How Are Social Security Benefits Taxed Irs

How Are Social Security Benefits Taxed Irs A new tax season has arrived. the irs reminds taxpayers receiving social security benefits that they may have to pay federal income tax on a portion of those benefits. social security benefits include monthly retirement, survivor and disability benefits. they don't include supplemental security income payments, which aren't taxable. You report the taxable portion of your social security benefits on line 6b of form 1040 or form 1040 sr. your benefits may be taxable if the total of (1) one half of your benefits, plus (2) all of your other income, including tax exempt interest, is greater than the base amount for your filing status. the base amount for your filing status is:.

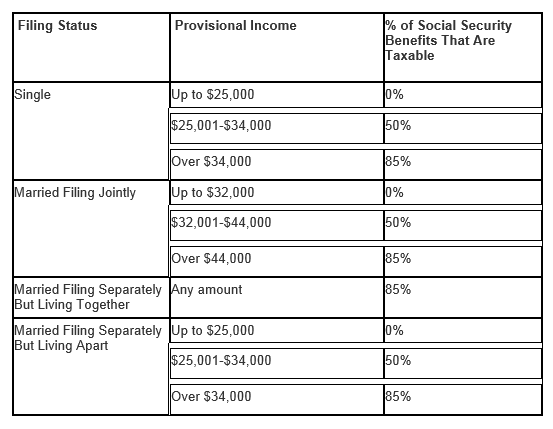

Retire Ready Are Social Security Benefits Taxed If you file your income tax return as an individual with a total income that’s less than $25,000, you won’t have to pay taxes on your social security benefits. single filers with a combined income of $25,000 to $34,000 must pay income taxes on up to 50% of their social security benefits. if your combined income is more than $34,000, you. Here are seven things social security recipients, present and future, should know about taxation of benefits. 1. income matters — age doesn’t. contrary to another common misperception, you don’t stop paying taxes on your social security when you reach a certain age. income, and income alone, dictates whether you owe federal taxes on your. The following tiered system determines the percentage of your benefits that are taxable. if your combined income is under $25,000 (single) or $32,000 (joint filing), there is no tax on your social. You will pay tax on your social security benefits based on internal revenue service (irs) rules if you: file a federal tax return as an "individual" and your combined income* is. between $25,000 and $34,000, you may have to pay income tax on up to 50% of your benefits. more than $34,000, up to 85% of your benefits may be taxable.

Are Your Social Security Benefits Taxable Capital Strategies Inc The following tiered system determines the percentage of your benefits that are taxable. if your combined income is under $25,000 (single) or $32,000 (joint filing), there is no tax on your social. You will pay tax on your social security benefits based on internal revenue service (irs) rules if you: file a federal tax return as an "individual" and your combined income* is. between $25,000 and $34,000, you may have to pay income tax on up to 50% of your benefits. more than $34,000, up to 85% of your benefits may be taxable. Combined income. social security tax amount. under $25,000 (single) or $32,000 (joint filing) no tax on your social security benefits. between $25,000 and $34,000 (single) or $32,000 and $44,000. Your social security benefits are taxable based on your filing status and agi. married filers with an agi of less than $60,000 may qualify for a full exemption ($45,000 for single filers). married.

Comments are closed.