How Much Money Do You Actually Need To Retire Less Than ођ

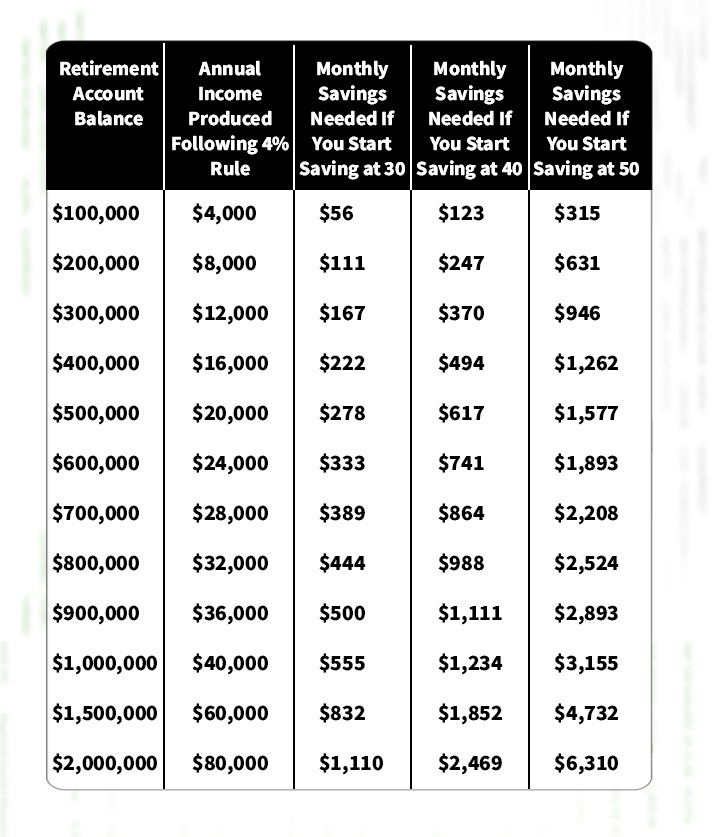

How To Calculate How Much Money You Need To Retire Business Insider At 5% a year, you’d need to annually contribute only $14,073 (rounded) for 40 years to reach $1.7 million. that breaks down to $562,915 in total contributions and $1,137,085 earned with interest. But it depends on many factors, financial experts say. according to a recent bmo survey, canadians think they need a staggering $1.7 million in savings to retire, a 20 per cent jump from 2020.

Retirement Calculator How Much You Need To Save вђ Canada News Group American adults say on average they now need $1.46 million to retire, according to the northwestern northwestern 0.0% mutual 2024 planning & progress study. that’s 15% higher than a year earlier. According to this rule, you’ll need 70% of your pre retirement household income each year in retirement for 25 years. for example, if your household brings in $150,000 in the year before you. It's an age old question that canadians frequently ask their financial planners: how much money do you actually need to retire? an early 2024 survey from bmo found that canadians on average believe they’ll need $1.7 million to retire, but that number is higher for millennials, who expect they will need $2.1 million saved up. Many struggling to save for retirement: survey. based on a survey commissioned by the healthcare of ontario pension plan (hoopp) earlier this year, more than 75 per cent of canadians between the.

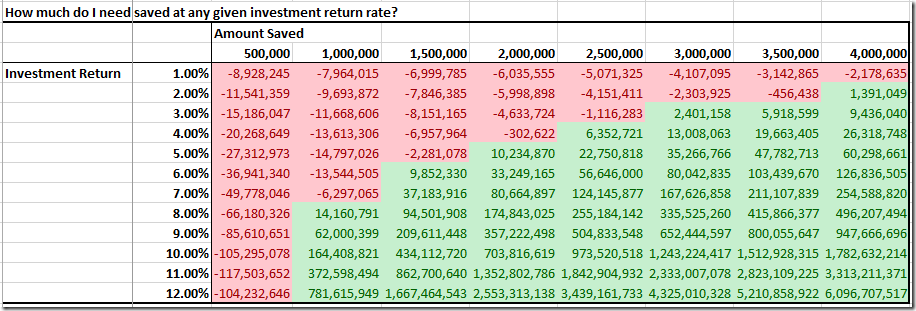

How Much Money Do You Need To Retire Spreadsheetsolving It's an age old question that canadians frequently ask their financial planners: how much money do you actually need to retire? an early 2024 survey from bmo found that canadians on average believe they’ll need $1.7 million to retire, but that number is higher for millennials, who expect they will need $2.1 million saved up. Many struggling to save for retirement: survey. based on a survey commissioned by the healthcare of ontario pension plan (hoopp) earlier this year, more than 75 per cent of canadians between the. The general wisdom is that you will need 70 to 80 percent of your current salary to maintain a similar lifestyle in retirement. that means if you made $100,000 each year, you should plan to have $70,000 to $80,000 in retirement income, for example. the logic is that you will spend less as a retiree – you’re not commuting, for instance, your. Many advisers say you need retirement cash flow equal to 70% to 80% of your peak pre retirement income. while that would be nice, most canadians retire comfortably on far less. “i get so upset.

Comments are closed.