Investment Options Definition Factors To Consider And Types

Investment Options Definition Factors To Consider And Types Investment options are financial assets that individuals or institutions can invest in to generate returns. these can include stocks, bonds, mutual funds, real estate, and more. investing is the process of allocating resources, often money, with the expectation of generating a profit or income over time. investments play a crucial role in. Definition of options. options are financial contracts that provide the right, but not the obligation, to buy or sell an underlying asset at a predetermined price and time. options trading allows investors to profit from market fluctuations and manage risk in their investment portfolios. options are commonly used to speculate on future price.

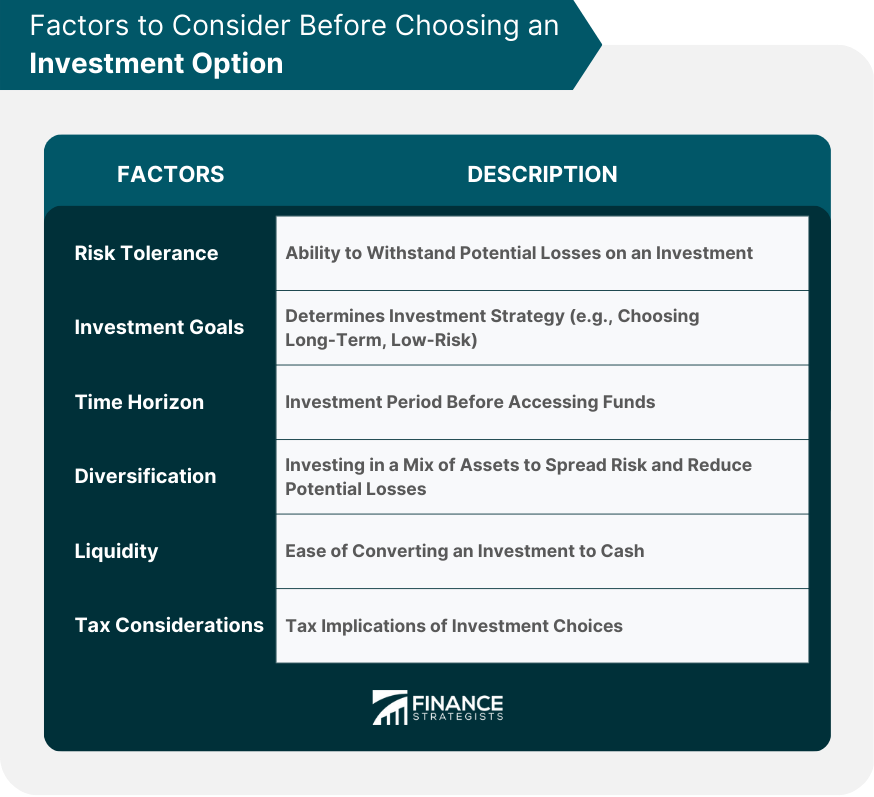

Investment Strategy Meaning Types Considerations Process A $1 increase in the stock’s price doubles the trader’s profits because each option is worth $2. therefore, a long call promises unlimited gains. if the stock goes in the opposite price. An investment strategy is a plan designed to help individual investors achieve their financial and investment goals. your investment strategy depends on your personal circumstances, including your. Level 1 strategies, such as covered calls and cash secured puts, involve risks like assignment and price volatility. level 2 strategies, including buying calls and puts, add further risks due to leverage, time decay, and the chance of losing the entire premium if options expire out of the money. There are various types of investments: stocks, bonds, mutual funds, index funds, exchange traded funds (etfs) and options. see which ones might work for you. updated mar 29, 2024 · 4 min read.

Comments are closed.