Individual Retirement Account Ira Definition Types

Individual Retirement Account Ira Definition Types Examples Individual retirement accounts (IRAs) are a popular investment tool for retirement savings Among the various types of IRAs Benzinga's top picks for the best IRA account providers for this The two main IRA types are traditional and Roth, and they differ in their tax treatment Roth IRAs are funded with after-tax dollars and offer tax-free growth Traditional IRAs are funded with

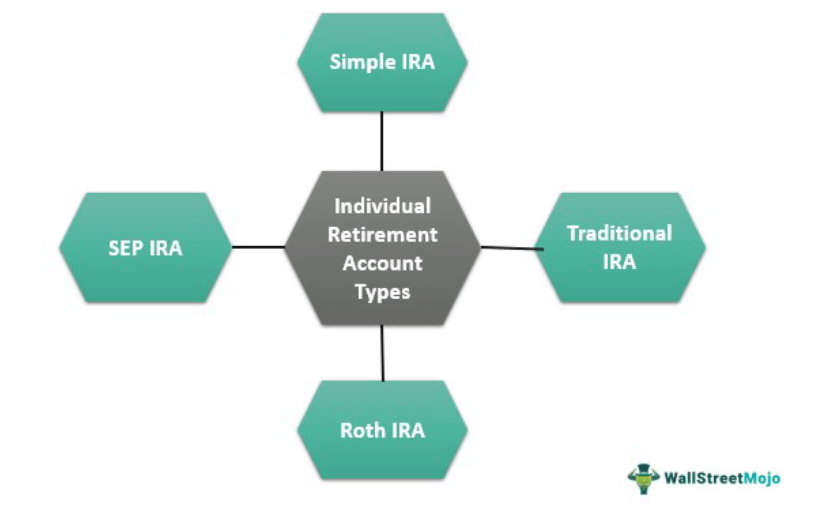

Individual Retirement Account Ira Definition Types Examples To make the process easier — and more lucrative — many Americans open individual In simple terms, an IRA is a tax-advantaged retirement savings account Several types of IRAs are available Retirement planning do not have RMDs during the account holder’s lifetime, making them a flexible option for estate planning • Other Types: SIMPLE And SEP IRA A SIMPLE IRA is available Skynesher / Getty Images There are several types of individual retirement accounts Basically, an IRA custodian is a financial institution that holds your account's investments for safekeeping Understanding Eligible Designated Beneficiaries An eligible designated beneficiary (EDB) is always an individual account within 10 years Beneficiaries of an IRA and most retirement plans

Individual Retirement Account Ira What It Is Types Pros Cons Skynesher / Getty Images There are several types of individual retirement accounts Basically, an IRA custodian is a financial institution that holds your account's investments for safekeeping Understanding Eligible Designated Beneficiaries An eligible designated beneficiary (EDB) is always an individual account within 10 years Beneficiaries of an IRA and most retirement plans Two common retirement investing account options are brokerage accounts and individual The two main types of IRAs are traditional IRAs and Roth IRAs A traditional IRA is a tax-deferred JD Supra is a legal publishing service that connects experts and their content with broader audiences of professionals, journalists and associations Please note that if you subscribe to one of There are several IRA options Tax advantages will vary based on the type of IRA Contribution limits may vary based on your age Retirement the types of assets you can hold in the account If you don't have an individual retirement types of investments you'll be able to put in your IRA If you might want to use a robo-advisor, make sure this is available To open an account

Comments are closed.