How To Stop A Wage Garnishment In Canada Consumer Proposal

How To Stop A Wage Garnishment In Canada Consumer Proposal Step 5: notify your employer. once the consumer proposal is filed, the licensed insolvency trustee will notify your employer to stop the wage garnishment. in most cases, this can be done within a matter of hours after the proposal has been filed. it’s important to note that the garnishment cannot be stopped until the consumer proposal is. At hoyes, michalos & associates inc., if you file a consumer proposal with us at 9:00 am, by noon that same day we can usually have a court order faxed to your employer, stopping the wage garnishment. that’s right: in most cases we can notify your employer to stop a wage garnishment within a matter of hours after you have filed a consumer.

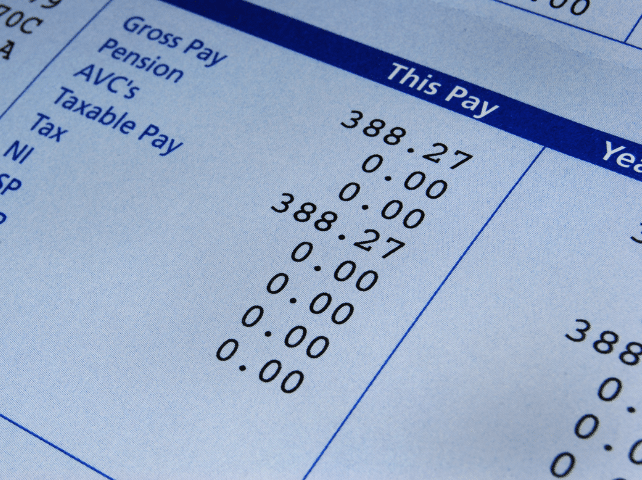

How To Stop A Wage Garnishment In Canada Consumer Proposal The ways you can stop wage garnishments are: negotiate repayment terms with the creditor on the condition that they remove the garnishment. obtain a loan to pay off the garnishing creditor in full. file a consumer proposal. file a personal bankruptcy. One way to stop wage garnishment in ontario once the order is in action is to file a consumer proposal. if you’re unsure how a consumer proposal works or how it affects your mortgage options, a trustee at david sklar & associates can walk you through the process. depending on your situation, you may not have to file bankruptcy to get a. Wage garnishments, there are 3 ways to stop a wage garnishment in ontario: file a consumer proposal: a consumer proposal is a legal agreement between you and your creditors to repay a portion of your debt over a period of time. this option will stop the wage garnishment process. declare bankruptcy: filing for bankruptcy will also stop the wage. There’s a limit to how much of your wages a creditor can garnish. in ontario, the maximum amount creditors can garnish is 50% of your wages. the 50% limit applies to spousal and child support payments. for commercial debts, such as a personal loan or credit card, creditors can only seize a maximum of 20%. in reality, the court will determine.

How To Stop A Wage Garnishment In Canada Consumer Proposal Wage garnishments, there are 3 ways to stop a wage garnishment in ontario: file a consumer proposal: a consumer proposal is a legal agreement between you and your creditors to repay a portion of your debt over a period of time. this option will stop the wage garnishment process. declare bankruptcy: filing for bankruptcy will also stop the wage. There’s a limit to how much of your wages a creditor can garnish. in ontario, the maximum amount creditors can garnish is 50% of your wages. the 50% limit applies to spousal and child support payments. for commercial debts, such as a personal loan or credit card, creditors can only seize a maximum of 20%. in reality, the court will determine. In this process, the lit will work with you to develop a "proposal"—an offer to pay creditors a percentage of what is owed to them, or extend the time you have to pay off the debts, or both. the term of a consumer proposal cannot exceed five years. payments are made through the lit, and the lit uses that money to pay each of your creditors. We can wholeheartedly recommend a consumer proposal to stop wage garnishment in ontario. it’s also ideal for discharging a sizable chunk of your debt and starting fresh with a new, manageable payment schedule. if you’re unsure how a consumer proposal works, contact david sklar & associates. we can walk you through the process step by step.

Comments are closed.