How The 3 Buckets Strategy Can Help You To Boost Your Sales

How The 3 Buckets Strategy Can Help You To Boost Your Sales It includes a percentage of a portfolio that could be lost if the market takes a downturn. “this bucket is designed to allow you to catch the 15 to 20% growth while assuming 100% risk if the. The 3 bucket retirement strategy is very modular you can have an income producing bucket combined with a cash equivalent bucket that balances out a more risky “growth only” bucket. then one can have a dynamic spending strategy to help reinforce the particular composition of ones retirement bucket strategy.

Retirement Income The Bucket Strategy The strategy involves dividing your assets into three distinct "tax buckets": tax deferred, tax free, and after tax. the goal is to have a diversified portfolio that allows you to control your tax situation in retirement, regardless of the tax policy or tax rates in place. the tax deferred bucket includes accounts such as 401ks and iras, the. The “now” bucket includes money needed over the first one to five years of retirement. it’s used to cover expenses needed beyond any income you have coming in at the time, such as social security, rentals, pensions or part time income. money in the “soon” bucket is for expenses beyond five years, such as 6 to 15 years, and the. The first bucket is used to fund day to day living expenses. the third bucket is used to fund longevity. the middle bucket is the go between or transfer place to refill bucket number #1 as it is depleted. let’s look more closely at the three buckets: bucket #1: cash flow. bucket #2: transfer. bucket #3: longevity. The buckets strategy is a retirement asset allocation and spend down strategy that you should certainly know about. it was popularized by ray lucia's book buckets of money: how to retire in comfort and safety. you don't need to read a whole book to understand it, though. like any retirement asset allocation or spend down strategy, the idea is.

The Three Bucket Strategy Plan To Rise Aboveв The first bucket is used to fund day to day living expenses. the third bucket is used to fund longevity. the middle bucket is the go between or transfer place to refill bucket number #1 as it is depleted. let’s look more closely at the three buckets: bucket #1: cash flow. bucket #2: transfer. bucket #3: longevity. The buckets strategy is a retirement asset allocation and spend down strategy that you should certainly know about. it was popularized by ray lucia's book buckets of money: how to retire in comfort and safety. you don't need to read a whole book to understand it, though. like any retirement asset allocation or spend down strategy, the idea is. Using this strategy, you'll hold $50,000 for the first two years in cash in your bank accounts. in the second bucket, $200,000 will be invested in fixed income assets. the remaining $250,000 will. The all important bucket 1. the linchpin of any bucket framework is a highly liquid component to meet near term living expenses for one year or more. cash yields are extremely low, so bucket 1 is.

The Three Bucket Strategy Started At 50 Using this strategy, you'll hold $50,000 for the first two years in cash in your bank accounts. in the second bucket, $200,000 will be invested in fixed income assets. the remaining $250,000 will. The all important bucket 1. the linchpin of any bucket framework is a highly liquid component to meet near term living expenses for one year or more. cash yields are extremely low, so bucket 1 is.

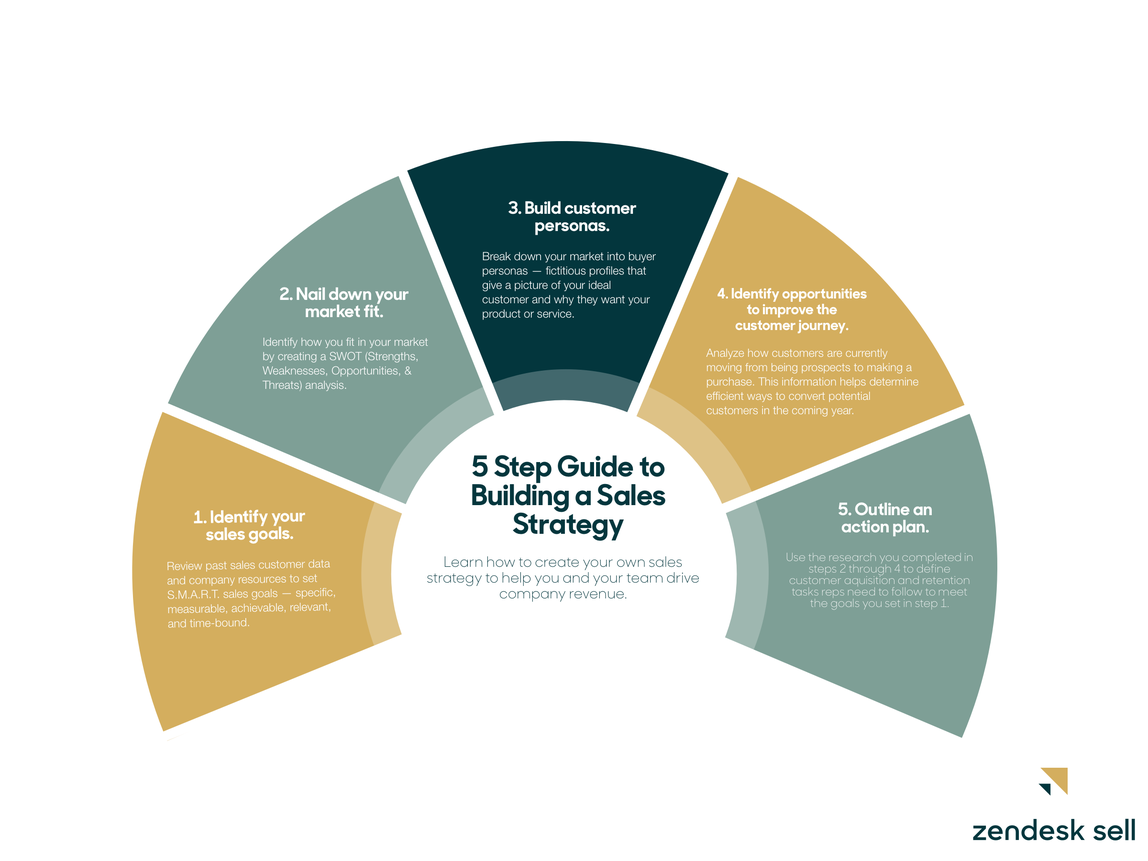

The Step By Step Guide To Building An Effective Sales Strategy

Comments are closed.