloc in that you borrow against your home’s equity, but the loan proceeds come in a lump sum payment rather than a revolving line of credit. 0% credit cards. depending on the amount you want to borrow, applying for a credit card with a 0% introductory period might be a good idea if you can repay the money before the introductory period ends. There are a few differences between a home equity line of credit (heloc) and a personal loan, but the main ones are the interest rates and the use of collateral to back the loans. a heloc requires a home as collateral; a personal loan typically requires no collateral at all.

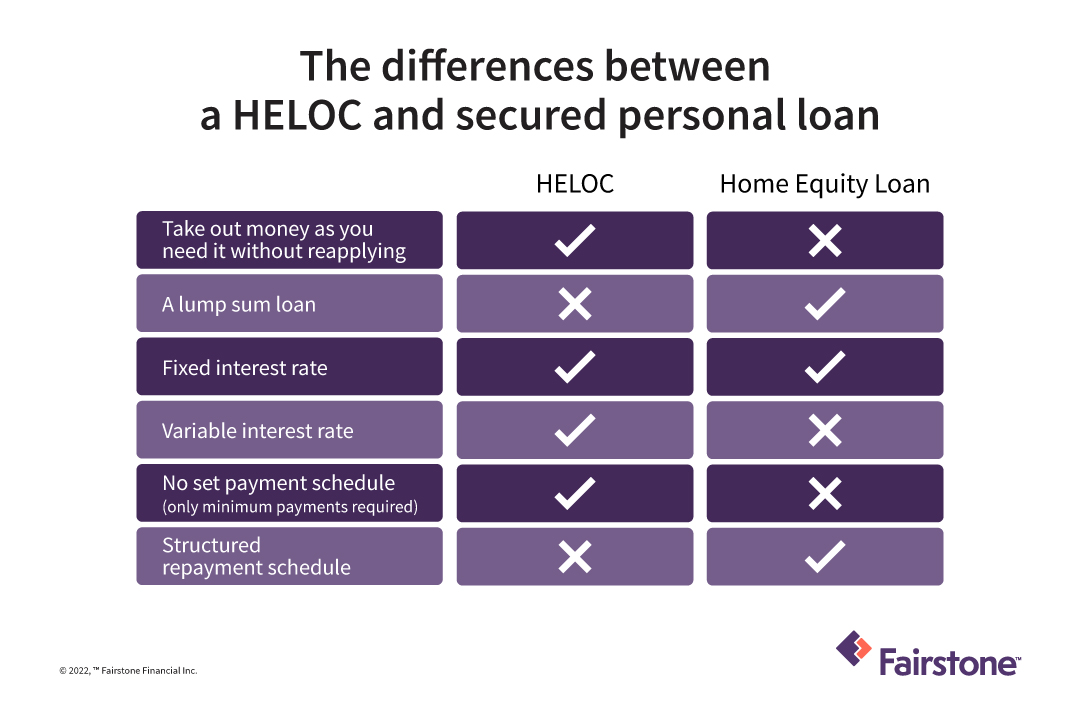

Home Equity юааloanюаб юааvsюаб юааhelocюаб юааwhatтащsюаб юааthe Differenceюаб Fairstone A home equity loan is similar to a heloc in that you borrow against your home’s equity, but the loan proceeds come in a lump sum payment rather than a revolving line of credit. 0% credit cards. depending on the amount you want to borrow, applying for a credit card with a 0% introductory period might be a good idea if you can repay the money before the introductory period ends. There are a few differences between a home equity line of credit (heloc) and a personal loan, but the main ones are the interest rates and the use of collateral to back the loans. a heloc requires a home as collateral; a personal loan typically requires no collateral at all. The main difference between a heloc and a personal loan is how they are typically secured and what this means for your loan terms. a heloc is a line of credit that uses your home equity as collateral. a personal loan is typically an unsecured loan, meaning it’s not backed by any collateral. in most cases, your possessions aren’t immediately. A heloc gives you a revolving line of credit backed by your home's equity, while a personal loan is a lump sum of money with a fixed repayment term. helocs often have variable interest rates, whereas personal loans usually come with fixed interest rates.

Personal Loan Vs Personal Line Of Credit What Are The Differences The main difference between a heloc and a personal loan is how they are typically secured and what this means for your loan terms. a heloc is a line of credit that uses your home equity as collateral. a personal loan is typically an unsecured loan, meaning it’s not backed by any collateral. in most cases, your possessions aren’t immediately. A heloc gives you a revolving line of credit backed by your home's equity, while a personal loan is a lump sum of money with a fixed repayment term. helocs often have variable interest rates, whereas personal loans usually come with fixed interest rates.

Comments are closed.