How To Set Up And Track Contractors For 1099 In Quickbooks

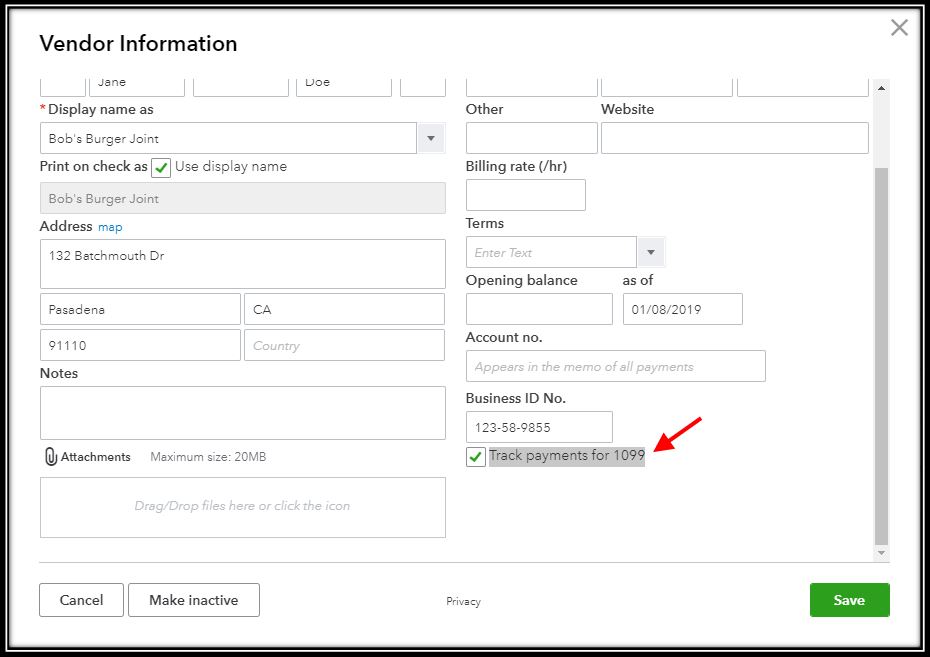

How To Set Up And Track Contractors For 1099 In Quickbooks In quickbooks and quickbooks contractor payments, you can set up your contractors as vendors. quickbooks and quickbooks contractor payments track all their related payments, so when you need to file their 1099s, you already have all their info. here's how to set up contractors for each product. any non employee who you might pay $600 or more in. In step 2 of the prepare 1099s module, select box 7: nonemployee compensation. choose the account you used to pay your contractors. this tells the irs what money was used for non employee compensation. in step 3, the vendors you started tracking will automatically appear on the list.

How To Add Independent Contractors And Track Them For 1099s In To see what contractors will get 1099s, or to see your payments totals, follow these steps to create 1099 reports. missing a contractor? see set up contractors and track them for 1099s. missing payments or new to quickbooks contractor payments? choose your product to learn how you can add a lump sum or individual payments to your contractors. Easy tutorial on how to set up quickbooks online to track for 1099.how to add vendors in quickbooks onlinehow to enter the vendors when categorizing transact. To set up this report, start by logging into your quickbooks online account and navigating to the ‘reports’ tab. from there, select ‘custom reports’ and then ‘transaction detail’. you can then customize the report by choosing the date range, specific vendors, and payment types you want to include. Step 1: add a contractor as a vendor. in case you haven’t already; enter the contractors as a vendor in quickbooks: click payroll and then choose contractors. then you have to select add a contractor. enter the information for your contractor or choose the email this contractor button to have them complete it. when finished, choose add.

How To Track Contractors For Filing 1099 In Quickbooks Online Youtube To set up this report, start by logging into your quickbooks online account and navigating to the ‘reports’ tab. from there, select ‘custom reports’ and then ‘transaction detail’. you can then customize the report by choosing the date range, specific vendors, and payment types you want to include. Step 1: add a contractor as a vendor. in case you haven’t already; enter the contractors as a vendor in quickbooks: click payroll and then choose contractors. then you have to select add a contractor. enter the information for your contractor or choose the email this contractor button to have them complete it. when finished, choose add. Submit. when you’re ready, click finish preparing 1099s. you can e file your 1099 misc forms right in qbo, send copies of 1099s to subcontractors in the mail, and submit forms to the irs. in 2020, the price was $15.99 for three contractors, and $5 for each additional. if you submit early, the price was $12.99. Step 1: create a bill. to initiate the payment process for a 1099 employee in quickbooks online, the first step is to create a bill, specifying the contractor’s details and the amount due. this involves accessing the ‘expenses’ tab, selecting ‘new transaction,’ and then choosing ‘bill.’. once on the bill creation screen, you’ll.

How To Set Up Contractors And Track Them For 1099s In Quickbooks Submit. when you’re ready, click finish preparing 1099s. you can e file your 1099 misc forms right in qbo, send copies of 1099s to subcontractors in the mail, and submit forms to the irs. in 2020, the price was $15.99 for three contractors, and $5 for each additional. if you submit early, the price was $12.99. Step 1: create a bill. to initiate the payment process for a 1099 employee in quickbooks online, the first step is to create a bill, specifying the contractor’s details and the amount due. this involves accessing the ‘expenses’ tab, selecting ‘new transaction,’ and then choosing ‘bill.’. once on the bill creation screen, you’ll.

Comments are closed.