How To Contribute To A Tax Free Roth Ira If You Make Too Much Money

How To Contribute To A Tax Free Roth Ira If You Make Too Much Money 1 for 2023, as a single filer, your modified adjusted gross income (magi) must be under $153,000 to contribute to a roth ira. as a joint filer, it must be under $228,000. 2 you must be 59 1 2 and have held the roth ira for five years before tax free withdrawals on earnings are permitted. 3 subject to certain exceptions for hardship or other. The backdoor roth ira strategy. the removal of a $100,000 magi limit for roth conversions in 2010 created a loophole in the tax code that allows high income filers to legally make indirect.

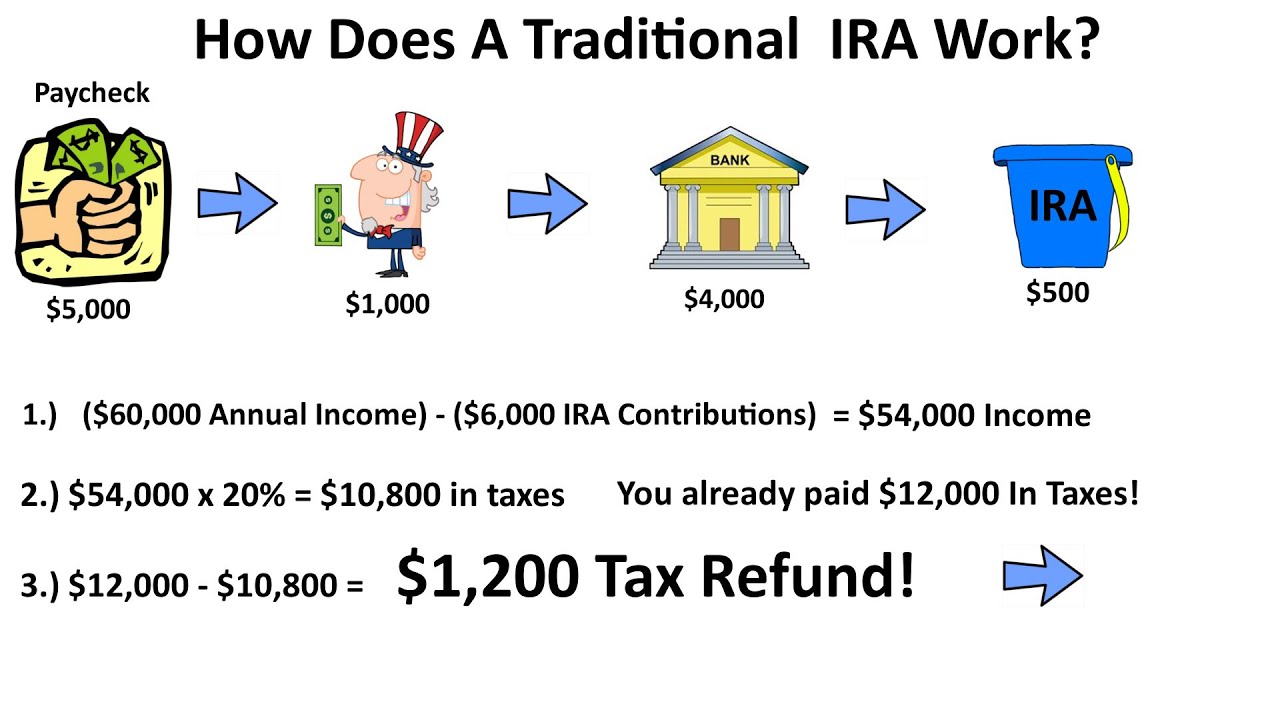

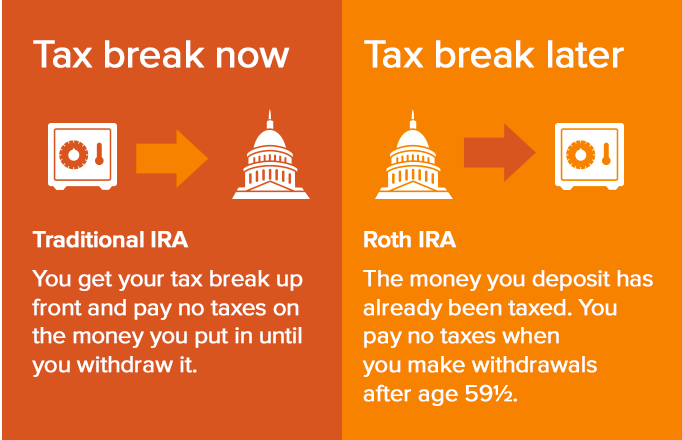

How Does An Ira Work Traditional Ira Explained In A Flow Chart Tax The roth ira is alluring because it allows anyone to contribute money, as long as they have earned income. you can even open a roth ira for your child and allow time to work in their favor. for. A roth ira is an ira that, except as explained below, is subject to the rules that apply to a traditional ira. you cannot deduct contributions to a roth ira. if you satisfy the requirements, qualified distributions are tax free. you can make contributions to your roth ira after you reach age 70 ½. you can leave amounts in your roth ira as long. For example, you must be 50 by the end of 2023 to contribute $7,500 to your ira or roth ira for the 2023 tax year. the amount increases in 2024 to $7,000 and $8,000 for people 50 and over. The most you can contribute to all of your traditional and roth iras is the smaller of: for 2021, $6,000, or $7,000 if you’re age 50 or older by the end of the year; or your taxable compensation for the year. for 2022, $6,000, or $7,000 if you’re age 50 or older by the end of the year; or your taxable compensation for the year.

Traditional Vs Roth Ira Alliance Wealth Advisors For example, you must be 50 by the end of 2023 to contribute $7,500 to your ira or roth ira for the 2023 tax year. the amount increases in 2024 to $7,000 and $8,000 for people 50 and over. The most you can contribute to all of your traditional and roth iras is the smaller of: for 2021, $6,000, or $7,000 if you’re age 50 or older by the end of the year; or your taxable compensation for the year. for 2022, $6,000, or $7,000 if you’re age 50 or older by the end of the year; or your taxable compensation for the year. The contribution limit for a roth ira is $7,000 (or $8,000 if you are over 50) in 2024. those are the caps even if you make more, up to the phaseout level. earned income is the basis for. At higher income levels, your maximum contribution declines the more you earn. and if your magi is $161,000 or more, you’re no longer eligible to contribute to a roth ira. if you’re a married couple filing jointly, you can contribute up to the maximum amount to each spouse’s ira if your combined magi is under $230,000 for 2024.

Comments are closed.