How To Efile Your 1099s At The Last Possible Minute

How To E File 1099s "this simplifies filing for those issuing 1099s and helps recipients receive information timely. the launch of iris can help reduce the millions of paper forms 1099 we project will be filed in 2023 and demonstrates our commitment to finding useful and innovative ways of reducing paperwork on the business community and others issuing 1099s. You can e file information returns for tax year 2022 and later with the information returns intake system (iris). the system also lets you file corrections and request automatic extensions. 10 or more returns: e filing is required. for system availability, check iris status. get solutions to known issues. there are 2 ways to e file with iris:.

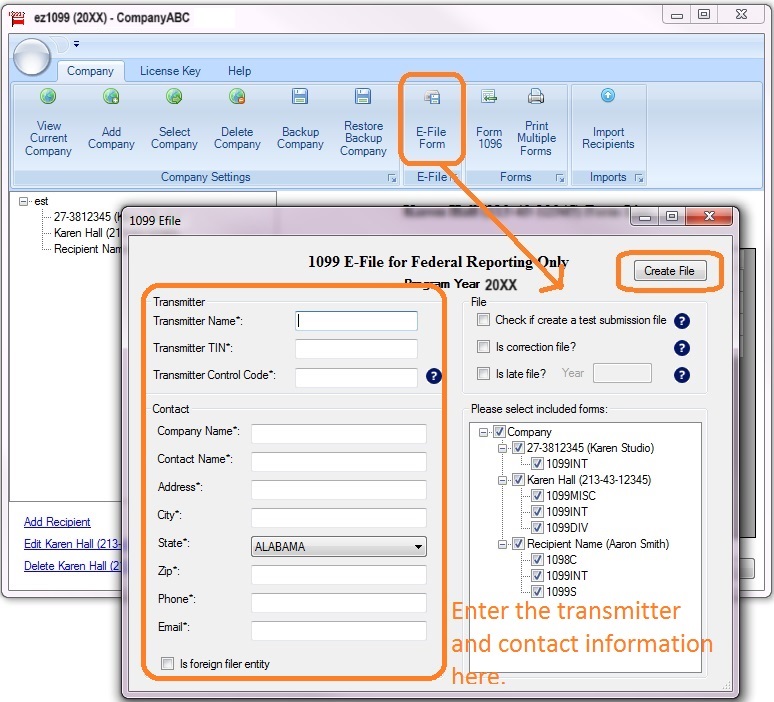

How To Efile Your 1099s With Rentec Direct Live Training Youtube To e file information returns with an irs system, you need to apply for a tcc. this five character, alphanumeric code identifies your firm or entity when you e file. don't delay in completing your tcc application. it may take to up 45 days for processing. apply for a tcc to e file with an irs system: the responsible official listed on your. Filing closer to april 15 will give you time to collect tax documents and help you avoid amending a return, but the more you delay, the worse a number of things can become. The form 1099 late filing penalty is as follows based on how late you file: $60 per form if you file within 30 days after the due date. $120 per form if over 30 days late but before aug 2. $310 per form after aug 1 or if you don’t file at all. $630 per form for intentionally disregarding filing requirements. Business owners and accounting clerks no longer need to deal with the headache around tax time. efile360 makes the e‑filing process of information return forms as painless as possible. it’s our job to provide the latest forms, know the deadlines, and stay up to date on regulations. cpas turn to us when their clients ask them to file 1099.

How To Efile 1099s Tax Forms The form 1099 late filing penalty is as follows based on how late you file: $60 per form if you file within 30 days after the due date. $120 per form if over 30 days late but before aug 2. $310 per form after aug 1 or if you don’t file at all. $630 per form for intentionally disregarding filing requirements. Business owners and accounting clerks no longer need to deal with the headache around tax time. efile360 makes the e‑filing process of information return forms as painless as possible. it’s our job to provide the latest forms, know the deadlines, and stay up to date on regulations. cpas turn to us when their clients ask them to file 1099. Copy 1: state tax department, if applicable. copy b: recipient (independent contractor or vendor) copy 2: recipient (independent contractor or vendor) copy c: keep in your business records. you can e file both forms with the irs. however, keep in mind that e filing deadlines may vary. file and send copies of form 1099 nec to workers by january. If you choose the 1099 e file service, intuit will e file your federal 1099 information with the irs, and then print and mail a copy directly to your contractors; fees apply. as part of the paid 1099 e file service, we also give your contractors online access to their 1099s.

Comments are closed.