How To Remove A Bankruptcy From Your Credit Report Lexington Law

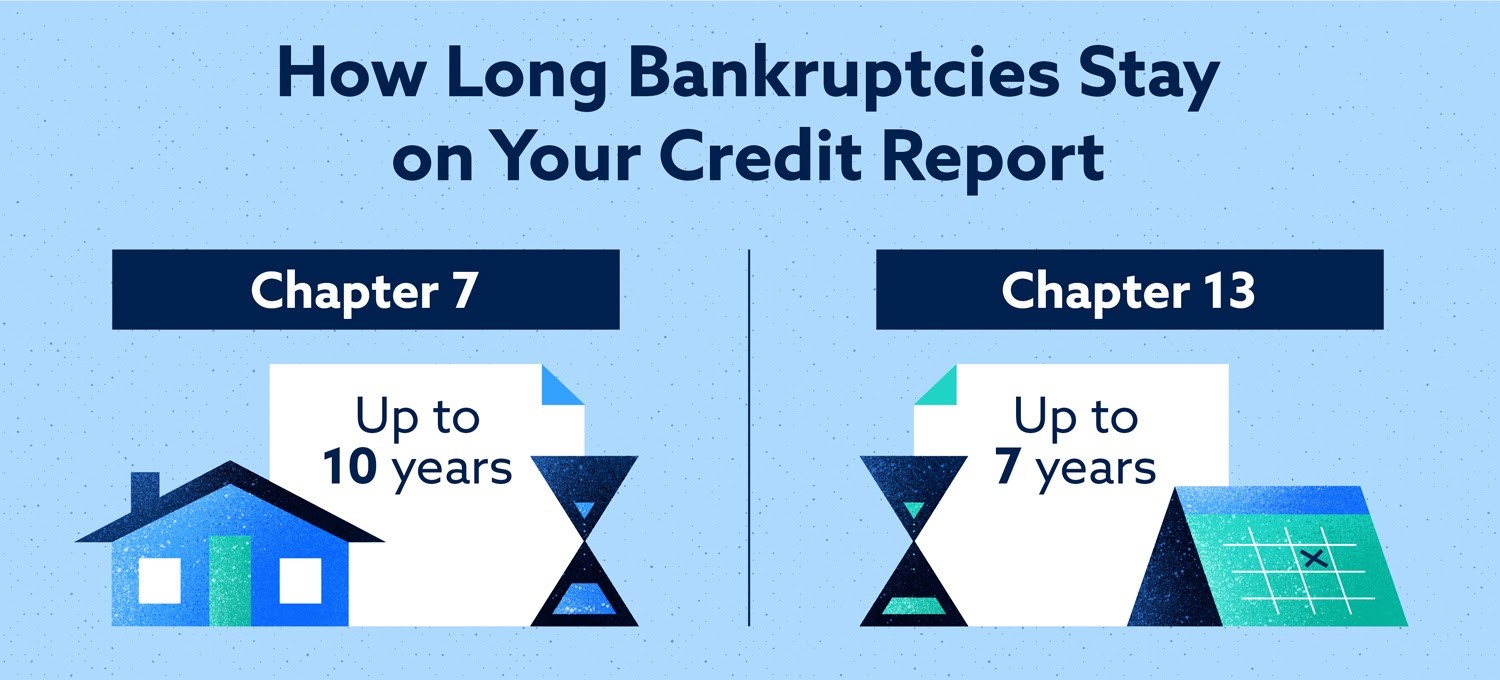

How To Remove A Bankruptcy From Your Credit Report Lexington Law There are only two ways to get a bankruptcy removed from your credit report: file a dispute with the credit bureaus or wait for the bankruptcy to leave the report after seven to 10 years. a legitimate bankruptcy cannot be disputed, so you’ll need to wait for it to leave the report unless you can prove that some aspect of the bankruptcy is. 2. negotiate a pay for delete charge off agreement. if your debt is still with the original lender, you can ask to pay the debt in full in exchange for the charge off notation to be removed from your credit report. if your debt has been sold to a third party, you can still try a pay for delete agreement.

How To Remove A Bankruptcy From Your Credit Report Lexington Law You cannot legally remove bankruptcy on your credit report just because: you do not want it on your record. you have a good credit score again. your debts are paid off. legally, bankruptcy will stay on your record for 10 years if you filed for c hapter 7 bankruptcy or seven years if you filed for c hapter 13 bankruptcy. Removing a bankruptcy when you actually filed. according to lexington law, it removed 21,417 bankruptcies from client credit reports in 2012. this impressive number is misleading, however. equifax, experian, and transunion each publish information about your payment habits. Chapter 7 bankruptcy is available to both individuals and businesses. as you’ve read, in chapter 7 bankruptcies, some items and property may be liquidated in order to pay the creditors. once complete, the filer will receive a complete discharge from the dischargeable debts based on the court’s decision. Yes, lexington law is a legitimate company offering credit repair services since 2004. it's one of the most reputable companies in the industry, with 2 decades of experience. lexington law has helped thousands of clients remove over 83 million items from their credit reports.

How To Remove A Bankruptcy From Your Credit Report Lexington Law Chapter 7 bankruptcy is available to both individuals and businesses. as you’ve read, in chapter 7 bankruptcies, some items and property may be liquidated in order to pay the creditors. once complete, the filer will receive a complete discharge from the dischargeable debts based on the court’s decision. Yes, lexington law is a legitimate company offering credit repair services since 2004. it's one of the most reputable companies in the industry, with 2 decades of experience. lexington law has helped thousands of clients remove over 83 million items from their credit reports. Write a dispute letter to the credit bureaus. wait 30 days for the credit bureaus to investigate your dispute. the credit bureaus will take out a bankruptcy record from your credit reports if they can't verify its accuracy. however, such cases may be rare since you are the one filing the bankruptcy petition. Lexington law. fees: $139.95 per month. ratings: consumer affairs 4 stars out of 5 | trustpilot 2.7 stars out of 5. time: varies; credit repair is a lengthy process based on multiple factors. view.

How To Remove A Bankruptcy From Your Credit Report Lexington Law Write a dispute letter to the credit bureaus. wait 30 days for the credit bureaus to investigate your dispute. the credit bureaus will take out a bankruptcy record from your credit reports if they can't verify its accuracy. however, such cases may be rare since you are the one filing the bankruptcy petition. Lexington law. fees: $139.95 per month. ratings: consumer affairs 4 stars out of 5 | trustpilot 2.7 stars out of 5. time: varies; credit repair is a lengthy process based on multiple factors. view.

How To Remove A Bankruptcy From Your Credit Report Lexington Law

Comments are closed.