How To File Your 1099 Misc And 1099 Nec In Quickbooks Online

How To File Your 1099 Misc And 1099 Nec In Quickbooks Online Youtube We will go over how to make sure your account is set up and ready to file 1099s for your vendors. whether you are e filing or manually filing, this webinar w. Quickbooks online can help you prepare your 1099s seamlessly, using the info you already have in your account. follow these steps to create and file your 1099s. when you file 1099s with us, we may email or mail a printed copy, to your contractors. step 1: create your 1099s. here’s how to get your 1099s ready to e file or print.

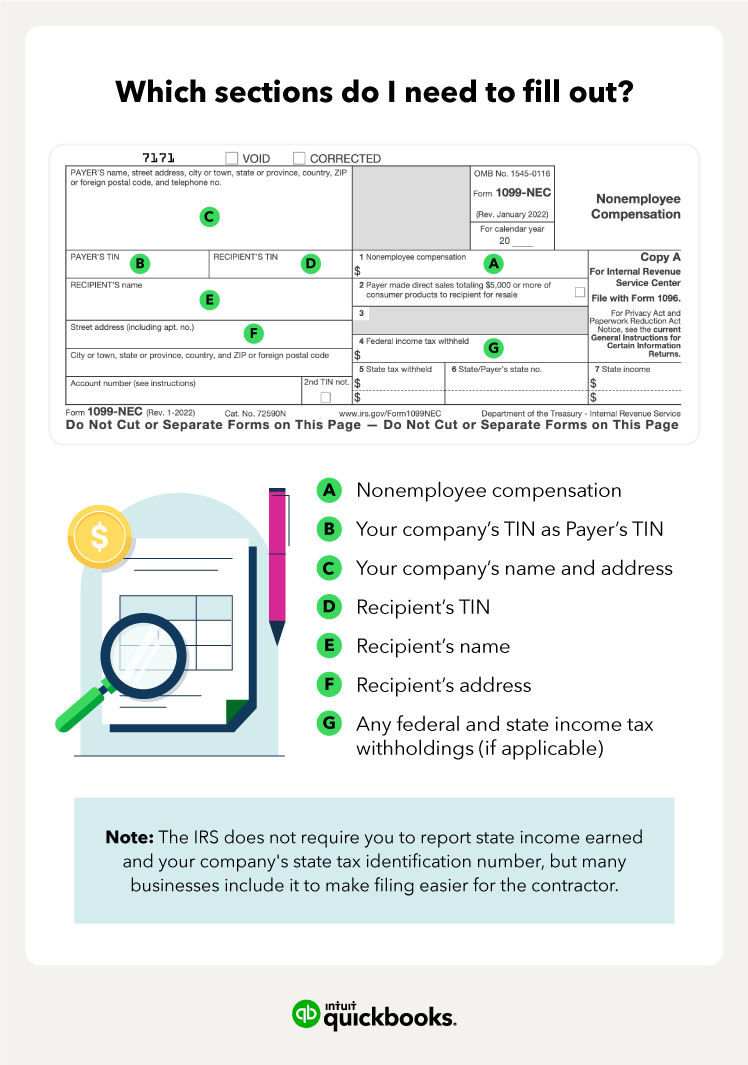

How To Fill Out A 1099 Form Quickbooks Based on your needs to file both the 1099 misc and 1099 nec you will need to adjust your chart of accounts to ensure accounts are set up specifically for each form. step 3: create a new account. add a new account to your chart of accounts to track the separate payments. step 4: move the payments to the new account. This video is for setting up and filing the 1099 nec and 1099 misc for quickbooks online users (qbo) are you ready for the new 1099 nec? ️ what are the chang. If you choose the 1099 e file service, intuit will e file your federal 1099 information with the irs, and then print and mail a copy directly to your contractors; fees apply. as part of the paid 1099 e file service, we also give your contractors online access to their 1099s. state filing not included. Are you ready for the new 1099 nec? what are the changes for the 2020 tax year…this video is for setting up and filing the 1099 nec and 1099 misc for quickbo.

Comments are closed.