Home Equity Loan Vs Heloc What S The Difference

:max_bytes(150000):strip_icc()/dotdash-home-equity-vs-heloc-final-866a2763fd0548eaa393afa0ffd7372b.jpg)

юааhome Equity Loan Vs Heloc Whatтащs The Differenceюаб Key takeaways. home equity loans and home equity lines of credit (helocs) are both based on a borrower's equity in their home. a home equity loan comes with fixed payments and a fixed interest. You can take a 15 year home equity loan for $87,000, which will be distributed upfront and repaid over the next 10 years at 4.5% interest. this gives you a monthly payment of $666, in addition to.

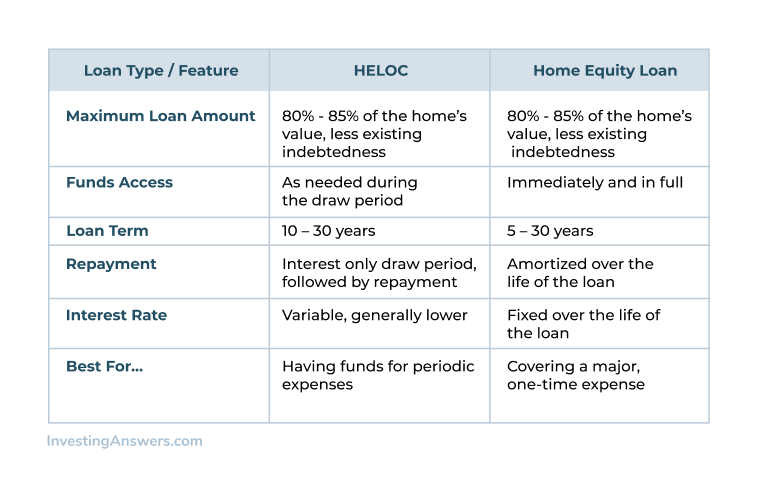

Heloc Vs Home Equity Loan What S The Difference Investinga Helocs often begin with a lower interest rate than home equity loans; however, the rate is variable, which means it rises or falls according to a base rate called the prime rate. current prime. The main difference between a home equity loan1 and a heloc is that in a home equity loan, you get an upfront lump sum that you repay in fixed payments, whereas a heloc lets you tap into equity as needed up to a certain limit. helocs typically have a variable interest rate (one that changes) versus fixed rates, which are typical in a home. Key takeaways. a home equity loan allows you to borrow a lump sum against the equity you've built up in your property. your equity is the current appraised value of your home minus what you owe on your mortgage. a home equity line of credit, also known as a heloc, provides a preapproved line of credit that is based on your equity. A home equity loan is a secured installment loan that allows you to borrow a set amount against your equity at a fixed interest rate and repayment term. heloc. a home equity line of credit (heloc.

Comments are closed.