How Federal Reserve Sets Interest Rates And Its Impact On Commercial

How Federal Reserve Sets Interest Rates And Its Impact On Commercial The federal reserve would enter this market with funds to balance out the supply and demand of funds and bring the fed funds rate closer to its target fed funds rate. essentially, if the federal. According to the committee for a responsible federal budget, the estimated total budget deficit from 2022 to 2031 will be $12.7 trillion. increasing rates by just half a percentage point would.

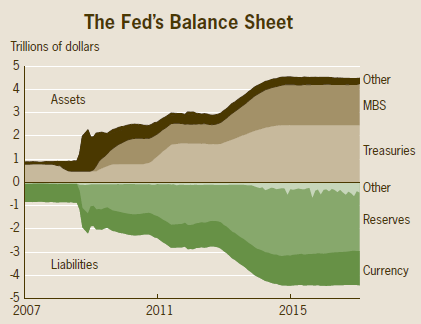

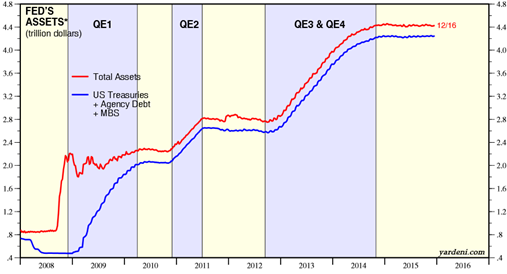

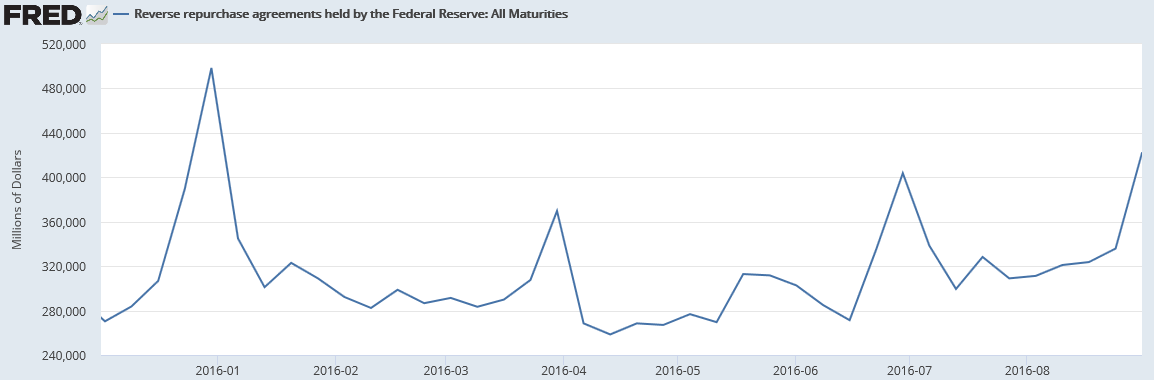

How Federal Reserve Sets Interest Rates And Its Impact On Commercial The federal reserve slashed its benchmark interest rate by half a percentage point, the first and the biggest cut since march 2020 when covid 19 was hammering the economy. the cut amounts to a declaration of victory over inflation, which has come down from a peak of 9.1% in june 2022 to 2.5% last month. The fed’s new framework, dubbed the “ample reserves” framework, uses new monetary policy tools to guide the ffr. the key tools are two “administered” rates (i.e., they are interest rates set by the fed rather than determined in a market) to guide the federal funds rate within the fomc’s target range: interest on reserves (ior. The fed forecasts a long term federal funds rate of 2.9%, higher than rates ever were from march 2008 to sept. 2022, a far ways from the near zero rates set from dec. 2008 to dec. 2015 and march. The federal funds rate is the interest rate that banks charge each other to borrow or lend excess reserves overnight. the law requires that banks must have a minimum reserve level in proportion to.

How Federal Reserve Sets Interest Rates And Its Impact On Commercial The fed forecasts a long term federal funds rate of 2.9%, higher than rates ever were from march 2008 to sept. 2022, a far ways from the near zero rates set from dec. 2008 to dec. 2015 and march. The federal funds rate is the interest rate that banks charge each other to borrow or lend excess reserves overnight. the law requires that banks must have a minimum reserve level in proportion to. The federal reserve conducts the nation's monetary policy to promote maximum employment, stable prices, and moderate long term interest rates in the u.s. economy. this section reviews u.s. monetary policy and economic developments in 2020, with excerpts and select figures from the monetary policy report published in february 2021 and june 2020. By cora lewis. updated 11:12 am pdt, september 18, 2024. new york (ap) — the federal reserve has cut its benchmark interest rate from its 23 year high, with consequences for debt, savings, auto loans, mortgages and other forms of borrowing by consumers and businesses. on wednesday, the fed announced that it reduced its key rate by an.

How Federal Reserve Sets Interest Rates And Its Impact On Commercial The federal reserve conducts the nation's monetary policy to promote maximum employment, stable prices, and moderate long term interest rates in the u.s. economy. this section reviews u.s. monetary policy and economic developments in 2020, with excerpts and select figures from the monetary policy report published in february 2021 and june 2020. By cora lewis. updated 11:12 am pdt, september 18, 2024. new york (ap) — the federal reserve has cut its benchmark interest rate from its 23 year high, with consequences for debt, savings, auto loans, mortgages and other forms of borrowing by consumers and businesses. on wednesday, the fed announced that it reduced its key rate by an.

Comments are closed.