How To Correct A 1099 Form Helpful Manual

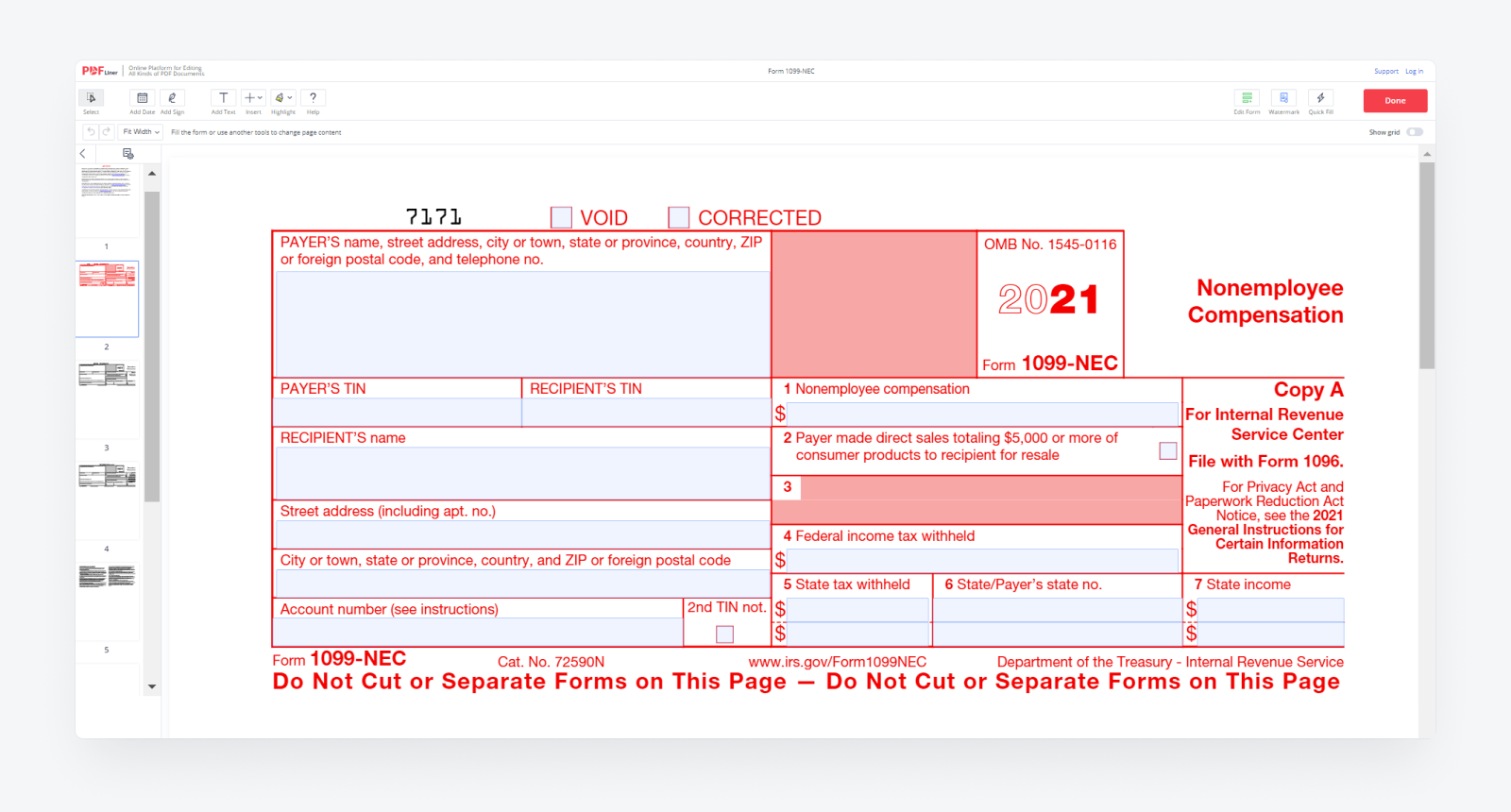

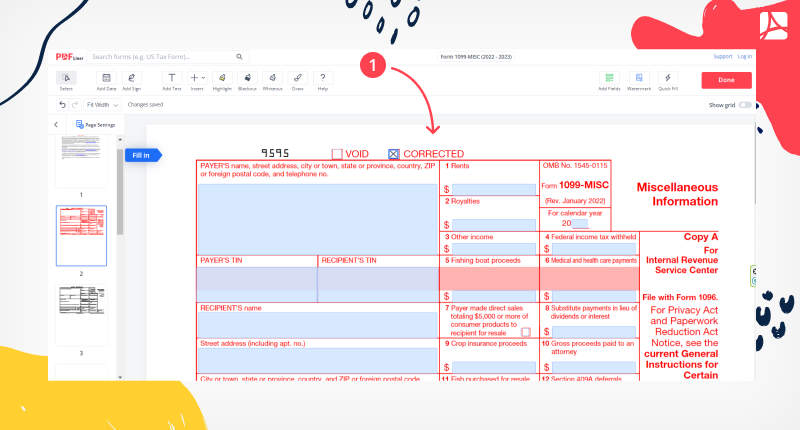

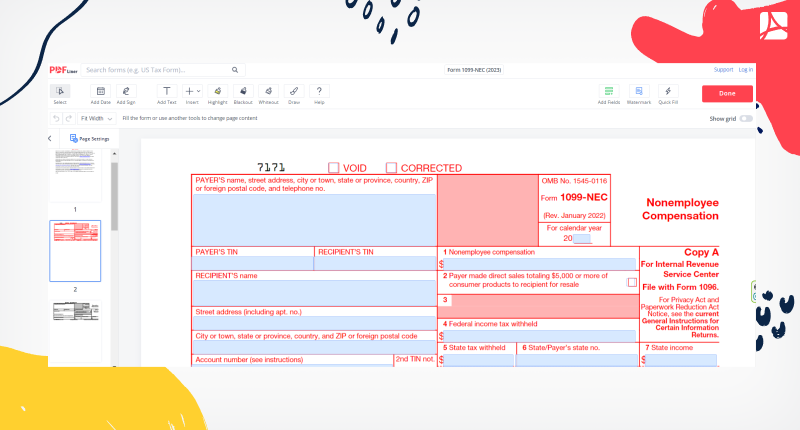

How To Correct A 1099 Form Helpful Manual Form 1099 nec, box 2. payers may use either box 2 on form 1099 nec or box 7 on form 1099 misc to report any sales totaling $5,000 or more of consumer products for resale, on a buy sell, a deposit commission, or any other basis. for further information, see the instructions, later, for box 2 (form 1099 nec) or box 7 (form 1099 misc). Steps 1 and 2. note: you do not have to file a corrected return for an incorrect payer tin and or incorrect payer name and address. correction. step 1. identify incorrect return submitted. prepare a new information return. enter an “x” in the “corrected” box (and date optional) at the top of the form.

How To Correct A 1099 Form Helpful Manual The issuer will prepare a form 1099 in the correct amount and check a “corrected” box on the form. the corrected form is supposed to cancel out the first one in the irs system, once you give. The best way to avoid issues with 1099 filing is to start preparing early. review your vendor information before year end to be sure you have all the form w 9s and other information required to file these forms. 3. completing the wrong form. if paper filing, be sure to use the correct year of the form. When you have made corrections to one or more 1099 forms, complete a new 1099 form for each recipient. mail copy a and the corrected transmission form (form 1096) to the irs processing center. give copy 2 and copy b to the recipient. keep both copies of copy c (the incorrect one and the corrected one) for your business records. Step 1: identify the incorrect return submitted: prepare a new form 1099. enter an x in the “corrected” box. enter the payer, recipient, and account number information exactly as it appeared on the original incorrect return. enter “0” for all money amounts.

How To Correct A 1099 Form Helpful Manual When you have made corrections to one or more 1099 forms, complete a new 1099 form for each recipient. mail copy a and the corrected transmission form (form 1096) to the irs processing center. give copy 2 and copy b to the recipient. keep both copies of copy c (the incorrect one and the corrected one) for your business records. Step 1: identify the incorrect return submitted: prepare a new form 1099. enter an x in the “corrected” box. enter the payer, recipient, and account number information exactly as it appeared on the original incorrect return. enter “0” for all money amounts. So, after you complete the new corrected form, follow the next steps: put a tick in the box “corrected” at the top of the page; send the new form to the irs; send the corrected form to the vendor or contractor with whom you worked; if you need, file form 1096 with the corrected return; don’t include incorrect form anywhere;. Step 7: submit the corrected forms to the irs. mail both the corrected form 1099 nec and the new form 1096 to the appropriate irs address, which can be found in the irs instructions for form 1096. make sure to submit the forms by the deadline for filing corrected 1099 nec forms to avoid potential penalties. retain copies of these forms for your.

Comments are closed.