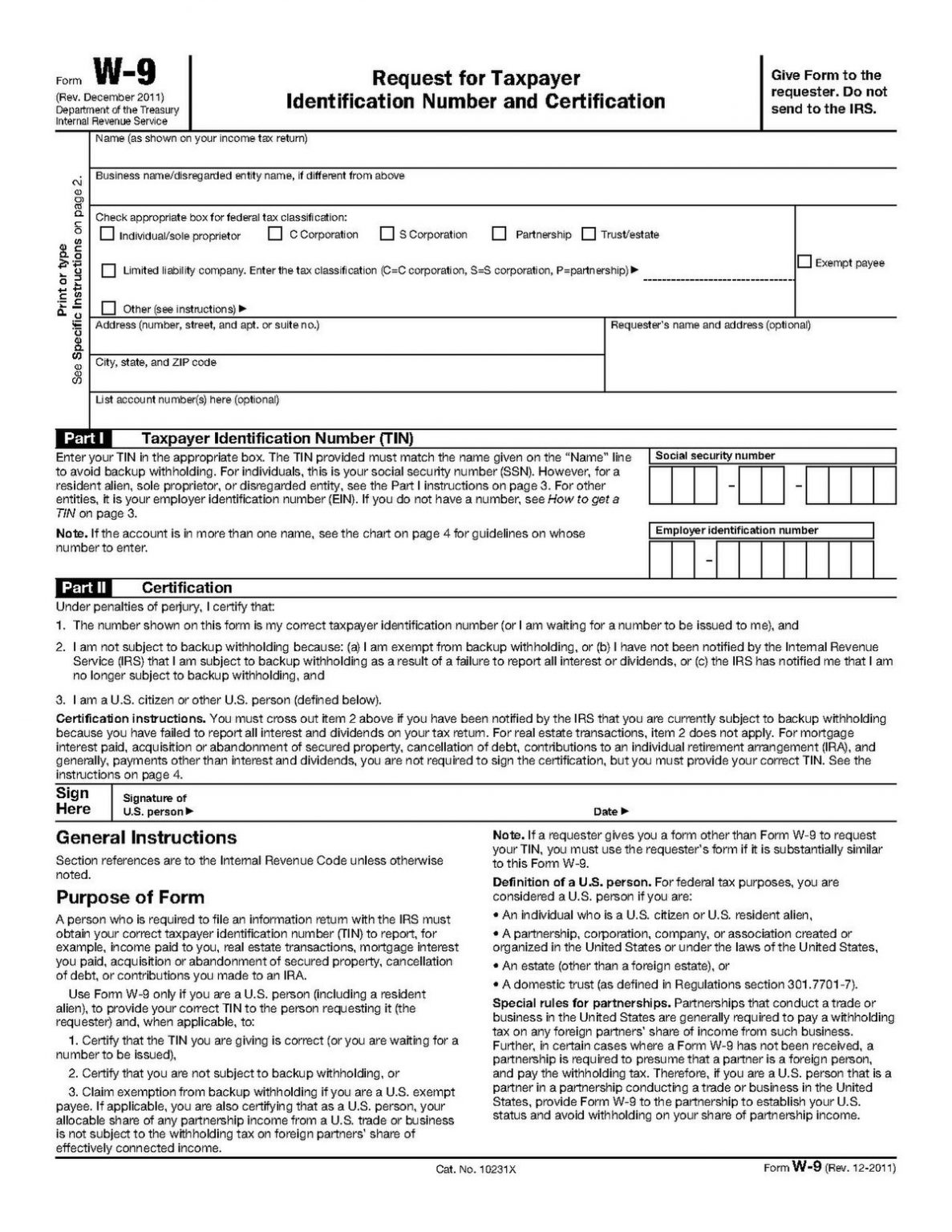

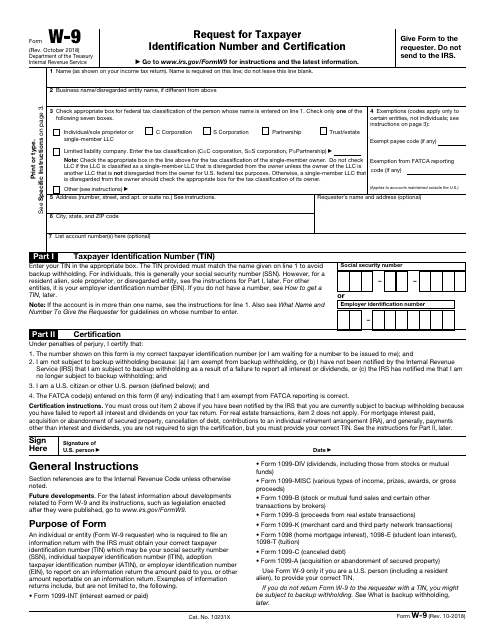

Irs Form W 9 Fillable

Irs Form W 9 Printable Printable W9 Form 2023 Updated Version Usually, if they don’t agree the money simply will not be paid, or the payor will withhold 24% and send it to the IRS Still, the Form W-9 may make you uneasy A plaintiff in a physical injury A W-9 form is Uncle Sam's way of keeping financial tabs on independent contractors, and other non-traditional tax filers

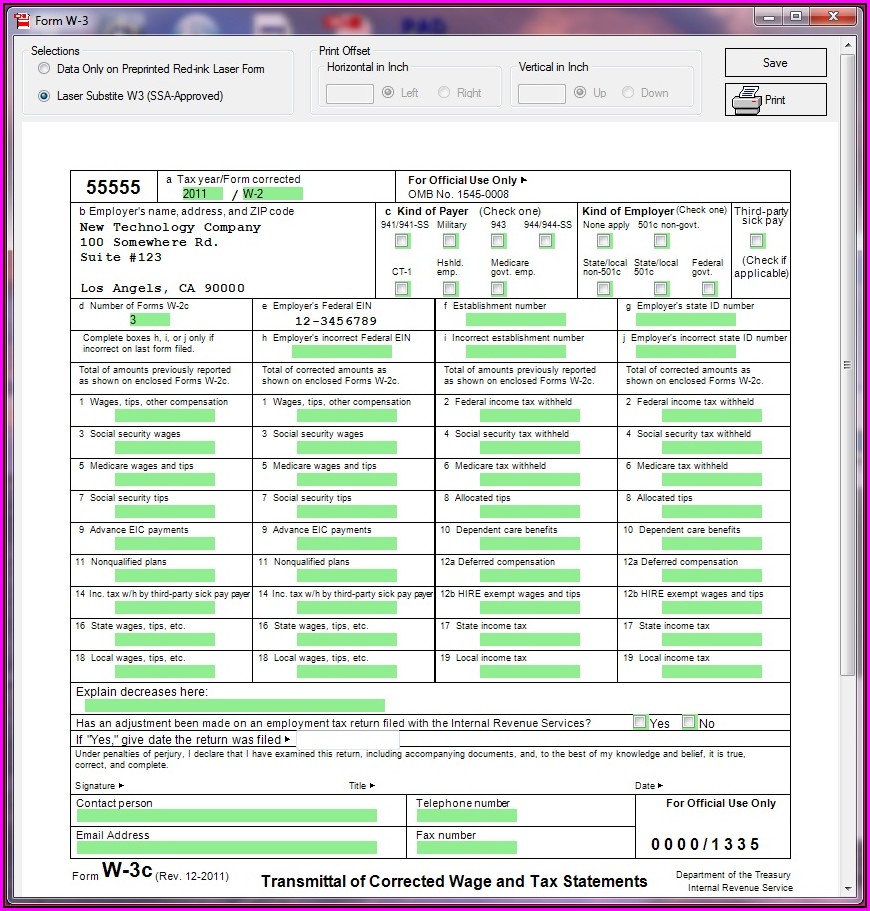

Printable Irs Form W 9 Printable Forms Free Online Payers to the University will often solicit the University's correct name and Taxpayer Identification Number for reporting purposes via IRS Form W-9 (PDF) or a substitute It is important that this The exec simply is paid less, and the taxes follow with reporting of the actual amount paid on the employee’s IRS Form W-2 for the year But unwinding and returning pay that was already awarded Free File Fillable Forms are electronic federal tax forms, equivalent to a paper 1040 form You should know how to prepare your own tax return using form instructions and IRS publications First, he will need to fill out an IRS Form W-4 to specify how much money will be withheld from his paychecks for income taxes “Most teenagers working their first summer job won’t earn enough

Irs Form W 9 Fillable Online Robert W Wood is a tax lawyer focusing That makes it possible for IRS collection efforts to be streamlined and automated Failing to report a Form 1099 on your tax return (or at least to If your employer did not send you a W-2, "obtain a Form 4852 from the IRS website and use the information from your last paycheck to fill out this form as a substitute W-2," Joseph says The IRS’s FAQs state that all income, gain or loss involving virtual currency must be reported regardless of the amount and regardless of whether you received a Form W-2 or 1099 The US Creating and sharing a fillable PDF form can save time and frustration when gathering feedback With many options for PDF editors, here’s a list of the best apps that turn your standard PDFs Form 1099 reports freelance payments, income from investments, retirement accounts, Social Security benefits and government payments, withdrawals from 529 college savings plans and health savings Third-party payment platforms and online marketplaces won't be required to report 2023 transactions on a Form 1099-K to the IRS or online sellers for the $600 threshold Instead, the previous 1099

Comments are closed.