How Big A Problem Is U S Household Debt Presented By Cme Group

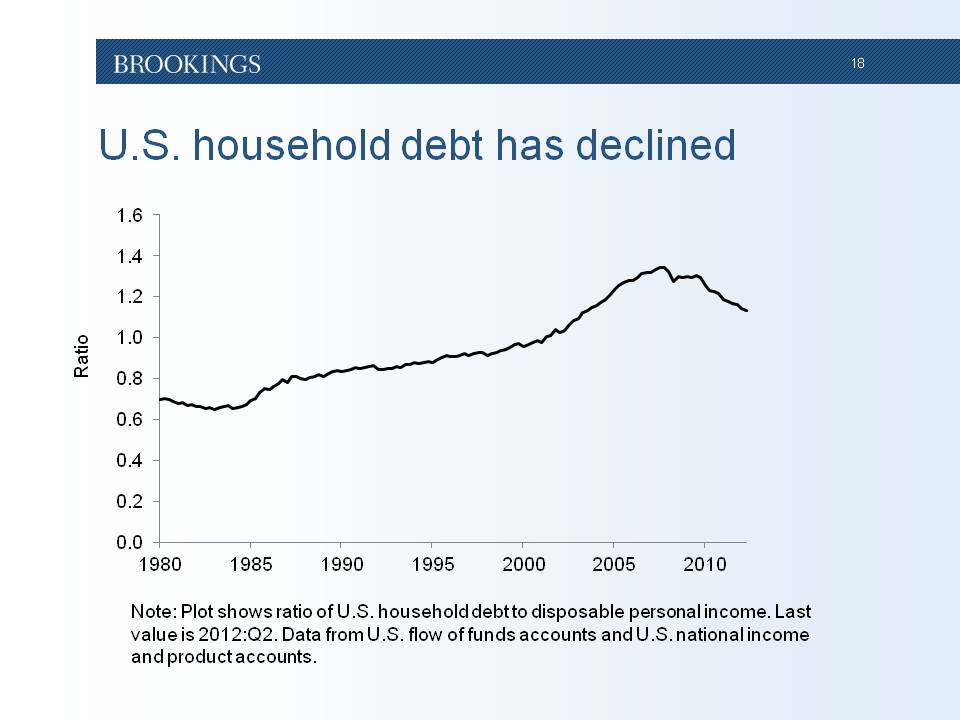

How Big A Problem Is U S Household Debt Presented By Cme Group Total u.s. household debt increased by a whopping $184 billion in the first quarter of 2024, taking overall credit card balances past the trillion dollar mil. The u.s. household debt burden is much more manageable today than it was back then, on the cusp of the great recession. (ap) by louis jacobson december 27, 2019.

The U S Household Debt Overhang Total household debt rose by $109 billion to reach $17.80 trillion, according to the latest quarterly report on household debt and credit. mortgage balances were up $77 billion to reach $12.52 trillion, while auto loans increased by $10 billion to reach $1.63 trillion and credit card balances increased by $27 billion to reach $1.14 trillion. All: how big a problem is u s household debt presented by cme group sort by: previous next. part 2: statements of economic interest groups. Overall, u.s. household debt increased by 4.8% from november 2022 to november 2023, with credit card debt as the highest increase at 16.6%. around a third of americans said they expected to go. New york — the federal reserve bank of new york’s center for microeconomic data today issued its quarterly report on household debt and credit. the report shows total household debt increased by $184 billion (1.1%) in the first quarter of 2024, to $17.69 trillion.

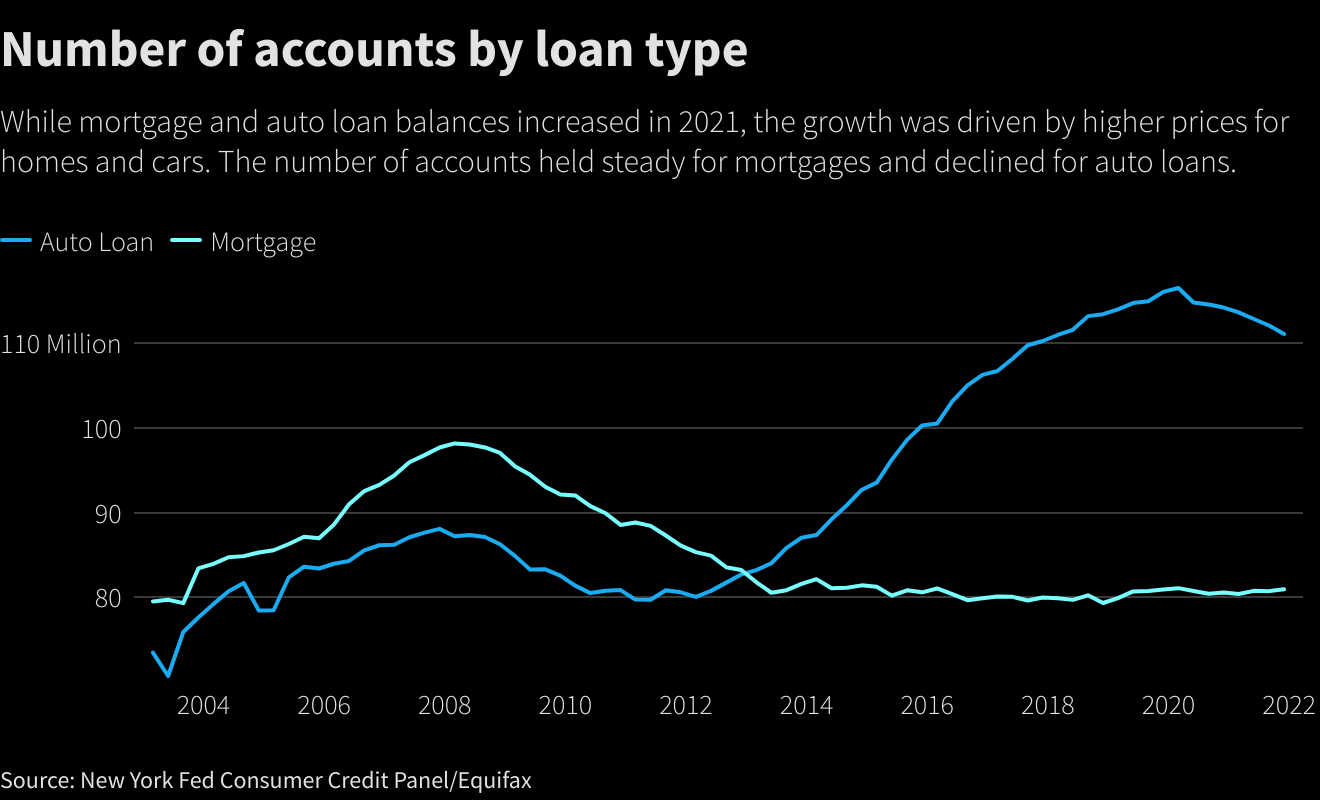

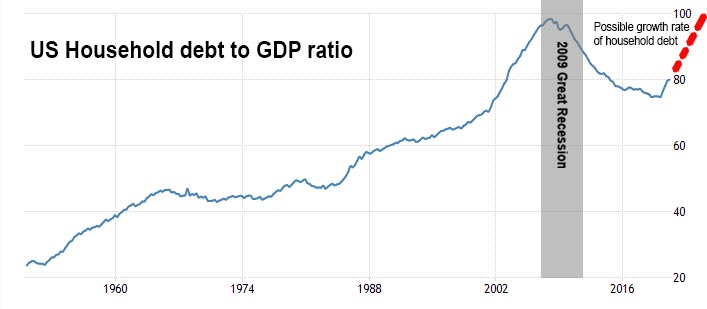

U S Household Debt Increased By 1 Trillion In 2021 The Most Since Overall, u.s. household debt increased by 4.8% from november 2022 to november 2023, with credit card debt as the highest increase at 16.6%. around a third of americans said they expected to go. New york — the federal reserve bank of new york’s center for microeconomic data today issued its quarterly report on household debt and credit. the report shows total household debt increased by $184 billion (1.1%) in the first quarter of 2024, to $17.69 trillion. 2. the current debt balance is far too high. the public debt balance actually needs to be evaluated in relation to gdp. the us's debt to gdp ratio hovered around 97% last year, below a key. Key points. record high debt: american households carry $17.796 trillion in debt as of q2 2024, averaging $104,215 per household. mortgage dominates debt: mortgage debt comprises 70% of total.

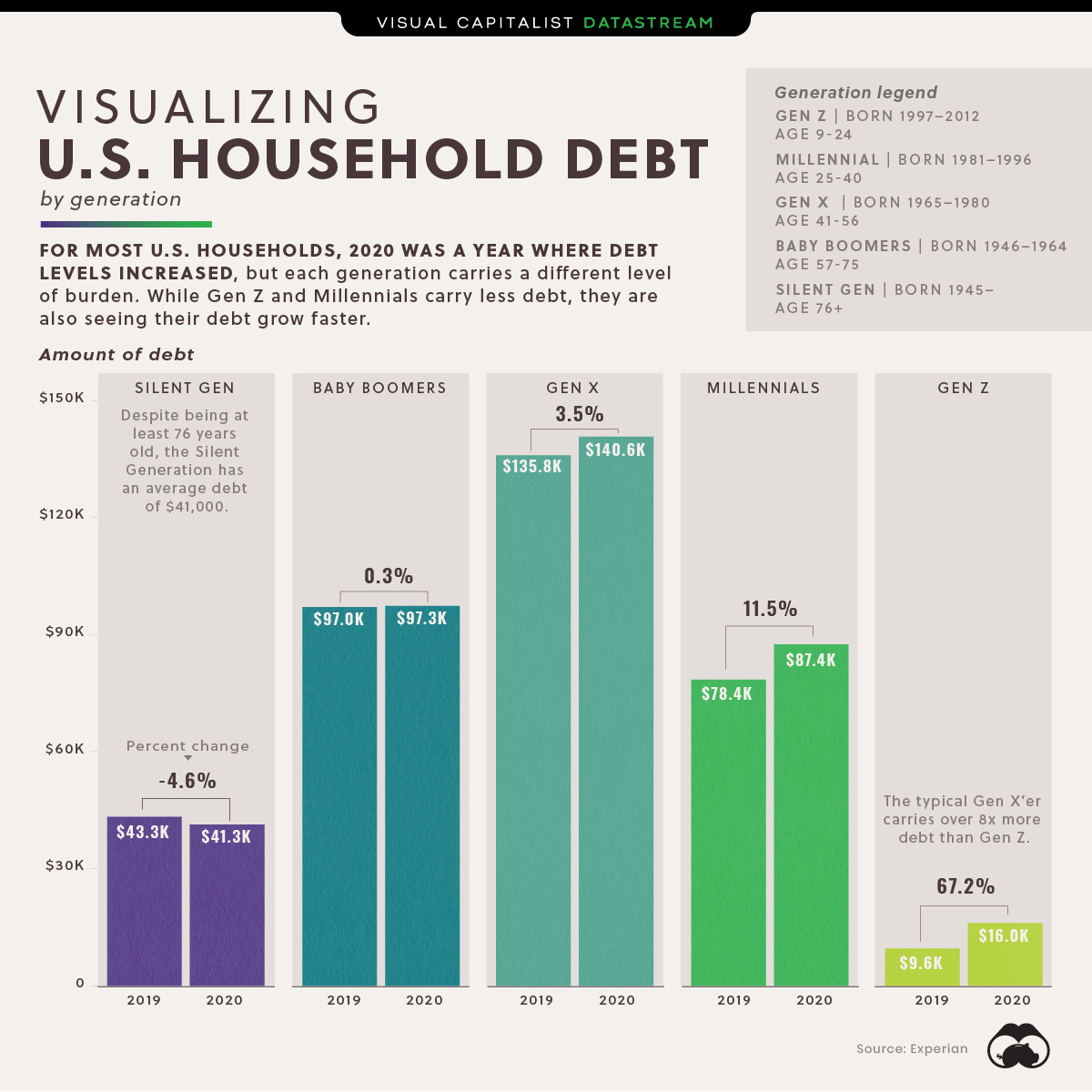

Visualizing U S Household Debt By Generation 2. the current debt balance is far too high. the public debt balance actually needs to be evaluated in relation to gdp. the us's debt to gdp ratio hovered around 97% last year, below a key. Key points. record high debt: american households carry $17.796 trillion in debt as of q2 2024, averaging $104,215 per household. mortgage dominates debt: mortgage debt comprises 70% of total.

Consumer Debt Breaks Records After Covid 19 Consolidated Credit

Comments are closed.