How To Fill Out A W 4 Form And Save On Taxes Nerdwallet

W 4 Guide To The 2024 Tax Withholding Form Nerdwallet Worksheets Filling out your w 4 correctly is a major factor in making sure you don't pay too much in taxes. nikita turk takes an in depth look at each section of a w 4. A w 4 form, or "employee's withholding certificate," is an irs tax document that employees fill out and submit to their employers. employers use the information on a w 4 to calculate how much tax.

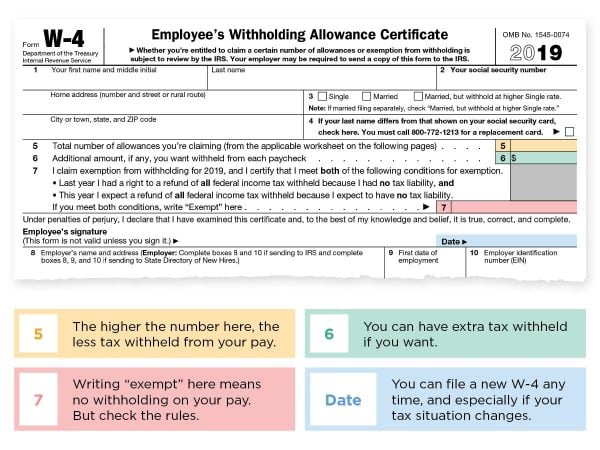

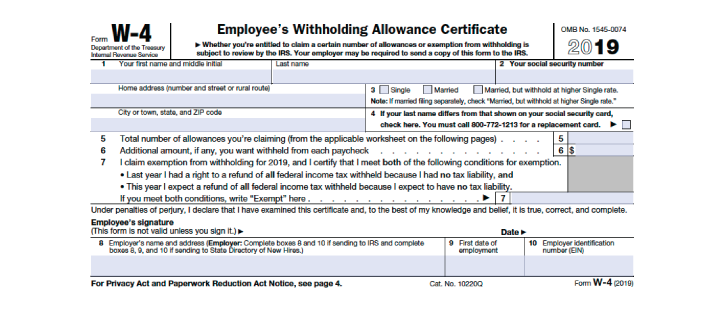

2019 W 4 Form How To Fill It Out What To Claim Calculator Nerdwalle With nerdwallet taxes powered by column tax, registered nerdwallet members pay one fee, regardless of your tax situation. save for college. w 4 form: what it is, how to fill it out in 2024. Filling out your w 4 correctly is a major factor in making sure you don't pay too much in taxes. nikita turk takes an in depth look at each section of a w 4 to empower you to fill out your form. As far as irs forms go, the new w 4 form is pretty straightforward. it has only five steps. if you are single, have one job, have no children, have no other income and plan on claiming the standard deduction on your tax return, you only need to fill out step 1 (your name, address, social security number and filing status) and step 5 (your. Adjust your additional withholding amount if needed. you can have extra tax taken out per pay period on the w 4. submit a new w 4 to your employer if needed to update your withholding. the bottom.

W 4 Form Irs How To Fill It Out Definitive Guide 2018 Smartasset As far as irs forms go, the new w 4 form is pretty straightforward. it has only five steps. if you are single, have one job, have no children, have no other income and plan on claiming the standard deduction on your tax return, you only need to fill out step 1 (your name, address, social security number and filing status) and step 5 (your. Adjust your additional withholding amount if needed. you can have extra tax taken out per pay period on the w 4. submit a new w 4 to your employer if needed to update your withholding. the bottom. Prior to 2020, a withholding allowance was a number on your w 4 form that your employer used to determine how much federal and state income tax to withhold from your paycheck. the more allowances you claimed on your form w 4, the less income tax would be withheld from each paycheck. beginning in 2020, the irs completely reworked form w 4 to. Step 2: account for all jobs you and your spouse have. unlike when you filled out w 4 forms in the past, you’ll have to fill out your w 4 with your combined income in mind, including self employment. otherwise, you may set up your withholding at too low a rate. to fill out this part correctly, you have three choices.

Comments are closed.