Inflation 101 The Basics Of Inflation Anchor

Inflation 101 The Basics Of Inflation Anchor With inflation dominating financial headlines both locally and across the globe, it seems an opportune time to take a closer look at the basic theory of inflation and the current inflationary status quo to better understand the impact for financial markets and investors alike. What is inflation? have you ever been shopping and noticed that the prices of a range of things you buy have gone up? if the same things in your shopping basket cost $100 last year and now they cost $105, at a very basic level, that’s “inflation.”. more precisely, inflation is defined as ongoing increases in the overall level of prices.

Inflation 101 The Basics Of Inflation Anchor We provide explanations of basic and fundamental concepts on the definition of inflation, measurement of inflation, costs of inflation, the importance of measuring and controlling inflation, the role of the federal reserve in inflation, and other concepts such as price indexes, hyperinflation, trend and underlying inflation, measures of inflation like cpi, core cpi, median cpi, trimmed mean. The basics of inflation. february 07, 2023. this 16 minute episode was released feb. 7, 2023, as a part of the timely topics podcast series. chris neely, a vice president in the research division at the federal reserve bank of st. louis. “inflation is a sustained rise in the general price level,” says chris neely, a vice president in the. Okay, inflation isn’t a new concept. this rise and fall has happened before, but in september 2022, the u.s. hit the biggest 12 month inflation surge in almost 40 years! 1. and you’re feeling it. the 2022 state of personal finance study showed that 85% of americans say inflation has impacted their lives. Percent inflation rate = (308.417 ÷ 52.1) x 100 = (5.9197) x 100 = 591.97%. since you wish to know how much $10,000 from january 1975 would be worth in january 2024, multiply the inflation rate.

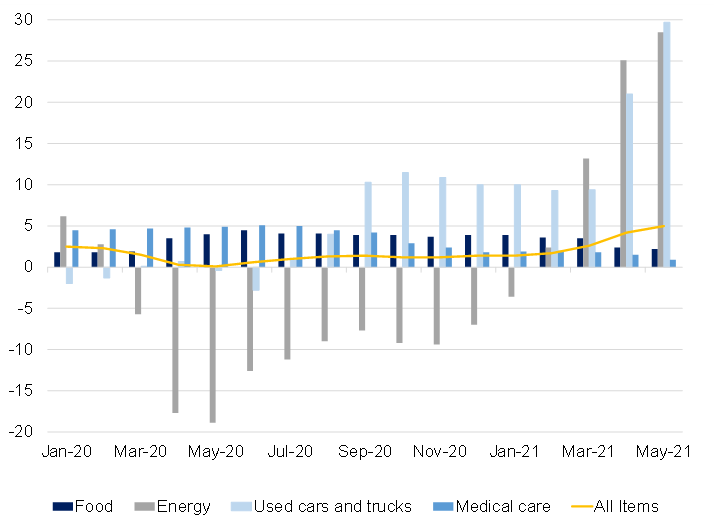

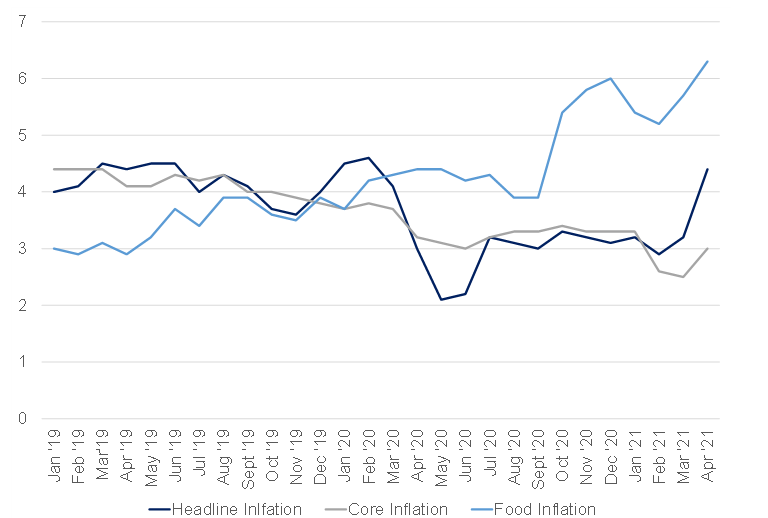

Inflation 101 The Basics Of Inflation Anchor Okay, inflation isn’t a new concept. this rise and fall has happened before, but in september 2022, the u.s. hit the biggest 12 month inflation surge in almost 40 years! 1. and you’re feeling it. the 2022 state of personal finance study showed that 85% of americans say inflation has impacted their lives. Percent inflation rate = (308.417 ÷ 52.1) x 100 = (5.9197) x 100 = 591.97%. since you wish to know how much $10,000 from january 1975 would be worth in january 2024, multiply the inflation rate. Inflation is when the average price of virtually everything consumers buy goes up. food, houses, cars, clothes, toys, etc. to afford those necessities, wages have to rise too. it’s not a bad thing. First, it helps to understand what industries and areas of the economy are experiencing the most rapid price increases. today, policymakers are keeping a close eye on services cpi. recently, it has remained high, even as goods inflation has come down. to understand why, we look to wage growth and the labor market.

Inflation 101 The Basics Of Inflation Anchor Inflation is when the average price of virtually everything consumers buy goes up. food, houses, cars, clothes, toys, etc. to afford those necessities, wages have to rise too. it’s not a bad thing. First, it helps to understand what industries and areas of the economy are experiencing the most rapid price increases. today, policymakers are keeping a close eye on services cpi. recently, it has remained high, even as goods inflation has come down. to understand why, we look to wage growth and the labor market.

Comments are closed.