How To Make A Budget Your Step By Step Guide Ramsey

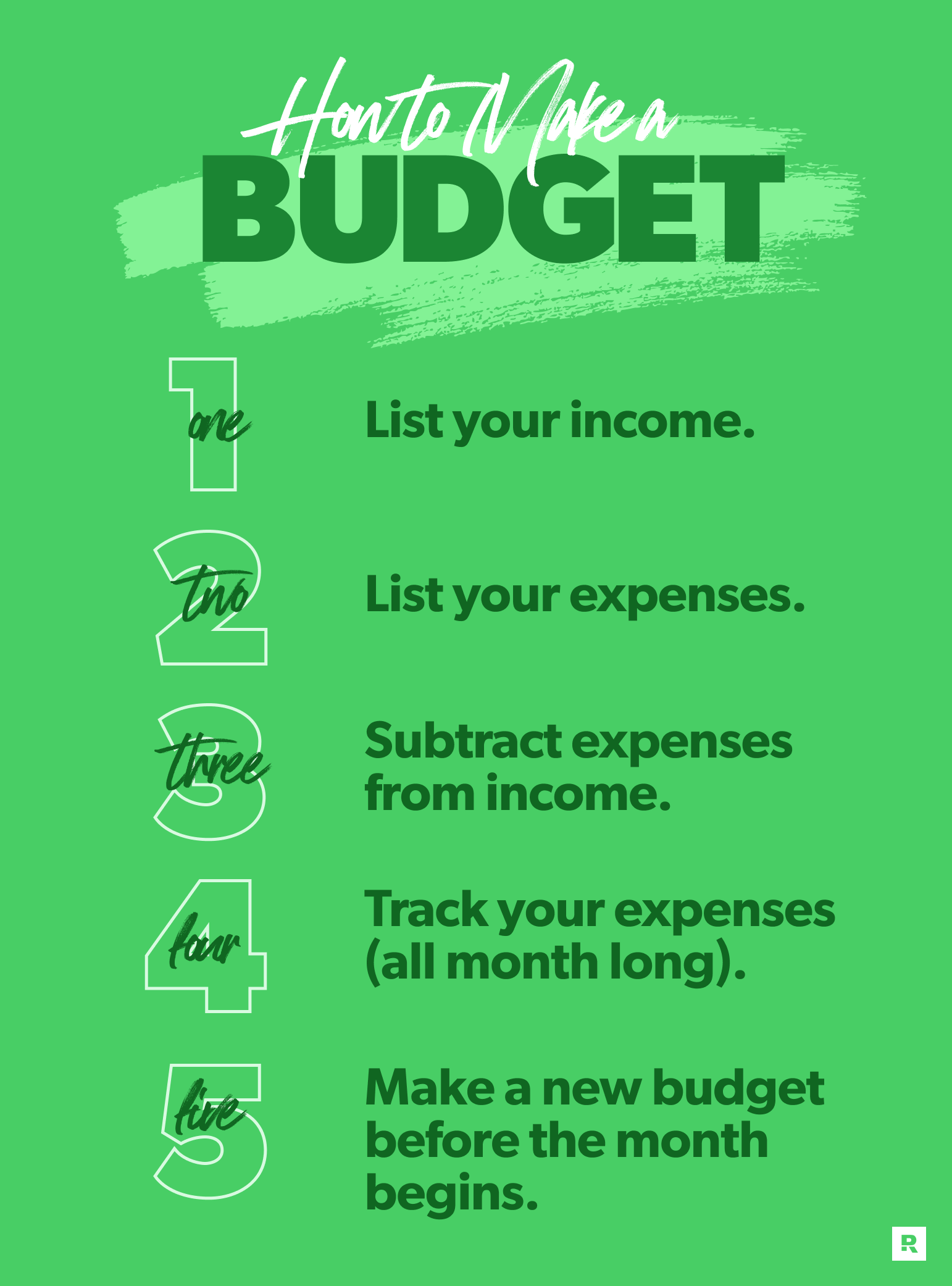

How To Make A Budget Your Step By Step Guide Ramsey Let’s do this.) subtract all your expenses from your income. this number should equal zero, meaning you just made a zero based budget. this is key: a zero based budget doesn’t mean you let your bank account reach zero. (leave a little buffer in there of about $100–300.) it also doesn’t mean you blow all your money. Step 2: list your expenses. now that you’ve planned for the money coming in, you can plan for the money going out. it’s time to list your expenses! (yep, this is when that bank account or statement gets super helpful.) think through these main areas as you're jotting down expenses: give and save. cover the four walls.

Budgeting For Beginners A Free Step By Step Guide Budgeting 5. make a new budget (before the month begins). your budget won’t change too much from month to month—but no two months are exactly the same. so, create a new budget every single month. don’t forget month specific expenses (like holidays or seasonal purchases). and do this before the month starts so you can get ahead of what’s coming. Here are ramsey’s ideal percentages across his 12 budget categories, using the example of a family of four with take home pay of $6,000 per month who needs part time childcare, has employer paid health insurance, and has paid off their non mortgage debt: housing costs: 25%. saving: 15%. Video: everydollar budgeting guide; video: how to reset next month's budget everydollar budgeting 101; ramsey break the cycle livestream; video: how to set up your budget; video: edit transactions; video: edit transactions; video: edit your budget; video: creating your first everydollar budget; video: how to set up personal goals. Step 1: enter your income. let's get started with your everydollar budget by adding your monthly income. the "planned" amount is what you expect to receive this month. step 2: plan expenses. now, you just have to enter a "planned" amount for each budget item until your "left to budget" amount is zero and you see the wording "it's an everydollar.

Comments are closed.