How To Make A Zero Based Budget Zero Based Budgeting Explaine

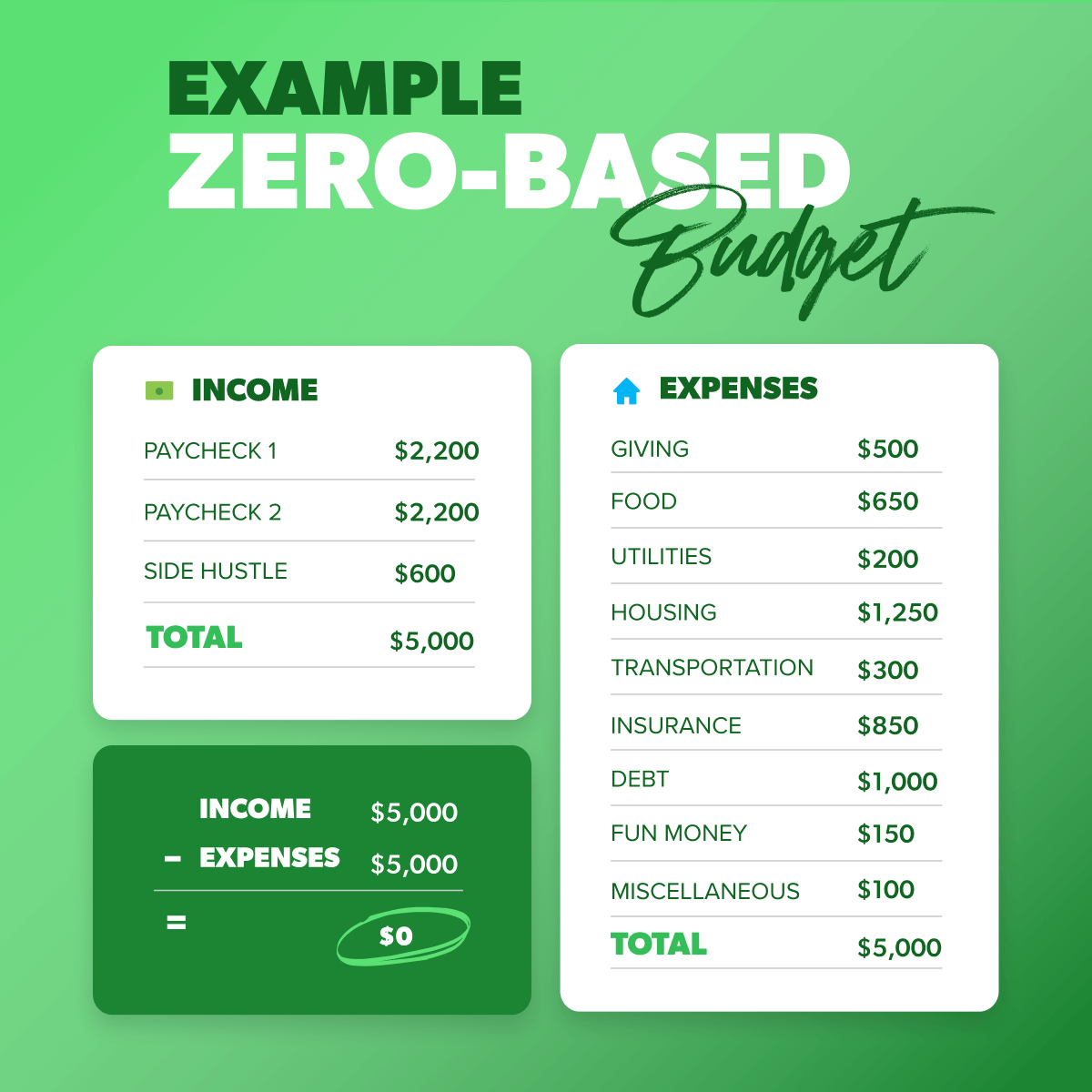

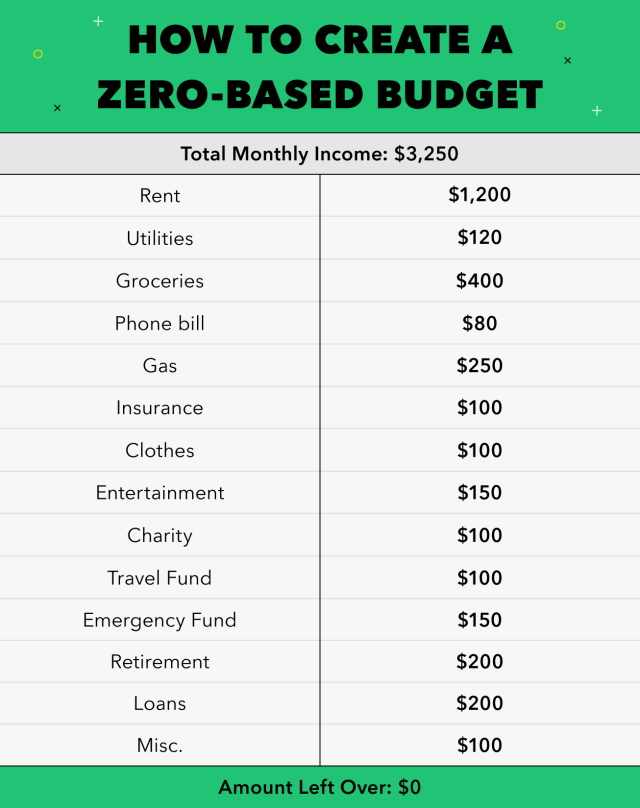

How To Create A Zero Based Budget Financial Expert Double pro tip: when you’re putting expenses in the budget, start with needs (those four walls) before wants (like fun money). 3. subtract your expenses from your income to equal zero. when you subtract all those expenses from your income, it should equal zero. Build your zero based budget with a budget app — such as you need a budget or goodbudget — or a spreadsheet or pen and paper. earn up to $350 in rewards each year. with a nerdwallet.

Zero Based Budgeting Zero Or Hero Deloitte Us Strategy Operations Making your own zero based budget may sound time intensive, but it’s a useful exercise for anyone new to budgeting. 1. figure out your monthly income. first, you’ll need to add up all of your monthly income. this can come from a variety of sources, including: wages and tips. freelance payments. Advantages of zero based budgeting. zero based budgeting is a proactive approach to spending money. instead of letting your impulses do the picking, you decide what you want to spend money on, far in advance of decision time. here are a few of the main benefits: assign a purposeful role to every dollar you earn; make financial goals a priority. Zero based budgeting (zbb) justifies all expenses for each new period. the process begins from a “zero base,” analyzing every function within an organization for its needs and costs. budgets. A zero based budget is a budgeting method in which every dollar of income is allocated for a specific purpose. this budgeting approach involves starting from scratch and allocating every dollar of.

How To Make A Zero Based Budget Zero Based Budgeting Ex Zero based budgeting (zbb) justifies all expenses for each new period. the process begins from a “zero base,” analyzing every function within an organization for its needs and costs. budgets. A zero based budget is a budgeting method in which every dollar of income is allocated for a specific purpose. this budgeting approach involves starting from scratch and allocating every dollar of. Zero based budgeting (zbb) is a budgeting technique that differs from traditional methods by requiring each expense to be justified and approved for each new budgeting period, regardless of whether the expense existed in the previous budget. unlike traditional incremental budgeting, where the new budget is based on past budgets with slight. A couple of benefits of zero based budgeting are: 1. it's incredibly insightful for spending habits. one of the benefits of zero based budgeting is that it shines a light on all of your spending. this gives you the ability to ruthlessly cut down on expenses that don't align with your values and goals. 2.

Zero Based Budgeting The Ultimate Guide Mintlife Blog Zero based budgeting (zbb) is a budgeting technique that differs from traditional methods by requiring each expense to be justified and approved for each new budgeting period, regardless of whether the expense existed in the previous budget. unlike traditional incremental budgeting, where the new budget is based on past budgets with slight. A couple of benefits of zero based budgeting are: 1. it's incredibly insightful for spending habits. one of the benefits of zero based budgeting is that it shines a light on all of your spending. this gives you the ability to ruthlessly cut down on expenses that don't align with your values and goals. 2.

Comments are closed.