How To Retire With 2 Million On A 50k Salary

How To Retire With 2 Million On A 50k Salary Youtube We'll assume you retain that salary throughout your career, even though your earnings will most likely rise over time. as a general rule of thumb, it's a good idea to sock away 15% to 20% of your. Saving $2 million for retirement on an annual salary of $50,000 might seem out of reach, but it’s certainly possible. cnbc’s emily lorsch breaks it all down .

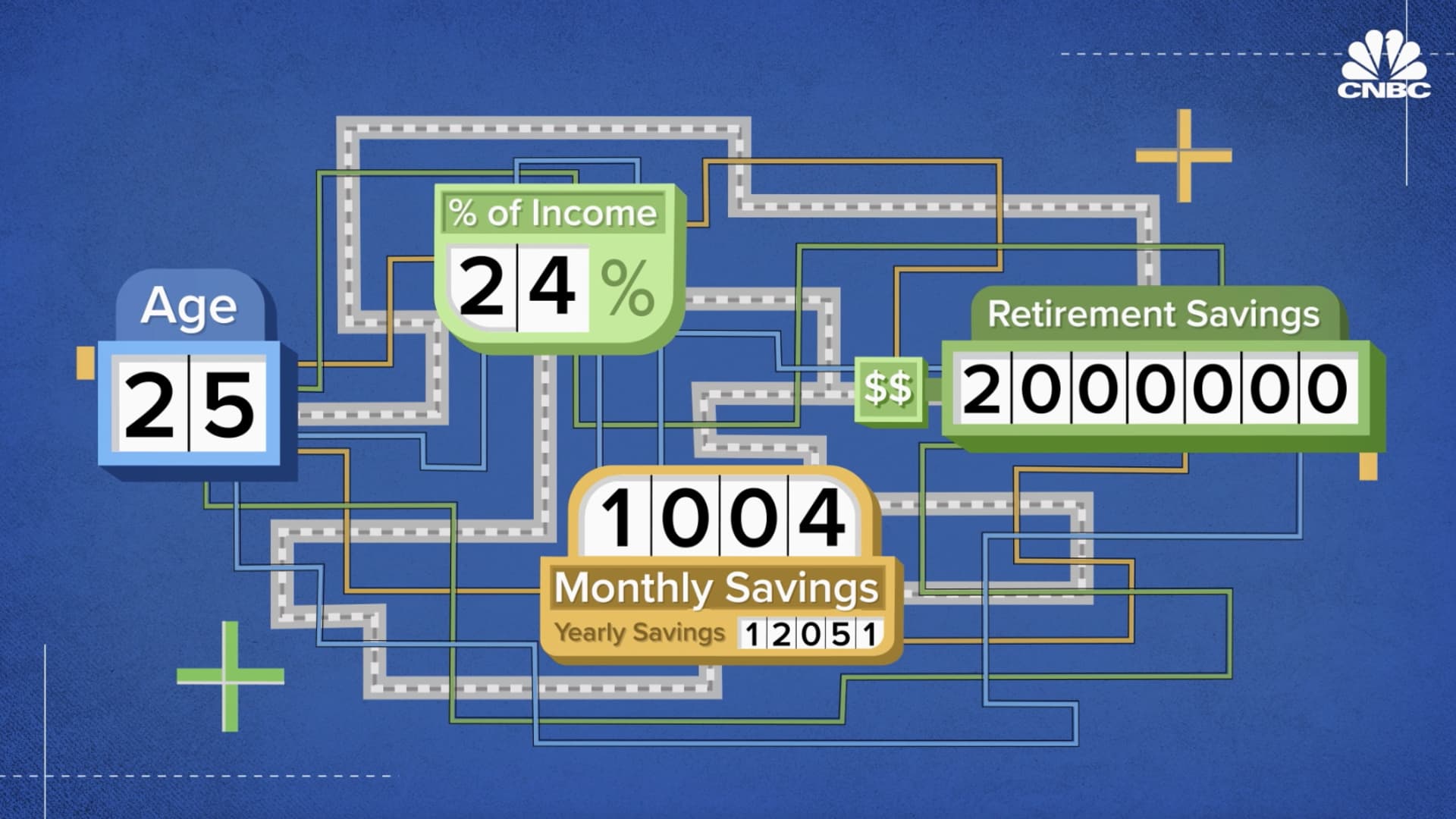

Here S How You Can Save 2 Million For Retirement On An Annual Salary If you want to retire with $2 million, you’ll need to invest about 24% of a salary of $50,000 starting in your 20s. waiting until you’re older will require a larger portion of your pay. if you. That $5,000 investment, with a 10% annual return, would jump to $325,000 after 30 years. as this hypothetical shows, it is definitely possible to amass more than $1 million for retirement on a. If your goal is to save $1 million by retirement age, you'd need to invest around $500 per month in this scenario. if you're earning $50,000 per year, that's around 12% of your salary. most. If you earn $50,000 a year, it's still possible to retire with over $1 million, per cnbc's calculations. how much to save monthly starting at ages 21, 25 & 30.

How To Save 2 Million For Retirement Youtube If your goal is to save $1 million by retirement age, you'd need to invest around $500 per month in this scenario. if you're earning $50,000 per year, that's around 12% of your salary. most. If you earn $50,000 a year, it's still possible to retire with over $1 million, per cnbc's calculations. how much to save monthly starting at ages 21, 25 & 30. Retirement age: enter the age you plan to retire. age 67 is considered full retirement age (when you get your full social security benefits) for people born in 1960 or later. life expectancy: this. If you're earning $50,000 per year, that's $1,500 per year in matching contributions, or $125 per month. instead of having to save $1,200 per month on your own, then, you just need to contribute.

Retire With 2 Million Newell Wealth Management Retirement age: enter the age you plan to retire. age 67 is considered full retirement age (when you get your full social security benefits) for people born in 1960 or later. life expectancy: this. If you're earning $50,000 per year, that's $1,500 per year in matching contributions, or $125 per month. instead of having to save $1,200 per month on your own, then, you just need to contribute.

Comments are closed.