How Does An Overdraft Facility Work Efinancemanagement

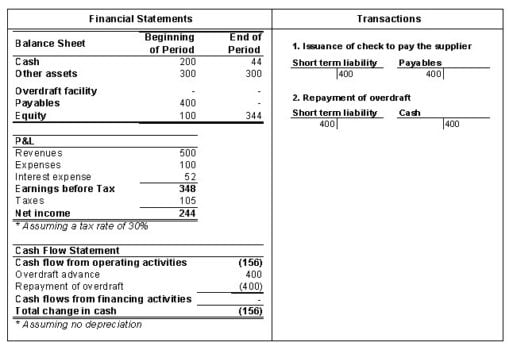

How Does An Overdraft Facility Work Efinancemanagement An overdraft or an od is a line of credit provided by banks to individual and business houses. this facility allows the account holder to use more funds than what is effectively available in their current account with the bank. nowadays, banks grant this facility to the customer’s savings account. let us understand how does an overdraft. A bank overdraft facility means an additional source of liquidity available to businesses and a helpful tool to manage short term cash flow problems. generally, an overdraft account will be an integral part of a company’s cash management, typically including an offsetting arrangement against the other company’s accounts. table of contents.

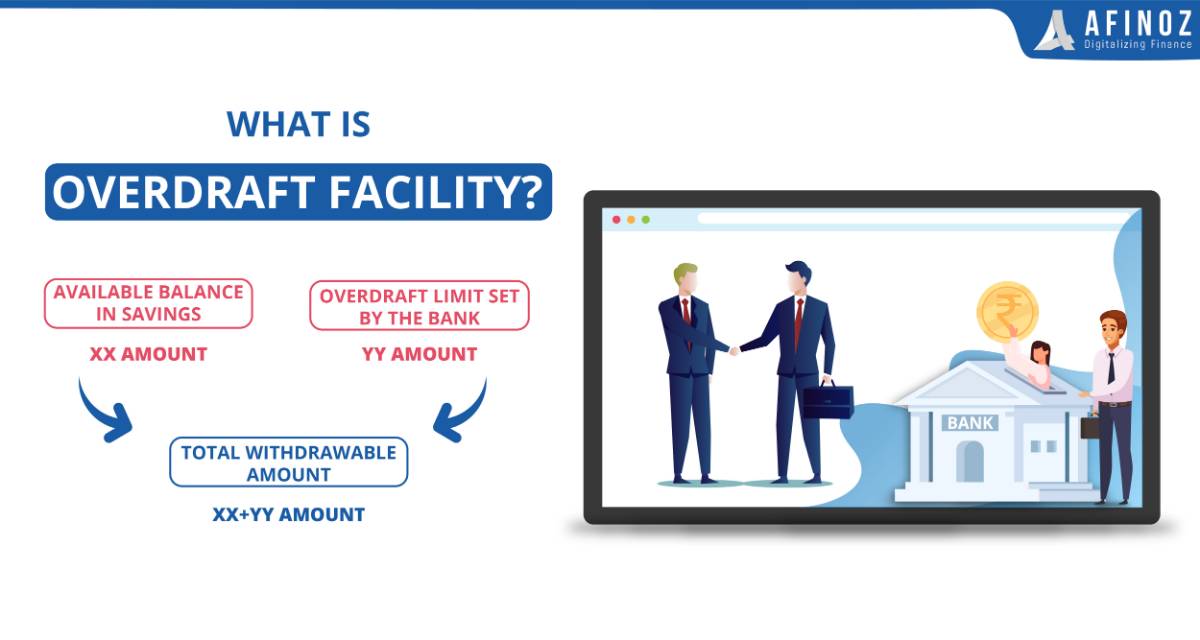

What Is An Overdraft And How Does It Work Overdraft interest is the interest a bank charges on an overdraft facility. an overdraft is a facility of extended credit from a bank. this facility allows the current account holder to withdraw money even when the account balance reaches zero. in other words, this facility allows the account holder to use more funds than what is effectively. An overdraft facility is a pre arranged agreement with your bank that allows you to overdraw your account up to a certain limit. this facility is often linked to current accounts used by businesses, but it can also be available to individuals with savings accounts. the main features of an overdraft facility include:. 10 march 2023. banking. an overdraft facility is a financial instrument that allows customers to withdraw money or make eligible spends from their bank account even if their balance is zero. the lender, however, typically charges a fixed rate of interest on the amount utilised over and above the available balance, i.e., the overdraft amount. An overdraft is a loan provided by a bank that allows a customer to pay for bills and other expenses when the account reaches zero. for a fee, the bank provides a loan to the client in the event.

Bank Overdraft Facility Efinancemanagement 10 march 2023. banking. an overdraft facility is a financial instrument that allows customers to withdraw money or make eligible spends from their bank account even if their balance is zero. the lender, however, typically charges a fixed rate of interest on the amount utilised over and above the available balance, i.e., the overdraft amount. An overdraft is a loan provided by a bank that allows a customer to pay for bills and other expenses when the account reaches zero. for a fee, the bank provides a loan to the client in the event. Overdraft protection is a program offered by many banks. if you opt in, you can be covered for transactions that would bring your account into the red—including purchases, atm withdrawals and written checks. 2. overdraft service differs from bank to bank. some may cover the difference from the transaction and charge you for it later on top of. This means the maximum interest charged, by law, can be: the repo rate x 2,2 10%. the repo rate is now 3,5%, so the maximum interest that can be charged is 17,7%. the main pitfall of an overdraft account is when people use it for expenses that aren’t urgent or essential. then when you need the overdraft facility for an emergency, there isn.

How Does An Overdraft Work Dime Alley Overdraft protection is a program offered by many banks. if you opt in, you can be covered for transactions that would bring your account into the red—including purchases, atm withdrawals and written checks. 2. overdraft service differs from bank to bank. some may cover the difference from the transaction and charge you for it later on top of. This means the maximum interest charged, by law, can be: the repo rate x 2,2 10%. the repo rate is now 3,5%, so the maximum interest that can be charged is 17,7%. the main pitfall of an overdraft account is when people use it for expenses that aren’t urgent or essential. then when you need the overdraft facility for an emergency, there isn.

Overdraft Meaning Example How Does It Work Types

Comments are closed.