How To Use Leverage In Real Estate Investments Maximize Returns

:max_bytes(150000):strip_icc()/most-important-factors-investing-real-estate.asp-ADD-FINALjpg-32950329a30d4500b6d7e0fd0ba95189.jpg)

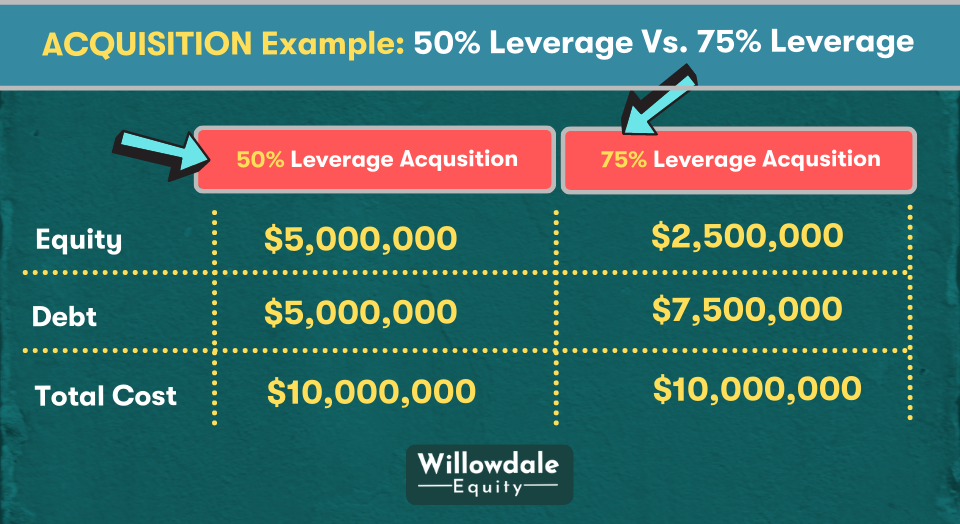

How To Use Leverage In Real Estate Investments Maximize Returns Leverage is a technique that real estate investors use to increase potential returns and build wealth over the long term. also known as other people’s money (opm), real estate leverage involves using debt plus a small amount of equity in the form of a down payment to purchase investment property. for example, by making a $30,000 or 25% down. What is leverage in real estate. leverage uses borrowed capital or debt to increase the potential return on an investment. in real estate, the most common way to leverage your investment is with your own money or through a mortgage. leverage works to your advantage when real estate values rise, but it can also lead to losses if values decline.

How To Use Leverage In Real Estate Investments Maximize Returns Leverage uses borrowed capital or debt to increase the potential return of an investment. in real estate, the most common way to leverage your investment is with your own money or through a mortgage. Loan to value ratio. to calculate the loan to value (ltv) ratio, simply divide the loan balance on a property by the property's current value. let’s say you have a $100,000 mortgage balance on an investment property that’s currently worth $675,000. by dividing $100,000 by $675,000, we find that 14.8% of the property is leveraged. Leverage can magnify your returns on investment. this is because you are using borrowed money to increase your potential gain. for instance, if a property appreciates by 10%, your return on investment will be much higher when leveraging: with no leverage: 10% return on $100,000 = $10,000. with 80% leverage: 10% return on $100,000 = $50,000. Leverage is generated by using borrowed capital as your funding source when you invest. this allows you to buy a much larger asset and increase the potential return on your investment than you.

Leverage In Real Estate Leveraging Real Estate To Build Wealth Leverage can magnify your returns on investment. this is because you are using borrowed money to increase your potential gain. for instance, if a property appreciates by 10%, your return on investment will be much higher when leveraging: with no leverage: 10% return on $100,000 = $10,000. with 80% leverage: 10% return on $100,000 = $50,000. Leverage is generated by using borrowed capital as your funding source when you invest. this allows you to buy a much larger asset and increase the potential return on your investment than you. In the leveraging scenario, you only had to spend $20,000 of your investable money. let’s assume you have that $100,000 to invest in both scenarios. there are 5 sums of $20,000 in $100,000. this means that instead of buying one property for $100,000, you could potentially leverage 5 properties. that’s right. What is leverage in real estate? (how to calculate and more) this article explains what leverage in real estate is and how you can use it to your advantage. this knowledge can help maximize return on investment (roi).

This Infographic Explains The Power Of Leverage In Regards To Real In the leveraging scenario, you only had to spend $20,000 of your investable money. let’s assume you have that $100,000 to invest in both scenarios. there are 5 sums of $20,000 in $100,000. this means that instead of buying one property for $100,000, you could potentially leverage 5 properties. that’s right. What is leverage in real estate? (how to calculate and more) this article explains what leverage in real estate is and how you can use it to your advantage. this knowledge can help maximize return on investment (roi).

How To Use Leverage In Real Estate Investing Gatsby Investment

Comments are closed.