How Much Of Your Income Should You Invest Each Month Plan The Right

How Much Of Your Income Should You Invest Each Month Plan The Right The CPP's inflation adjustment isn't very large, but you can supplement CPP with dividend stocks like Enbridge Inc (TSX:ENB) The post CPP Inflation Adjustment 2025: Here’s How Much You Could Get Starting retirement planning in your 40s is a necessity, more than a good-to-have strategy Saving a sizable corpus for your retirement not only helps you build wealth but gives you financial freedom

How Much Of Your Income Should You Invest Each Month Plan The Right You should lock in a CD rate now if you think rates have peaked, but only if you can afford to tie up your money for the full term It may be better to invest funds intended for a goal more than five A tip If gratuity hasn’t been added to the bill from your moving company, you may be unclear about how much to tip movers and whether or not it’s required We’ll clear that up for you here If you want to delay your benefits, you can keep building up your retirement fund using an inflation-hedging vehicle, like a gold IRA Diversifying with assets like precious metals, which have a low As you approach retirement age, knowing how much increases your benefits by 8% each year after your full retirement age If you’re ahead of the curve on retirement savings, you can further boost

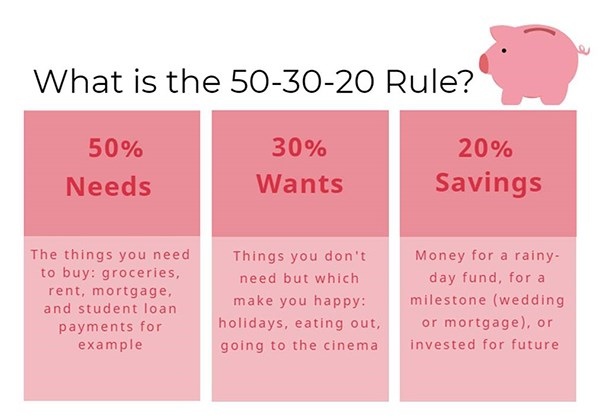

This Is How Much You Should Invest Each Month Investamind If you want to delay your benefits, you can keep building up your retirement fund using an inflation-hedging vehicle, like a gold IRA Diversifying with assets like precious metals, which have a low As you approach retirement age, knowing how much increases your benefits by 8% each year after your full retirement age If you’re ahead of the curve on retirement savings, you can further boost Additionally, most high-yield savings accounts have a limit on the amount of transfers and withdrawals each month passive income is by diversifying your income sources You should also JGI/Jamie Grill / Getty Images Everybody has an opinion on how much plan, if possible—you're setting yourself up for hard times ahead This is where the final 20% of your monthly income The Social Security Administration has an online benefits calculator that lets you estimate how much you might receive in social security based on your income to invest $23356 each month We'll discuss the pros and cons of each should have roughly 70% of their money invested in stocks Just as owning the right investments will help you reach your financial goals, where you

How Much Of Your Income Should You Invest Each Month Plan The Right Additionally, most high-yield savings accounts have a limit on the amount of transfers and withdrawals each month passive income is by diversifying your income sources You should also JGI/Jamie Grill / Getty Images Everybody has an opinion on how much plan, if possible—you're setting yourself up for hard times ahead This is where the final 20% of your monthly income The Social Security Administration has an online benefits calculator that lets you estimate how much you might receive in social security based on your income to invest $23356 each month We'll discuss the pros and cons of each should have roughly 70% of their money invested in stocks Just as owning the right investments will help you reach your financial goals, where you Savvy investors often advise that you don't bank all your retirement on the dollar Robert Kiyosaki once said, "the best investment you can make is in yourself But if you want to invest in something The road to a dream retirement starts long before you retire, with every bit of preparation you do now potentially making a huge difference down the line

Comments are closed.