Inflation Stocks And What It Means For Your Money

What Is Inflation And What It Means For Your Money Ramseysolutions In an ideal world, the stock market likes to see sustained growth in prices of around 1% to 3% per year, which is considered low to moderate inflation. this “healthy” environment means that. How does inflation work? inflation occurs when prices rise across the economy, decreasing the purchasing power of your money. in 1980, for example, a movie ticket cost on average $2.89. by 2019.

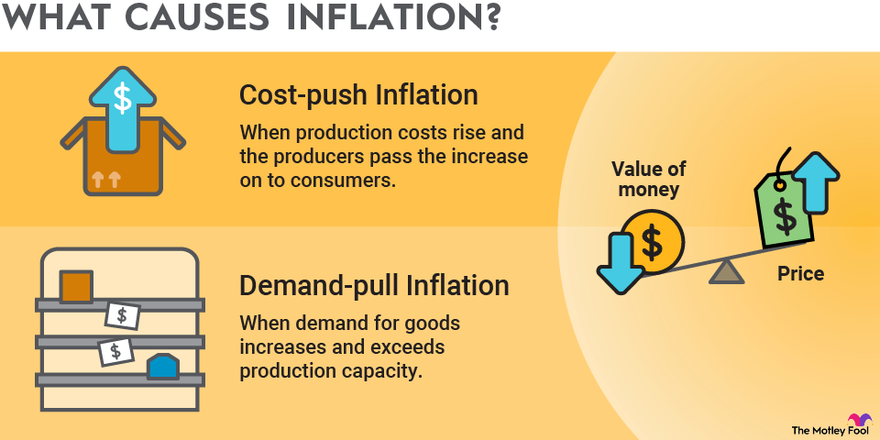

Inflation What It Means For Our Money And Stocks Youtube Causes and types: inflation from cost push or demand pull factors creates price cycles. investing impact: stocks outperform cash during inflation. wise investing preserves purchasing power. motley. Higher inflation is generally considered to be bad for bonds because their interest payments are usually fixed, and rising prices reduces their purchasing power. the effect on stocks, however, is mixed. higher inflation is likely to be accompanied by more volatility in stock prices, and value stocks that benefit from faster economic growth. Vikki velasquez. inflation is an economy wide, sustained trend of increasing prices from one year to the next. the rate of inflation represents how quickly investments lose their real value and. That means consumers could sock away some cash in a high interest savings account or cd and earn a rate that's 1.5 percentage point to 2 percentage point higher than the current inflation rate.

What Is Inflation And What Causes It The Motley Fool Vikki velasquez. inflation is an economy wide, sustained trend of increasing prices from one year to the next. the rate of inflation represents how quickly investments lose their real value and. That means consumers could sock away some cash in a high interest savings account or cd and earn a rate that's 1.5 percentage point to 2 percentage point higher than the current inflation rate. 1 free stock. after linking your bank account (stock value range $5.00 $200) however, inflation means your money will probably buy less over time. molina suggests investing the money you don. Let’s take a look at an example. you have £100 and, over the next year, the inflation rate is 10%. at the end of the year, the nominal or face value of your money remains at £100 (you still.

Comments are closed.