How Much Of Your Income Should You Invest Each Month Plan The Ri

How Much Of Your Income Should You Invest Each Month If you’re wondering, “how much should i be investing this year?”, the answer is to invest whatever amount you can afford! still, the general rule of thumb is to strive to invest 10% 20% of your income regularly into individual retirement accounts (iras) and other investment portfolios in order to achieve a normal retirement age (in your mid 60’s). You also accumulate $100,000 in your 401 (k) in that period, thanks to steady contributions, solid returns and a good employer match. from age 35 to age 67, you’d need to invest just over $1,000 per month or 20% of your income to reach your $1.5 million savings goal. this example illustrates how you can accomplish both goals—investing and.

How Much Of Your Income Should You Invest Each Month Use nerdwallet's free roth ira calculator to estimate your balance at retirement and calculate how much you are eligible to contribute to a roth ira. got a 401(k)? we have a calculator for that, too. Price return is the annualized change in the price of the stock or mutual fund. if you buy it for $50 and the price rises to $75 in one year, that stock price is up 50%. if the following year the. This is how much of your income should go toward investing, according to experts select speaks with a cfp about a 50 15 5 rule to help you stay on track with your investments. updated sun, jul 30 2023. Use the investment calculator to determine: how much an initial investment will grow over time. how much you’ll need to invest now to retire. the amount you should contribute to retirement each year, even if you’re starting to invest later in life. how much to invest per month to reach a future financial goal.

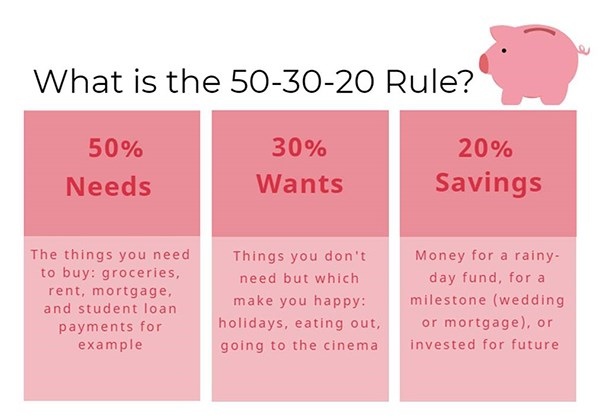

How Much Of Your Income Should You Invest Each Month This is how much of your income should go toward investing, according to experts select speaks with a cfp about a 50 15 5 rule to help you stay on track with your investments. updated sun, jul 30 2023. Use the investment calculator to determine: how much an initial investment will grow over time. how much you’ll need to invest now to retire. the amount you should contribute to retirement each year, even if you’re starting to invest later in life. how much to invest per month to reach a future financial goal. If you’re 50 or older, your $7,000 limit translates to $583 a month. if you invest $6,000 once a year at an average 7% rate of return, you could have $612,438 in your ira after 30 years. on the other hand, if you invest $500 a month, you could end up with $658,684. that’s an estimated increase of nearly $40,000 just from contributing. Many of the experts we spoke with suggested, as a general rule, to invest a set percentage of your after tax income. although that percentage can vary depending on your income, savings, and debts.

How Much Of Your Income Should You Invest Each Month If you’re 50 or older, your $7,000 limit translates to $583 a month. if you invest $6,000 once a year at an average 7% rate of return, you could have $612,438 in your ira after 30 years. on the other hand, if you invest $500 a month, you could end up with $658,684. that’s an estimated increase of nearly $40,000 just from contributing. Many of the experts we spoke with suggested, as a general rule, to invest a set percentage of your after tax income. although that percentage can vary depending on your income, savings, and debts.

Comments are closed.