How Much For Roth Ira 2024 Vonny Johnette

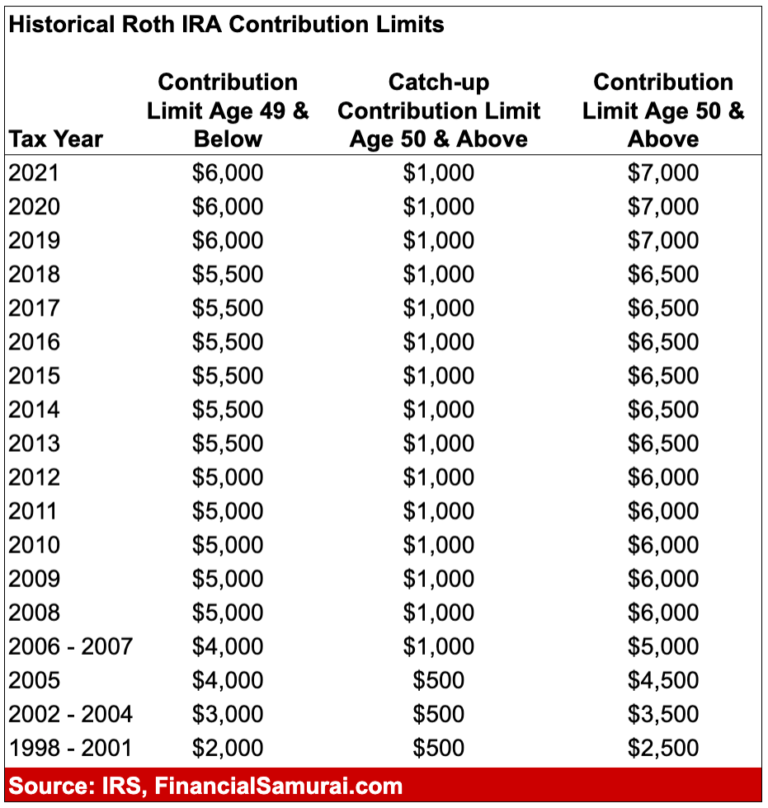

How Much Roth Ira 2024 Kipp Simone Subtract from the amount in (1): $228,000 if filing a joint return or qualifying widow (er), $ 0 if married filing a separate return, and you lived with your spouse at any time during the year, or. $146,000 for all other individuals. divide the result in (2) by $15,000 ($10,000 if filing a joint return, qualifying widow (er), or married filing. The roth ira contribution limit for 2024 is $7,000 in 2024 ($8,000 if age 50 or older). at certain incomes, the contribution amount is lowered until it is eliminated completely.

How Much Can You Put In Roth Ira 2024 Nerty Zabrina The 2024 roth ira income limits are $161,000 for single tax filers and $240,000 for those married filing jointly. the roth ira contribution limits are $7,000, or $8,000 if you're 50 plus. The roth ira contribution limit for 2024 is $7,000 for those under 50, and $8,000 for those 50 and older. your personal roth ira contribution limit, or eligibility to contribute at all, is dictated by your income level. a roth ira is a tax advantaged way to save and invest for retirement. People with incomes above certain thresholds cannot qualify to make roth ira contributions. for the 2024 tax year, the threshold is anything above an adjusted gross. The maximum total annual contribution for all your iras combined is: tax year 2023 $6,500 if you're under age 50 $7,500 if you're age 50 or older. tax year 2024 $7,000 if you're under age 50 $8,000 if you're age 50 or older. with the passage of secure 2.0 act, effective 1 1 2024 you may also be eligible to contribute to your roth ira.

Comments are closed.