Instructions For Bankruptcy Forms For Non Individuals Fill Out Sign

Instructions For Bankruptcy Forms For Non Individuals Fill Out Sign Le date, fill in the actual date that the debt was incurred.when a deb. was incurred on multiple dates, fill in the range of dates. for example, if the debt is from a credit card, fill in the. the process for filing a bankruptcy case for non individualsto file for bankruptcy. the debtor must give the court several forms and documen. Schedule h: your codebtors (non individuals) non individual debtors. b 207. statement of financial affairs for non individuals filing for bankruptcy. non individual debtors. b 309a. notice of chapter 7 bankruptcy case – no proof of claim deadline (for individuals or joint debtors) meeting of creditors notices. b 309b.

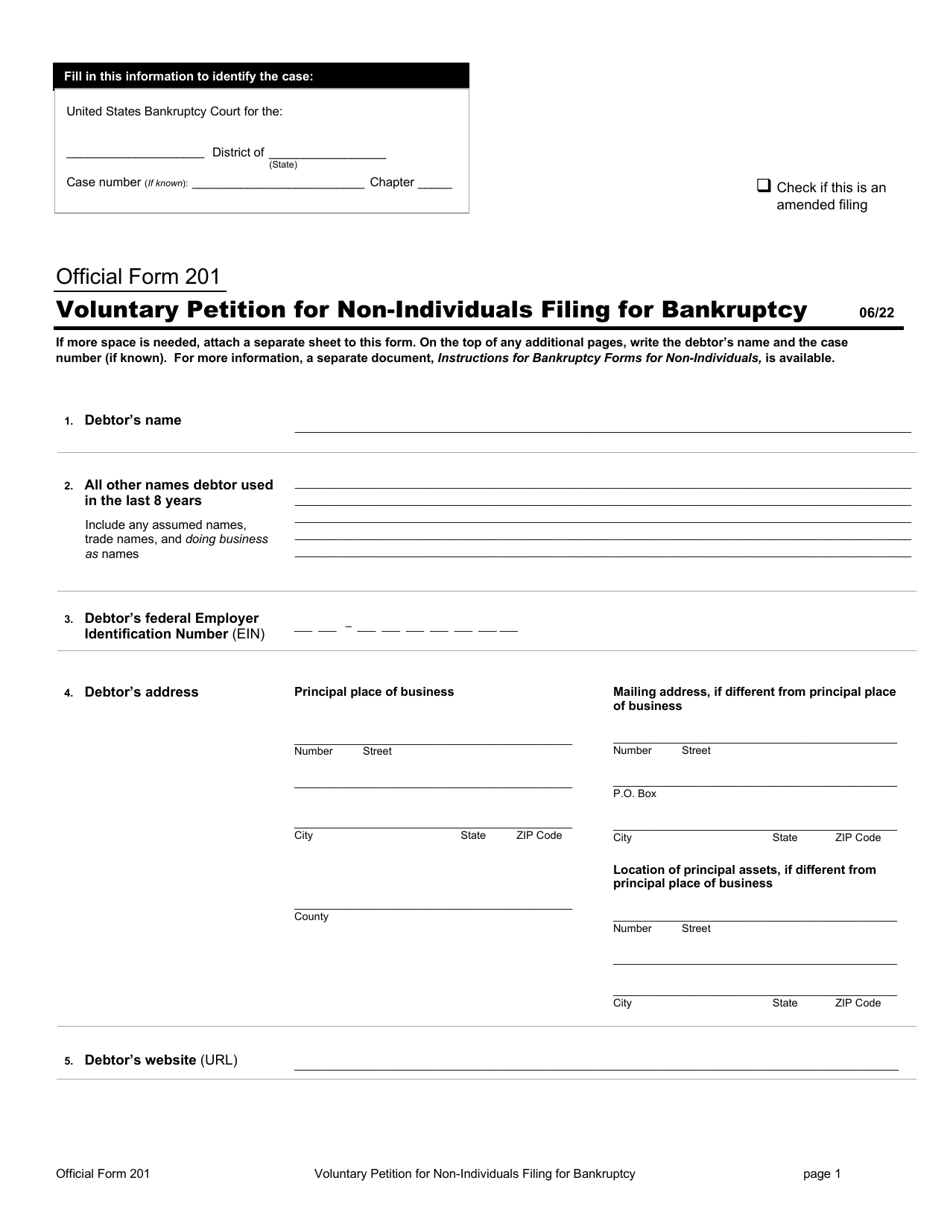

Download Instructions For Bankruptcy Forms For Non Individuals Pdf Voluntary petition for non individuals filing for bankruptcy. download form (pdf, 215.92 kb) form number: b 201. category: non individual debtors. effective onjune 22, 2024. this is an official bankruptcy form. official bankruptcy forms are approved by the judicial conference and must be used under bankruptcy rule 9009. Bankruptcy fraud is a serious crime. making a false statement, concealing property, or obtaining money or property by fraud in connection with a bankruptcy case can result in fines up to $500,000 or imprisonment for up to 20 years, or both. 18 u.s.c. §§ 152, 1341, 1519, and 3571. general instructions. Here's a list of the forms all individuals must file in chapter 7 bankruptcy. you'll notice that you have two means test form choices (the means test qualifies you for chapter 7). if you're exempt from taking the means test, use bankruptcy form 122a 1 supp. get debt relief now. we've helped 205 clients find attorneys today. The voluntary petition for individuals filing for bankruptcy form is the cover sheet for your paperwork. on it, you'll provide your name and address, as well as: your social security number. the name of any businesses you own. the bankruptcy chapter you intend to file. how you plan to pay the filing fee.

Download Instructions For Bankruptcy Forms For Non Individuals Pdf Here's a list of the forms all individuals must file in chapter 7 bankruptcy. you'll notice that you have two means test form choices (the means test qualifies you for chapter 7). if you're exempt from taking the means test, use bankruptcy form 122a 1 supp. get debt relief now. we've helped 205 clients find attorneys today. The voluntary petition for individuals filing for bankruptcy form is the cover sheet for your paperwork. on it, you'll provide your name and address, as well as: your social security number. the name of any businesses you own. the bankruptcy chapter you intend to file. how you plan to pay the filing fee. The last four years of tax returns. two to six months of bank and retirement statements. two to six months of paycheck stubs, if employed, and. if you own a business, one to two years of monthly and yearly profit and loss statements. the chapter 13 trustee can request other documents related to your finances. Form 204). fill out this form only if the debtor files under chapter 11. attachment to voluntary petition for non individuals filing for bankruptcy under chapter 11 (official form 201a). this form is filed only by non individual debtors who file under chapter 11 and who are required to file periodic reports (for example, forms.

Official Form 201 Download Printable Pdf Or Fill Online Voluntary The last four years of tax returns. two to six months of bank and retirement statements. two to six months of paycheck stubs, if employed, and. if you own a business, one to two years of monthly and yearly profit and loss statements. the chapter 13 trustee can request other documents related to your finances. Form 204). fill out this form only if the debtor files under chapter 11. attachment to voluntary petition for non individuals filing for bankruptcy under chapter 11 (official form 201a). this form is filed only by non individual debtors who file under chapter 11 and who are required to file periodic reports (for example, forms.

Comments are closed.