Inaccurate 1099 Tax Form Heres How To Fix It

Inaccurate 1099 Tax Form Here S How To Fix It Youtube Most of the time when you say “my 1099 is wrong” the irs already has it. so if the issuer of the form 1099 has already sent it to the irs, ask for a “corrected” form 1099. the issuer will. Most of the time when you say “my 1099 is wrong” the irs already has it. so if the issuer of the form 1099 has already sent it to the irs, ask for a “corrected” form 1099. the issuer will.

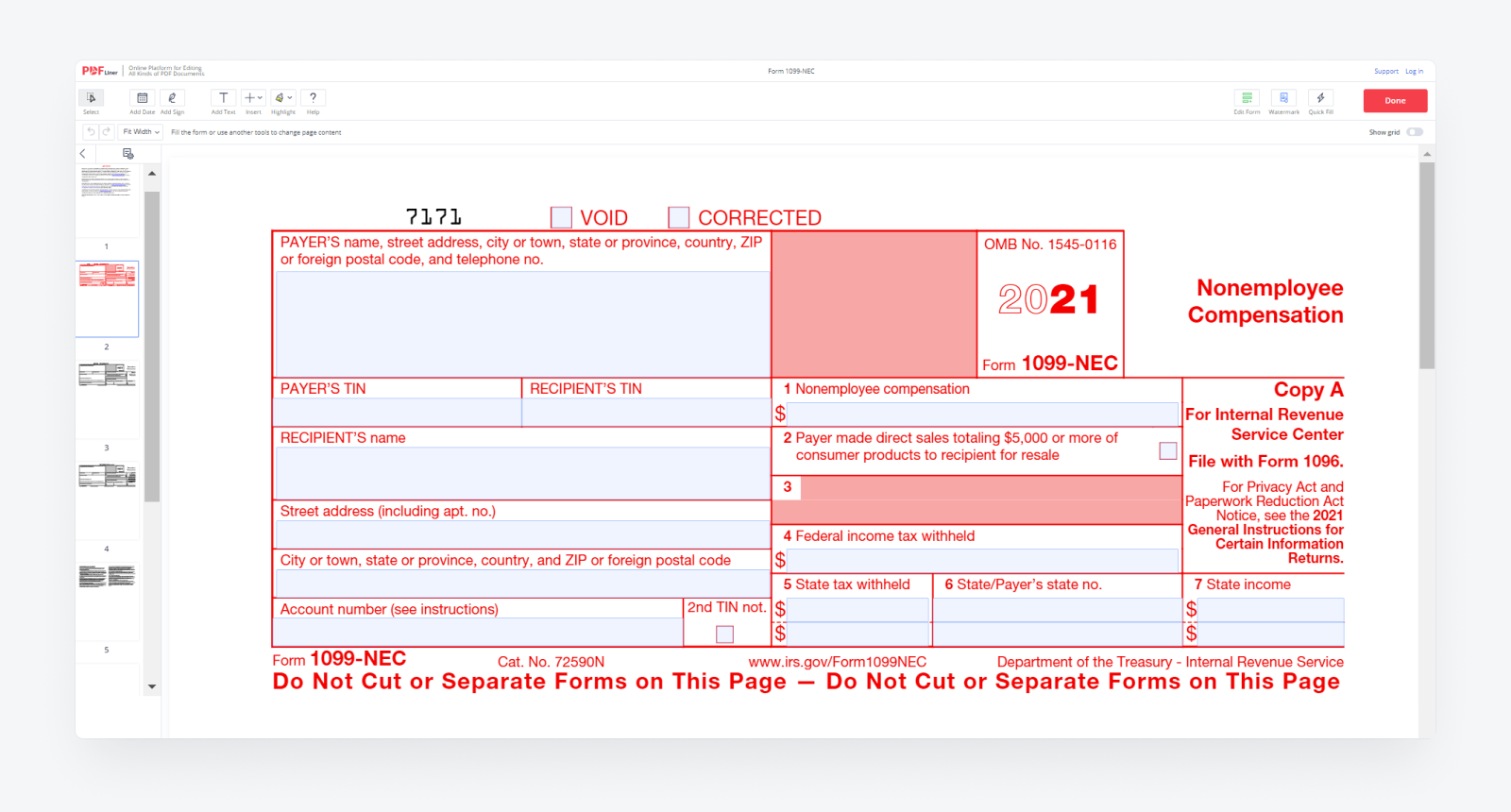

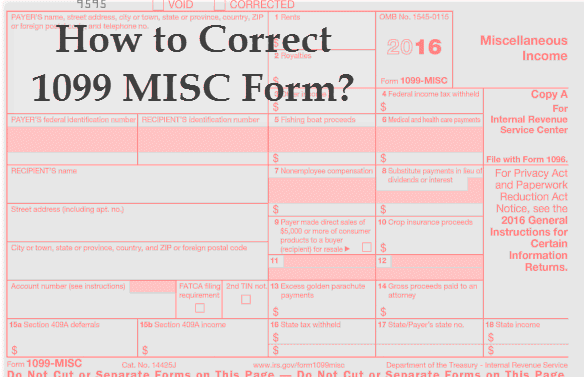

How To Correct A 1099 Form Helpful Manual We'll often see 1099 tax forms issued incorrectly, like 1099 k's that cover the same income as a 1099 nec, or duplicate 1099 necs filed with the irs. this ca. First, you need an explanation of your tax return that explains your predicament with attachments that support you. let us assume that you got a 1099 form revealing that you were paid $25,000 from a company when indeed, you got $2000. listing that you got $20,000 on your tax return and calling it a day makes no sense. Yes, if your customer is willing to correct the 1099, then it can be amended. at the top of the form 1099 nec, there is an option to select “corrected.” the amended 1099s should be mailed to the irs and the forms can be ordered here. while the general statute of limitations to amend is three years, you’ll want to request your customer to. When you have made corrections to one or more 1099 forms, complete a new 1099 form for each recipient. mail copy a and the corrected transmission form (form 1096) to the irs processing center. give copy 2 and copy b to the recipient. keep both copies of copy c (the incorrect one and the corrected one) for your business records.

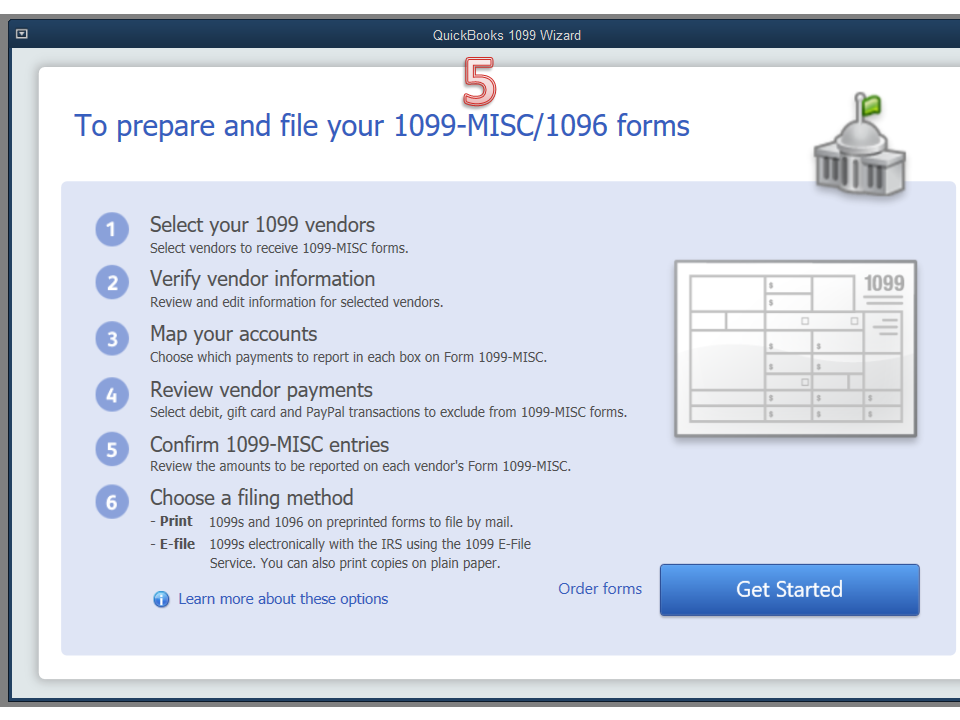

Solved 1099 Not Working Yes, if your customer is willing to correct the 1099, then it can be amended. at the top of the form 1099 nec, there is an option to select “corrected.” the amended 1099s should be mailed to the irs and the forms can be ordered here. while the general statute of limitations to amend is three years, you’ll want to request your customer to. When you have made corrections to one or more 1099 forms, complete a new 1099 form for each recipient. mail copy a and the corrected transmission form (form 1096) to the irs processing center. give copy 2 and copy b to the recipient. keep both copies of copy c (the incorrect one and the corrected one) for your business records. Disputing an incorrect 1099. if the issuer of an erroneous 1099 refuses to correct its mistake, you'll need to include an explanation on your tax return and attach documentation in support of your. The best way to avoid issues with 1099 filing is to start preparing early. review your vendor information before year end to be sure you have all the form w 9s and other information required to file these forms. 3. completing the wrong form. if paper filing, be sure to use the correct year of the form.

Dealing With Errors In Form 1099 Brandon A Keim Phoenix Tax Attorney Disputing an incorrect 1099. if the issuer of an erroneous 1099 refuses to correct its mistake, you'll need to include an explanation on your tax return and attach documentation in support of your. The best way to avoid issues with 1099 filing is to start preparing early. review your vendor information before year end to be sure you have all the form w 9s and other information required to file these forms. 3. completing the wrong form. if paper filing, be sure to use the correct year of the form.

How To Make Corrections To Form 1099 Misc Form Tax2efile Blog

Comments are closed.