How To Save 1000000 For Early Retirement Saving For Retirement

The Best Order To Save For Retirement Infographic The Retirement According to the 25x rule, you would need to save at least $1.25 million to be able to safely withdraw $50,000 of income in your first year of retirement. and keep in mind that depending on the. How to retire early in 5 steps. 1. make adjustments to your current budget. here’s where that work comes in: no matter how you want to slice it, retiring early means making some changes to how.

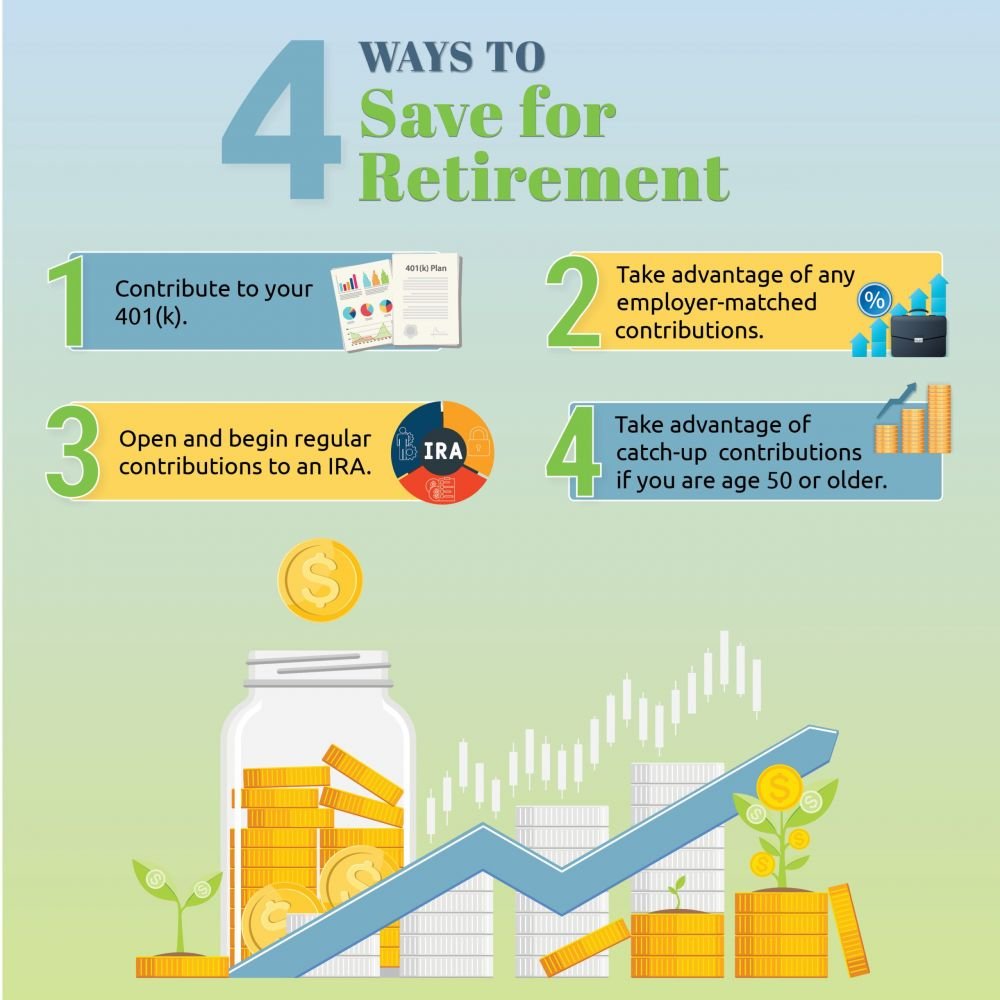

4 Ways To Save For Retirement Assuming a 6% rate of return and the $1.25 million figure from our earlier example, you would need to save about $218,000 over 30 years to reach this hypothetical retirement goal. that works out. Retirement age: enter the age you plan to retire. age 67 is considered full retirement age (when you get your full social security benefits) for people born in 1960 or later. life expectancy: this. 2. consider common rules of thumb. the rule used most often is the 80% rule, which says you should aim to replace 80% of your preretirement income. this is a loose rule: some people suggest. To see how much monthly income you could count on if you retired as expected in five years, multiply your current savings by 4% and divide by 12. for example, $1 million x .04 = $40,000. divide that by 12 to get $3,333 per month in year one of retirement. (again, you could increase that amount with inflation each year thereafter.).

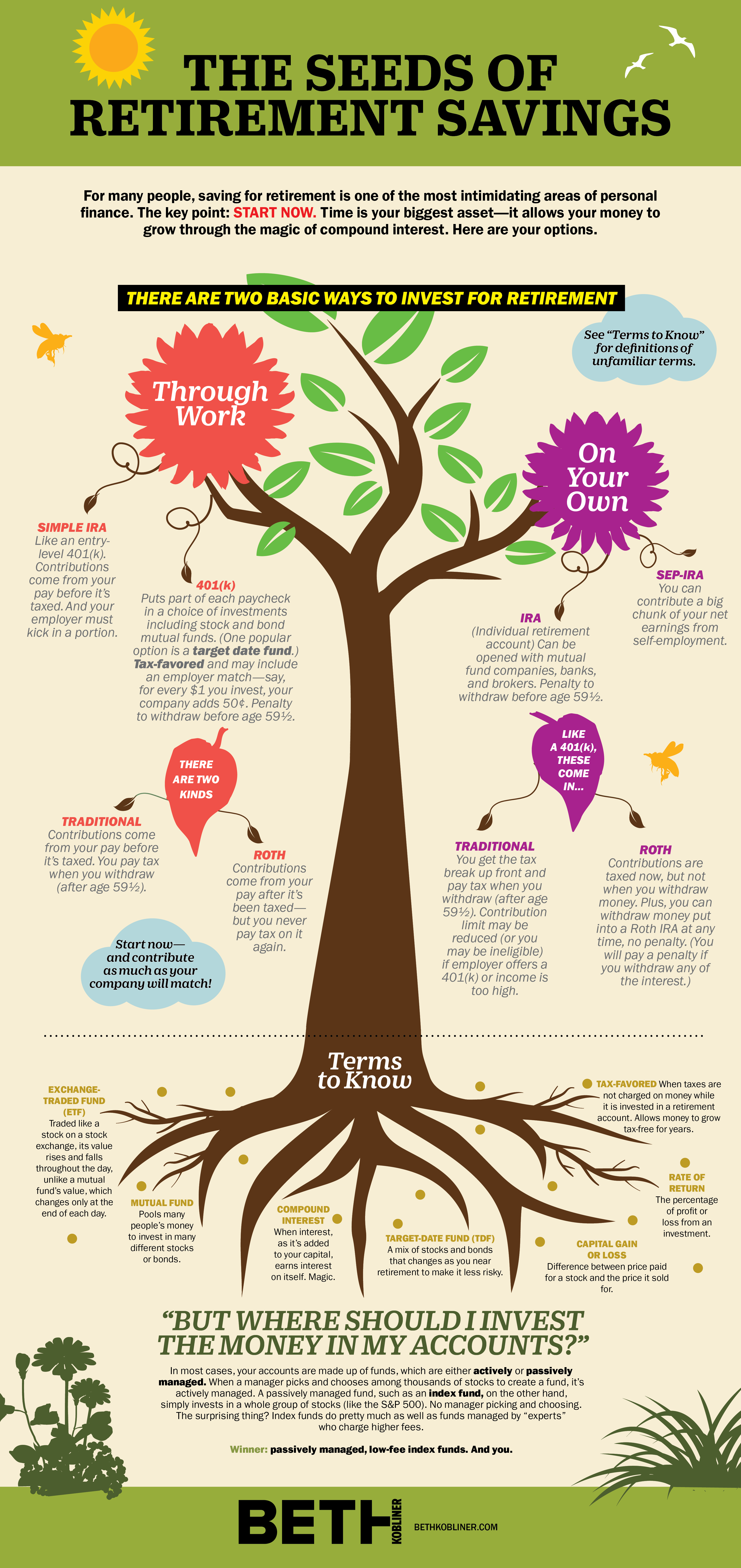

7 Ways To Jump Start Your Retirement Savings Saving For Retirement 2. consider common rules of thumb. the rule used most often is the 80% rule, which says you should aim to replace 80% of your preretirement income. this is a loose rule: some people suggest. To see how much monthly income you could count on if you retired as expected in five years, multiply your current savings by 4% and divide by 12. for example, $1 million x .04 = $40,000. divide that by 12 to get $3,333 per month in year one of retirement. (again, you could increase that amount with inflation each year thereafter.). To prepare your home for your early retirement, you might: pay off your mortgage early. downsize your home. make major repairs (replace your roof or sewer main, invest in tuckpointing) complete. Putting $100 into a retirement account every month starting at age 20 is more effective than putting $100,000 into a retirement account at age 65. even assuming a relatively low 5% rate of return.

Retirement Infographic To prepare your home for your early retirement, you might: pay off your mortgage early. downsize your home. make major repairs (replace your roof or sewer main, invest in tuckpointing) complete. Putting $100 into a retirement account every month starting at age 20 is more effective than putting $100,000 into a retirement account at age 65. even assuming a relatively low 5% rate of return.

Comments are closed.