How Power Bi Can Boost Your Mortgage Business Data Insights For Mortgage Professionals Part 1

Reimagine Mortgage Data Analytics With Power Bi Power bi changes the game by providing a dynamic and interactive platform enabling lenders to transform raw data into actionable insights quickly. streamlined data visualization. power bi empowers mortgage professionals to transform raw data into visually engaging dashboards and reports. with intuitive drag and drop functionality, lenders can. Mortgage lenders know data can hold the secrets to understanding and anticipating the needs of their business, their consumers, and the broader industry. having visibility into industry trends and the performance of peer groups provide opportunities to optimize business processes and gain an advantage over the competition. analyze your encompass data with encompass data connect today.

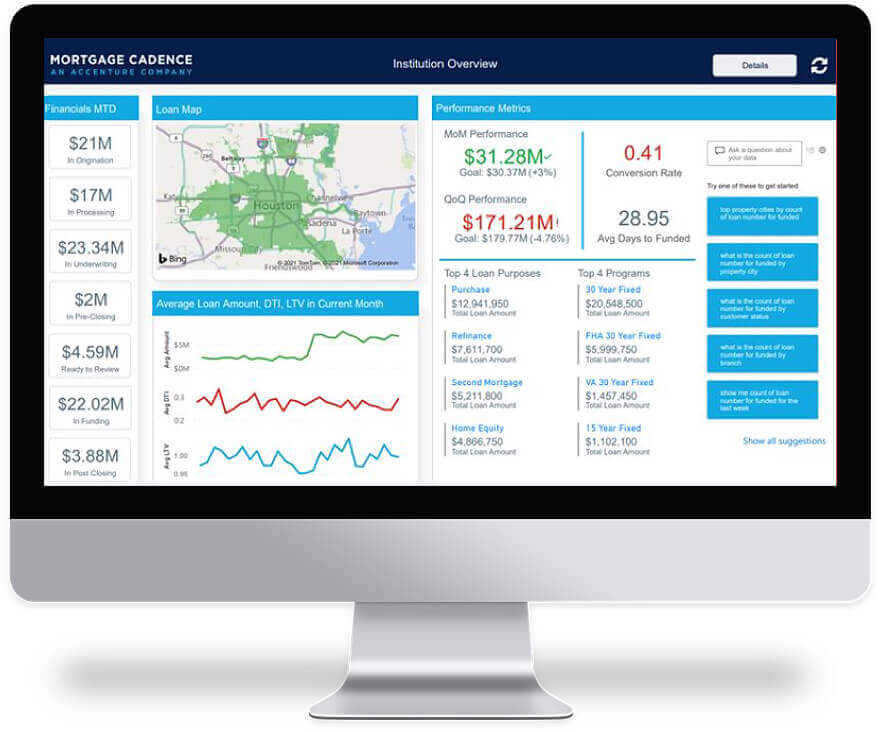

Mortgage Analytics Software Business Analytics Mortgage Cadence Here’s a step by step process for creating a basic power bi dashboard you can build on to track and analyze key financial metrics. 1. define your goals and gather data. determine the purpose and goals of your dashboard. identify the key metrics and insights you want to present and who your audience would be. For instance, you can create a flow that sends an email or notification when a certain condition is met in a power bi report, or you can use power automate to update data sources based on insights. Power bi is the reporting solution of choice for the mortgage cadence platform, bringing your data together as coherent, visually immersive and interactive insights. completely integrated into mcp, power bi gives you the ability to see reports directly on platform as well as access them through the web. power bi delivers business intelligence. Starting with data profiling, so we can identify possible outliers and anomalies, then applying various data shaping techniques to prepare the data before it becomes part of our data model data modeling — as we are building an analytic solution, the data model must satisfy (or at least should satisfy) some general postulates related to data.

Get Insights Into Your Business Data With Power Bi вђ Housing Pr Power bi is the reporting solution of choice for the mortgage cadence platform, bringing your data together as coherent, visually immersive and interactive insights. completely integrated into mcp, power bi gives you the ability to see reports directly on platform as well as access them through the web. power bi delivers business intelligence. Starting with data profiling, so we can identify possible outliers and anomalies, then applying various data shaping techniques to prepare the data before it becomes part of our data model data modeling — as we are building an analytic solution, the data model must satisfy (or at least should satisfy) some general postulates related to data. Here are 20 steps you can take to grow your business right now. 1 – follow up with current and former customers. between online customer reviews and traditional word of mouth, consumers rely heavily on reviews from past customers to decide who to do business with. this is no difference in the mortgage industry, as 52% of buyers stated that. According to gartner, power bi is the leading data visualization tool with more than 6 million users and 97% of fortune 500 companies using it to democratize data insights. power bi is made up of two components: power bi desktop is a free desktop version that allows for data analysis and report creation and includes the power query editor.

Comments are closed.