How We Invest In Early Stage Biotech Companies

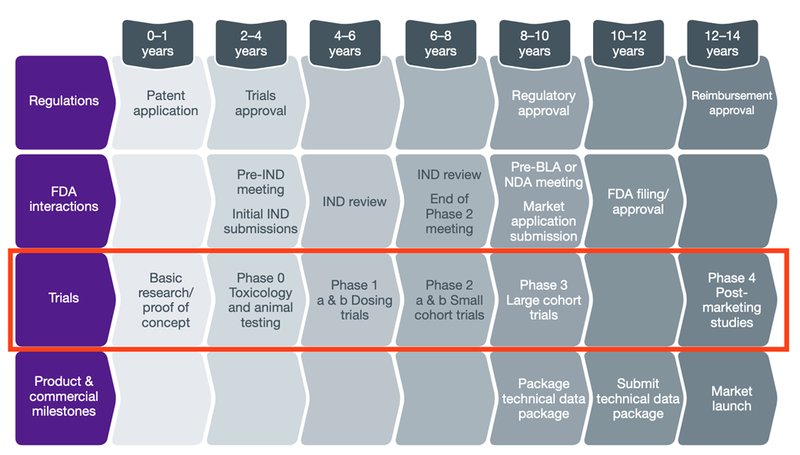

How We Invest In Early Stage Biotech Companies We will take you through the early stage biotech company lifecycle, so that you can better understand your biotech investments and know the key questions to ask at each stage. the typical lifecycle of an early stage biotech company is: discovery → preclinical trials (phase 0) → clinical trials (i, ii, iii) → commercialisation ($$$). In recent years, biotech public markets have struggled to stage a meaningful comeback.the s&p biotechnology select industry index entered fourth quarter 2023 more than 50 percent lower than its peak in february 2021, and only 30 biotechs have undergone an ipo in the first three quarters of 2023 versus 114 ipos in 2021 (exhibit 1). 1 s&p capital iq, accessed october 2023.

How We Invest In Early Stage Biotech Companies All in all, the current landscape presents both management and investors with a number of challenges as we settle into the latter half of 2023 and into 2024.”. essentially, investors are looking for companies that are at a later stage. so, while an early stage biotech can be preclinical, the amount of money companies need to raise will need. While many sectors have struggled during covid 19, the biotech sector has continued to grow and attract high investment. by the summer of 2020, 37 biotech companies raised a total of $6.7 billion through us ipos, compared to $5 billion in all of 2019 across 51 ipos. 1 the nasdaq biotechnology index rose to a five year high in december 2020. While the conditions may seem favorable, for those seeking funding for an emerging biotech company, there are three major challenges that may stand in the way. relevancy. achieving and maintaining buy side relevancy is critical to getting the attention an early stage biotech company needs to access funding. but considering that the number of u. Investing in and partnering with biotech companies is clearly going to drive pharma’s future. when we launched parexel biotech three years ago, the data showed that roughly 75 80% of all assets were sitting in small and mid sized biotech customers. today, we’re seeing that this number is closer to 90%.

Scio Assists With Early Stage Biotech Company Evaluation Learn Why While the conditions may seem favorable, for those seeking funding for an emerging biotech company, there are three major challenges that may stand in the way. relevancy. achieving and maintaining buy side relevancy is critical to getting the attention an early stage biotech company needs to access funding. but considering that the number of u. Investing in and partnering with biotech companies is clearly going to drive pharma’s future. when we launched parexel biotech three years ago, the data showed that roughly 75 80% of all assets were sitting in small and mid sized biotech customers. today, we’re seeing that this number is closer to 90%. Investment in next generation biotech platforms. from 2019 to 2021, vc companies invested more than $52 billion in therapeutic based biotech companies globally. two thirds of that went to start ups with platform technologies (exhibit 2). 2. vc investors appear focused on emerging technologies that can tailor treatments to individual patients. Ioteching in action:five ways to attract early stage investors“investors told us they only fund a fraction of the start ups that pitch to them: the most compelling ones can map a product’s or platform t. chnology’s journey from basic science to commercialization.”biotech companies are a significant driver of innovation in drug de.

How Early Stage Biotech Companies Overcome Financial Hurdles Investment in next generation biotech platforms. from 2019 to 2021, vc companies invested more than $52 billion in therapeutic based biotech companies globally. two thirds of that went to start ups with platform technologies (exhibit 2). 2. vc investors appear focused on emerging technologies that can tailor treatments to individual patients. Ioteching in action:five ways to attract early stage investors“investors told us they only fund a fraction of the start ups that pitch to them: the most compelling ones can map a product’s or platform t. chnology’s journey from basic science to commercialization.”biotech companies are a significant driver of innovation in drug de.

China Medical System Cms To Invest Up To вј25 Million To Support Early

Comments are closed.