How Much Should You Put Monthly Into A Roth Ira

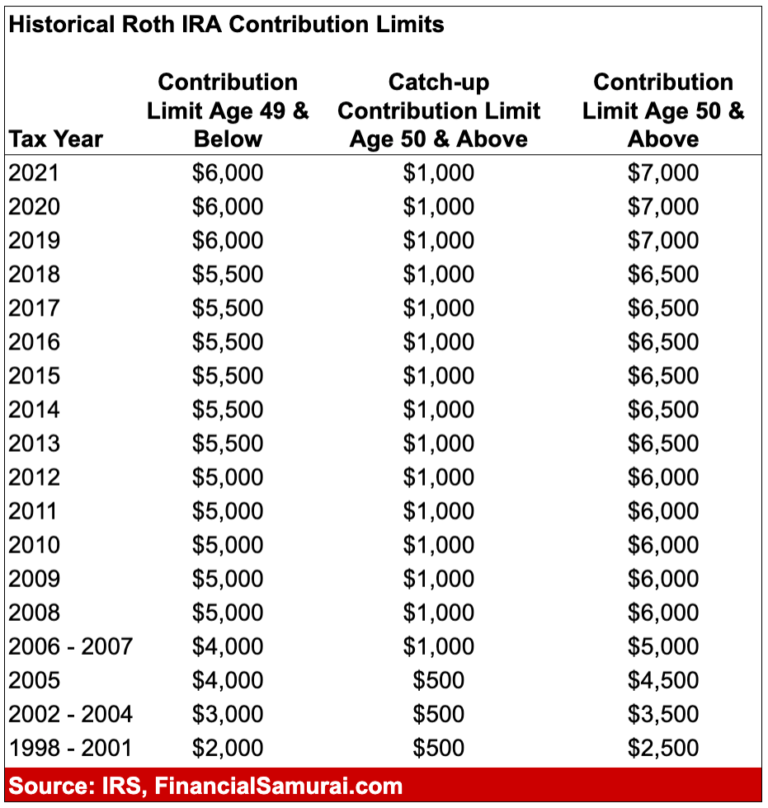

How Much Should I Put In My Roth Ira Monthly Investment Finance Because the maximum annual contribution amount for a roth ira is $6,000, following a dollar cost averaging approach means you would therefore contribute $500 a month to your ira. if you’re 50 or older, your $7,000 limit translates to $583 a month. if you invest $6,000 once a year at an average 7% rate of return, you could have $612,438 in. The amount you can contribute to a roth ira depends on your annual income. the roth ira contribution limit for 2024 is $7,000 in 2024 ($8,000 if age 50 or older) .

How Much Should I Put In My Roth Ira Monthly Retirement News Dai The maximum amount you can contribute to a traditional ira or roth ira (or combination of both) in 2024 is $7,000. so that’s about $583 a month. if you’re age 50 or over, the irs allows you to contribute up to $7,500 annually (or $625 a month). note that there are income limits for roth ira eligibility. Also, because there are no taxes owed on roth ira contributions, setting aside as much as possible in a roth ira can help reduce the size of a taxable estate, leaving more money for heirs. tax diversification in retirement –retirees are required to pay taxes on distributions from retirement plans such as a 401(k) or traditional ira, as well. How much should you put in your roth ira? the ideal amount to contribute to a roth ira is $6,000 (or $7,000 if you are 50 or older) in 2022, or up to the contribution limits of your income. chloe elise, ceo, founder, and financial coach at deeper than money, told the balance over email that she recommends maxing out your roth ira whenever. The investments inside of a roth ira generate investment returns. historically, you could expect a 7% to 10% rate of return on individual stocks and stock based mutual funds. however, according to business insider, the s&p 500 average yearly return has increased to about 14.7% in the past 10 years.

Guide To How Much To Put In Roth Ira Per Month Moneylion How much should you put in your roth ira? the ideal amount to contribute to a roth ira is $6,000 (or $7,000 if you are 50 or older) in 2022, or up to the contribution limits of your income. chloe elise, ceo, founder, and financial coach at deeper than money, told the balance over email that she recommends maxing out your roth ira whenever. The investments inside of a roth ira generate investment returns. historically, you could expect a 7% to 10% rate of return on individual stocks and stock based mutual funds. however, according to business insider, the s&p 500 average yearly return has increased to about 14.7% in the past 10 years. Traditional and roth iras give you options for managing taxes on your retirement investments. contribution limits. unlike taxable investment accounts, you can’t put an unlimited amount of money. The roth ira contribution limit for 2024 is $7,000 for those under 50, and $8,000 for those 50 and older. your personal roth ira contribution limit, or eligibility to contribute at all, is dictated by your income level. a roth ira is a tax advantaged way to save and invest for retirement.

Comments are closed.