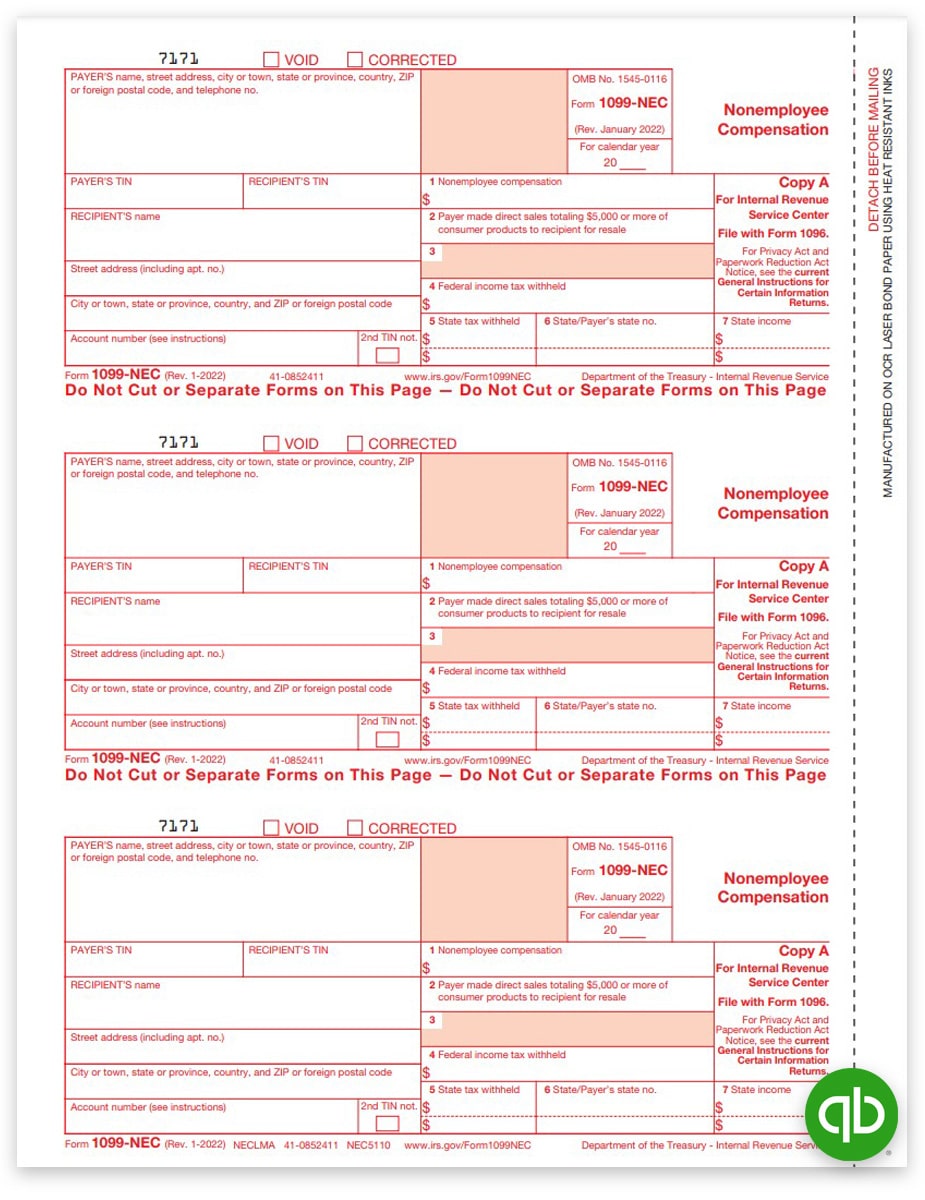

Intuit Quickbooks 1099 Nec Form Irs Copy A Discounttaxforms

Intuit Quickbooks 1099 Nec Form Irs Copy A Discounttaxforms 1099nec tax forms – quickbooks® compatible. use intuit® quickbooks® to print 1099 nec tax forms for 2023 to report non employee compensation. this 1099nec copy a form is mailed to the irs by a payer. order as few as 25 forms and get big discounts on larger quantities – no coupon needed! if you have 10 w2 and 1099 forms (combined) for. Compatible 2024 1099 tax forms for intuit® quickbooks® software. everyday discounts – no coupon code required! save big over intuit ® marketplace; small minimums; 100% quickbooks compatible; 1099 nec, misc, envelopes and e file; fast, friendly service from the tax form gals! 1099 e filing requirements — e file copy a for 10 1099 and w2.

Intuit Quickbooks 1099 Nec Form Irs Copy A Discounttaxforms Import your year end data from quickbooks® and we’ll do the rest! easy online 1099 & w2 filing – we print and mail recipient copies, and e file with the government. file new 1099 nec forms, w2 forms, corrections and more with just a few clicks. starting at just $4.75 per form with discounts for larger volumes. learn more. Quickbooks online can help you prepare your 1099s seamlessly, using the info you already have in your account. follow these steps to create and file your 1099s. when you file 1099s with us, we may email or mail a printed copy, to your contractors. step 1: create your 1099s. here’s how to get your 1099s ready to e file or print. To do that: create your 1099s in quickbooks. in the choose a filing method window, select the print 1099 nec or print 1099 misc button. specify the date range for the forms then choose ok. select all vendors you wish to print 1099s for. press on the print 1099 button. select print 1096s instead, if printing form 1096. On the left side menu, select income. click on the ss benefits, alimony, misc. income screen. select the form 1099 misc nec hyperlink at the top right of the input. enter the payer information from form 1099 nec. scroll down to the 1099 nec subsection. enter the box 1 amount in (1) nonemployee compensation. enter the box 4 amount in (4) federal.

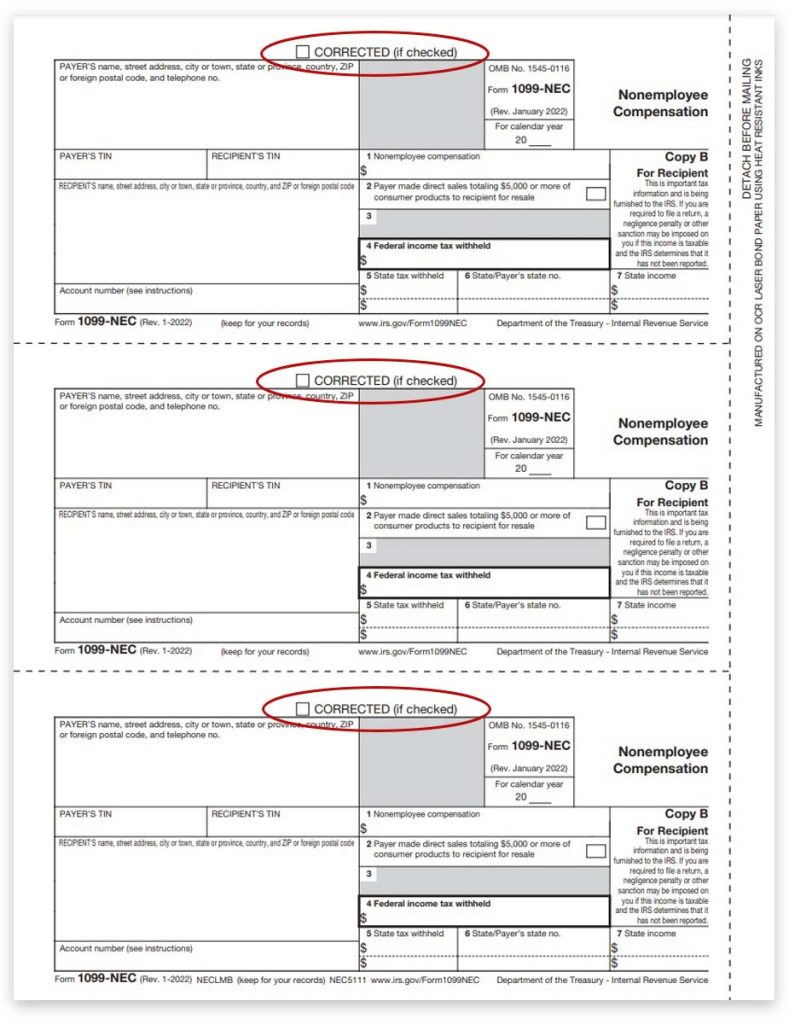

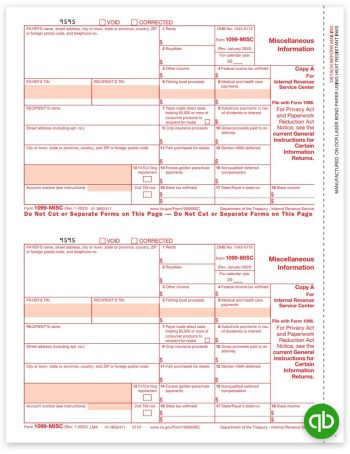

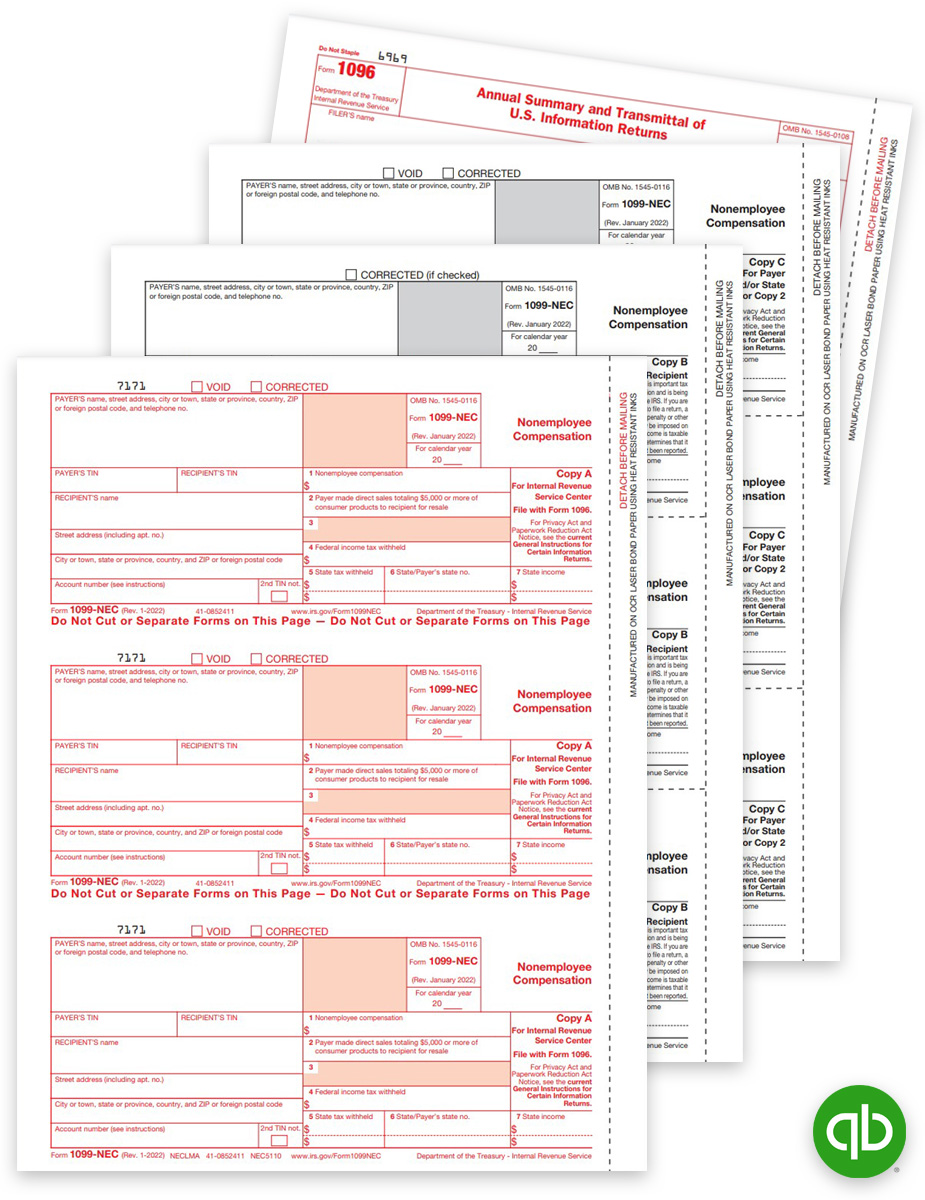

Intuit Quickbooks 1099 Nec Tax Forms Set 2022 Discounttaxforms To do that: create your 1099s in quickbooks. in the choose a filing method window, select the print 1099 nec or print 1099 misc button. specify the date range for the forms then choose ok. select all vendors you wish to print 1099s for. press on the print 1099 button. select print 1096s instead, if printing form 1096. On the left side menu, select income. click on the ss benefits, alimony, misc. income screen. select the form 1099 misc nec hyperlink at the top right of the input. enter the payer information from form 1099 nec. scroll down to the 1099 nec subsection. enter the box 1 amount in (1) nonemployee compensation. enter the box 4 amount in (4) federal. Starting at $58.99. use federal 1099 misc tax forms to report payments of $600 or more for rents, royalties, medical and health care payments, and gross proceeds paid to attorneys. these “continuous use” forms no longer include the tax year. quickbooks will print the year on the forms for you. each kit contains:. Step 3: submit the 1099 form. when you produce a 1099 nec, you provide copies of the form to different recipients: submit copy a to the irs with form 1096, which reports all 1099 forms issued to contractors, and the total dollar amount of payments. send copy 1 to your state’s department of revenue. provide copy b to the recipient (the.

Intuit Quickbooks 1099 Nec Tax Forms Set 2023 Discounttaxforms Starting at $58.99. use federal 1099 misc tax forms to report payments of $600 or more for rents, royalties, medical and health care payments, and gross proceeds paid to attorneys. these “continuous use” forms no longer include the tax year. quickbooks will print the year on the forms for you. each kit contains:. Step 3: submit the 1099 form. when you produce a 1099 nec, you provide copies of the form to different recipients: submit copy a to the irs with form 1096, which reports all 1099 forms issued to contractors, and the total dollar amount of payments. send copy 1 to your state’s department of revenue. provide copy b to the recipient (the.

Comments are closed.