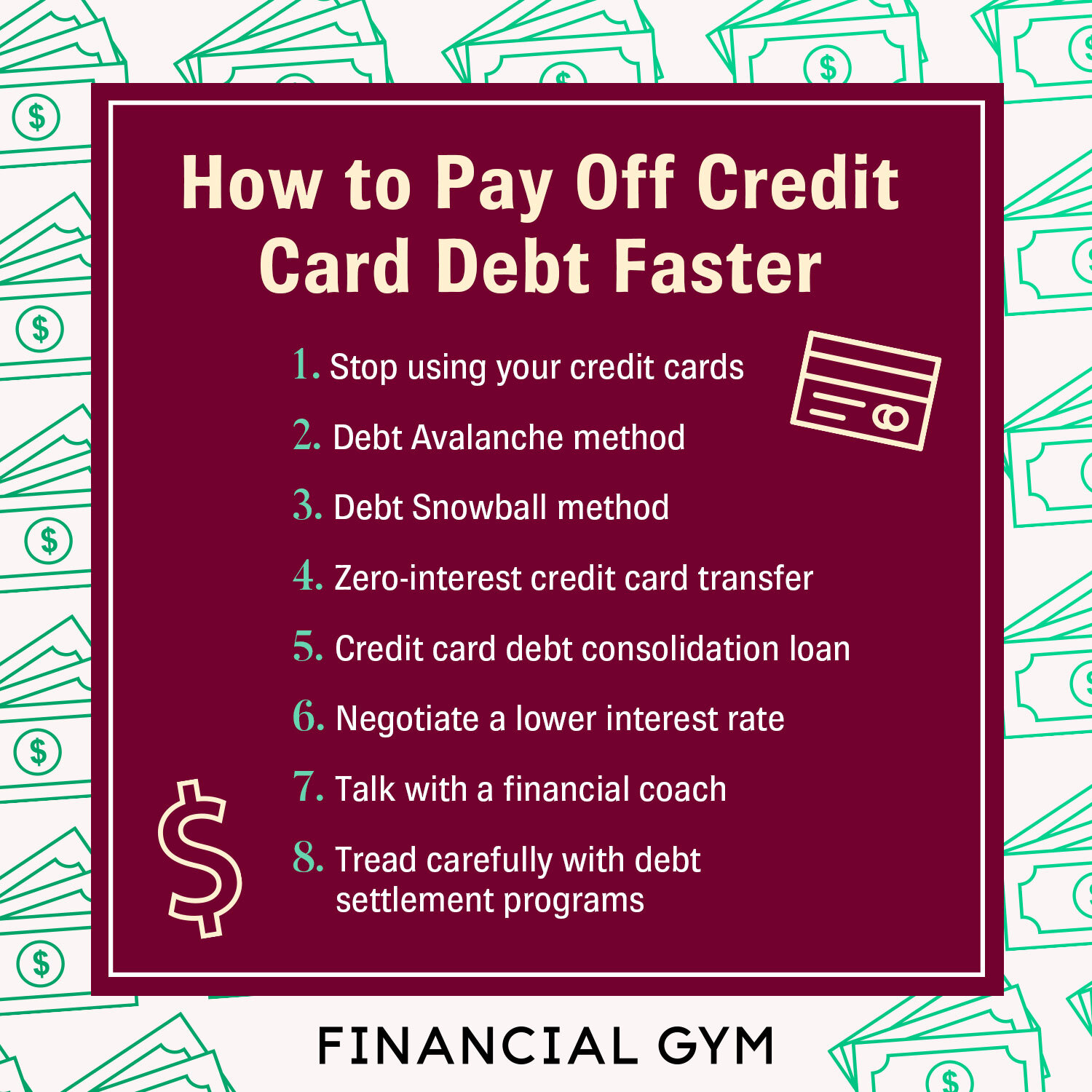

How To Pay Off Credit Card Debt Fast 8 Steps To R

How To Pay Off Credit Card Debt Fast 8 Steps To Redu 5. lower your living expenses. while you are taking some or all of these steps to pay off your credit card debt, it’s beneficial to look for ways to lower your living expenses. doing so may help. 1. debt snowball. the debt snowball method is the best way to pay off credit card debt—and the fastest way. (trust me: i know from personal experience!) here’s how the debt snowball works: list all your debts from smallest to largest. if you’ve got multiple credit cards, list the balances individually.

How To Pay Off Credit Card Debt 7 Strategies Lexington Law Wallethub. @wallethub. to pay off $7,000 in credit card debt within 36 months, you will need to pay $254 per month, assuming an apr of 18%. you would incur $2,127 in interest charges during that time, but you could avoid much of this extra cost and pay off your debt faster by using a 0% apr balance transfer credit card. 5. create a $1,000 emergency fund. it’s really important to have an emergency buffer even while paying off debt. if something happens, you can use this cash instead of going back to your credit cards. plan to contribute to your emergency fund a little bit at a time, e.g., $100 a paycheck. Continue until all your credit card balances have been paid in full. say you have three credit cards with balances of $700, $1,500 and $4,000. with the snowball method, you’d pay off the card with the $700 balance first. then you’d move on to the card with the $1,500 balance, and you’d pay off the one with the $4,000 balance last. 6. switch to cash. this strategy might be good for you if: you’re looking for ways to limit your credit card usage. if your main goal is to pay off your credit card debt, the last thing you want.

How To Pay Off Credit Card Debt Faster Continue until all your credit card balances have been paid in full. say you have three credit cards with balances of $700, $1,500 and $4,000. with the snowball method, you’d pay off the card with the $700 balance first. then you’d move on to the card with the $1,500 balance, and you’d pay off the one with the $4,000 balance last. 6. switch to cash. this strategy might be good for you if: you’re looking for ways to limit your credit card usage. if your main goal is to pay off your credit card debt, the last thing you want. Here are five easy things you can do to cut your interest costs and get out of debt faster. 1. learn your interest rates and pay off highest rate cards first. almost 2 in 5 americans with credit. You want to use the card to get out of debt, not add to it, she says. second, pay attention to the balance transfer fee, usually between 3% 5%. if you are transferring $10,000, you might pay up.

Comments are closed.