How To Fill Out A 1099 Form Quickbooks

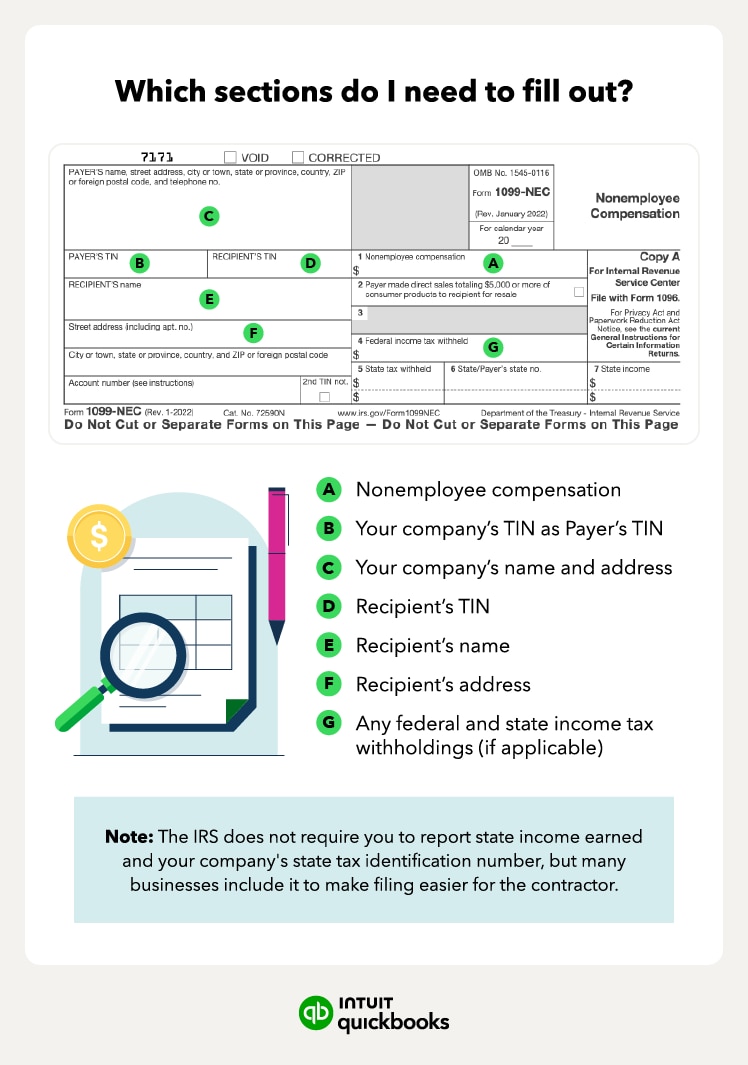

How To Fill Out A 1099 Form Quickbooks Here are the instructions for how to complete a 1099 nec, line by line: box 1: nonemployee compensation: post the nonemployee compensation and. payer’s tin: list your company’s taxpayer identification number (tin) as payer’s tin. payer’s information: list your business’s name and address in the top left section of the form. Step 1: get the invite from your employer. ask your employer or client to invite you to fill out your w 9. if you already have a quickbooks self employed account, ask them to send the invite to the email address you use to sign in. if you don't have an account, you can create a limited quickbooks self employed account just for your forms.

How To Process 1099 Forms In Quickbooks Online Youtube Quickbooks online can help you prepare your 1099s seamlessly, using the info you already have in your account. follow these steps to create and file your 1099s. when you file 1099s with us, we may email or mail a printed copy, to your contractors. step 1: create your 1099s. here’s how to get your 1099s ready to e file or print. We will go over how to make sure your account is set up and ready to file 1099s for your vendors. whether you are e filing or manually filing, this webinar w. Learn more about 1099 forms: intuit.me 3suoxyuin this quickbooks payroll tutorial, @hectorgarciacpa will take you through all you need to know about 1. Tax time is here and businesses who paid contractors over $600 total in 2022, need to file form 1099 nec for them. we go over how to file the irs form 1099 n.

Comments are closed.