Hmo Vs Ppo Which Plan Is Best For You

Ppo Vs Hmo Plans вђ Abc Medicare Lower cost. hmo plans typically have lower monthly premiums. you can also expect to pay less out of pocket. higher cost. ppos tend to have higher monthly premiums in exchange for the flexibility to use providers both in and out of network without a referral. out of pocket medical costs can also run higher with a ppo plan. Hmo vs. ppo health insurance. choosing the best health insurance plan requires figuring out what you want and need from such coverage. an hmo is a good choice if you want the cheapest health.

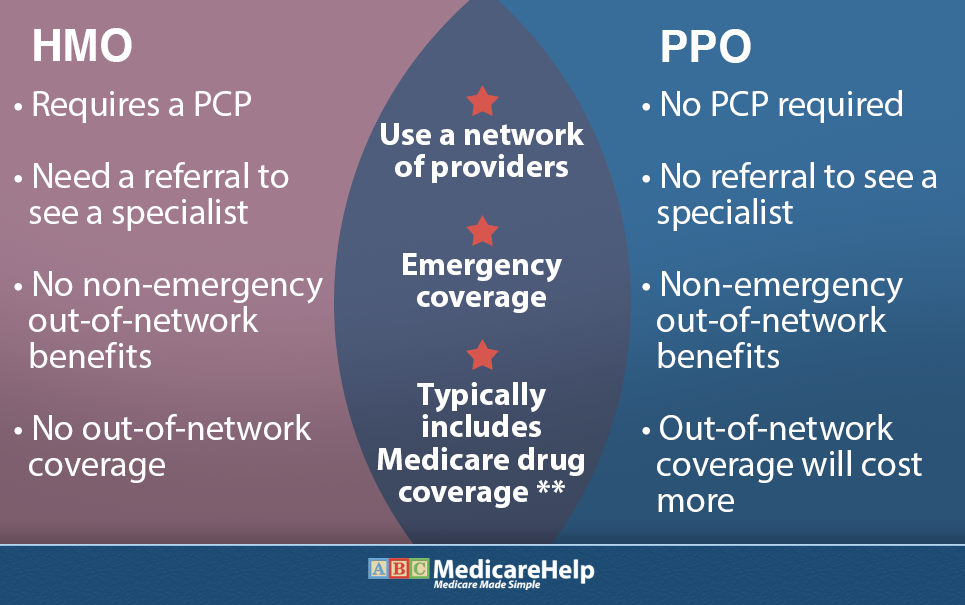

Hmo Vs Ppo How To Pick Your Health Insurance Plan One Medical Key takeaways: there are two main types of medicare advantage plans: health maintenance organization (hmo) and preferred provider organization (ppos) plans. hmo plans offer lower costs but limit. Hmo vs. ppo. it’s important to consider and compare the differences between medicare advantage hmo and ppo plans. hmo plans typically have lower premiums and less out of pocket costs. ppo plans have higher premiums and cost sharing, but greater flexibility to choose your doctor or other health care provider. maximize your 2024 savings. There are a few key differences between hmo and ppo plans. primary care physicians. hmo plans generally require members to utilize a primary care physician (pcp), while ppo plans typically do not. cost. on average, hmo members can generally expect to pay lower premiums than members of ppo plans. referrals. Health maintenance organization (hmo) and preferred provider organization (ppo) are two of the most popular types of major medical health insurance plans. the major differences between hmo vs ppo plans can be found in the: size of the network. the cost of the plan. the ability to see specialists without referrals. the size of the in network.

Hmo Vs Ppo Health Insurance Plans вђ Napkin Finance There are a few key differences between hmo and ppo plans. primary care physicians. hmo plans generally require members to utilize a primary care physician (pcp), while ppo plans typically do not. cost. on average, hmo members can generally expect to pay lower premiums than members of ppo plans. referrals. Health maintenance organization (hmo) and preferred provider organization (ppo) are two of the most popular types of major medical health insurance plans. the major differences between hmo vs ppo plans can be found in the: size of the network. the cost of the plan. the ability to see specialists without referrals. the size of the in network. Hmo plans require referrals from your primary care doctor to see specialists. ppo plans do not. an hmo often costs less than a ppo but you’re limited to in network providers and you’re responsible for all out of network costs except those resulting from medical emergencies. Before you enroll in an hmo or a ppo, make sure you know each plan’s rules about coverage. look at deductibles, premiums, and prices for in network and out of network providers. check to see if your doctors are in the plan's provider network. you can minimize costs in an ppo by using in network doctors, hospitals, and healthcare providers.

Hmo Vs Ppo Health Insurance Plans Selecting The Right Plan For Your Hmo plans require referrals from your primary care doctor to see specialists. ppo plans do not. an hmo often costs less than a ppo but you’re limited to in network providers and you’re responsible for all out of network costs except those resulting from medical emergencies. Before you enroll in an hmo or a ppo, make sure you know each plan’s rules about coverage. look at deductibles, premiums, and prices for in network and out of network providers. check to see if your doctors are in the plan's provider network. you can minimize costs in an ppo by using in network doctors, hospitals, and healthcare providers.

Comments are closed.