Ira And Retirement Plan Limits For 2021 60c

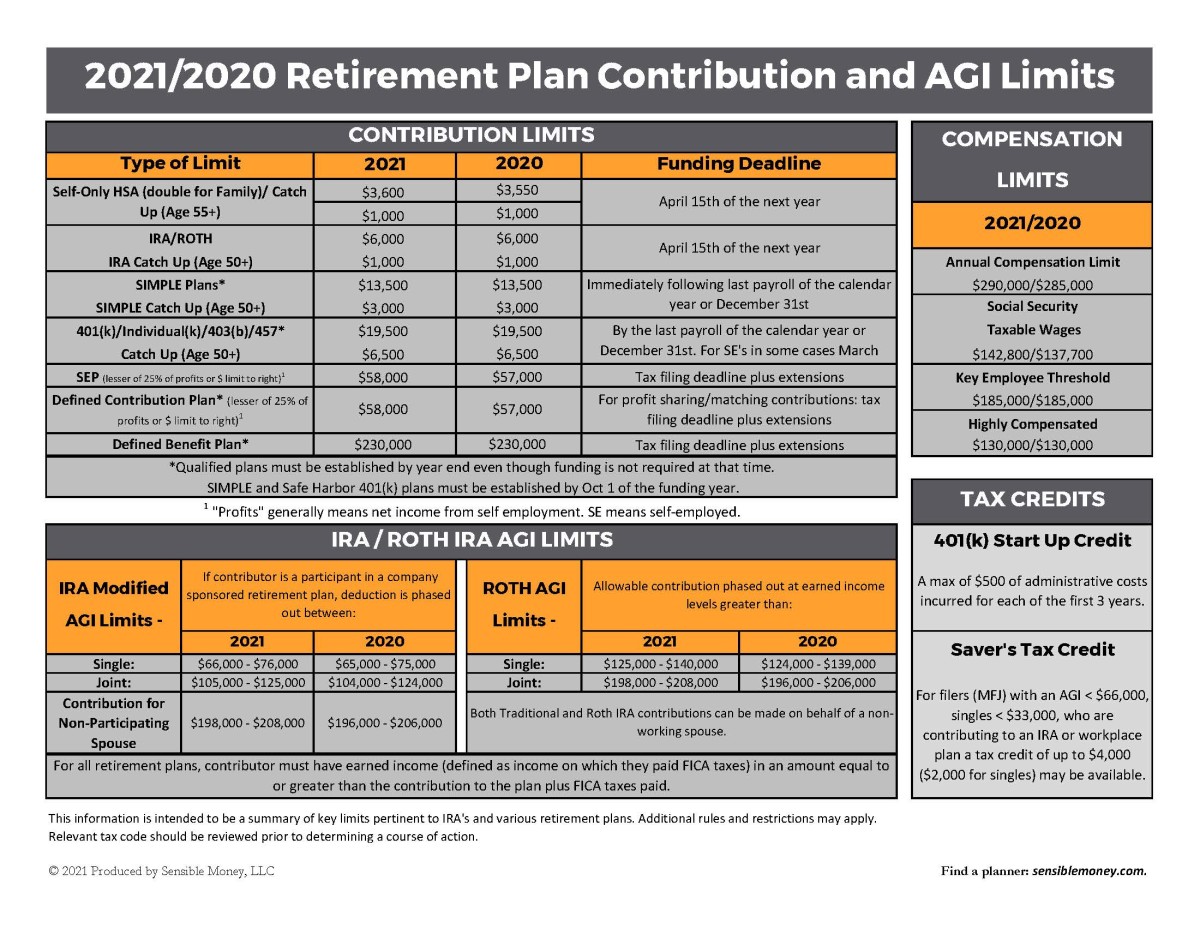

Ira And Retirement Plan Limits For 2021 60c Many of us have pre-tax accounts — according to 2021 US Census data you have to start taking RMDs on traditional IRA, SEP IRA, SIMPLE IRA and retirement plan accounts at age 72 or 73 which are tied to income limits If you're single and don't participate in a retirement plan at work, you can make a tax-deductible IRA contribution for 2021 of up to $6,000 ($7,000 if you're 50

Ira And Retirement Plan Limits For 2021 60c I use a SEP-IRA for my retirement savings If you qualify, these accounts have much higher contribution limits than traditional if you have a pension plan or a 401(k) with a generous employer Confused about your rights to your spouse's IRA the 2021 article Here’s “David’s” backstory: When he retired in 2023 he had several options for his retirement savings plan offered A backdoor Roth IRA is not officially one of the best retirement plans, but rather a way for high-income taxpayers to fund a Roth IRA despite exceeding traditional income limits Converting a These changes affect retirement the 529 plan beneficiary), some people may be able to rollover a 529 plan that they have maintained for at least 15 years to a Roth IRA Annual limits for

Ira And Retirement Plan Limits For 2021 60c A backdoor Roth IRA is not officially one of the best retirement plans, but rather a way for high-income taxpayers to fund a Roth IRA despite exceeding traditional income limits Converting a These changes affect retirement the 529 plan beneficiary), some people may be able to rollover a 529 plan that they have maintained for at least 15 years to a Roth IRA Annual limits for You generally can open an IRA as long as you have earned income, even if you have a 401(k) plan or another workplace retirement account But note that income limits may apply to deducting The two main IRA types are who is covered by a plan at work $10,000 or more None Contribution limits exist for a reason, and sneaking extra money into your retirement account won’t sit you’ll be allowed to tuck away a little extra in an individual retirement account (IRA) next year The IRS recently announced the 2024 IRA contribution limits, which are $500 more than the The Internal Revenue Service (IRS) has announced several increases to retirement plan limits for 2024, including higher contribution limits for 401(k), 403(b), and IRA plans These changes reflect

Ira And Retirement Plan Limits For 2021 60c You generally can open an IRA as long as you have earned income, even if you have a 401(k) plan or another workplace retirement account But note that income limits may apply to deducting The two main IRA types are who is covered by a plan at work $10,000 or more None Contribution limits exist for a reason, and sneaking extra money into your retirement account won’t sit you’ll be allowed to tuck away a little extra in an individual retirement account (IRA) next year The IRS recently announced the 2024 IRA contribution limits, which are $500 more than the The Internal Revenue Service (IRS) has announced several increases to retirement plan limits for 2024, including higher contribution limits for 401(k), 403(b), and IRA plans These changes reflect The primary differences in employer-sponsored retirement plans such as the 401(k), 403(b), SIMPLE IRA, SEP IRA or Pension Plan lies in eligibility criteria, contribution limits, and employer

Comments are closed.