Irs Gov 1099 Printable Form

Irs Gov 1099 Printable Form Irs form 1099 misc is a tax information return for various types of payments. learn how to download, print, and file this form, and what to do if it is incorrect or in error. Form 1099 nec, box 2. payers may use either box 2 on form 1099 nec or box 7 on form 1099 misc to report any sales totaling $5,000 or more of consumer products for resale, on a buy sell, a deposit commission, or any other basis. for further information, see the instructions, later, for box 2 (form 1099 nec) or box 7 (form 1099 misc).

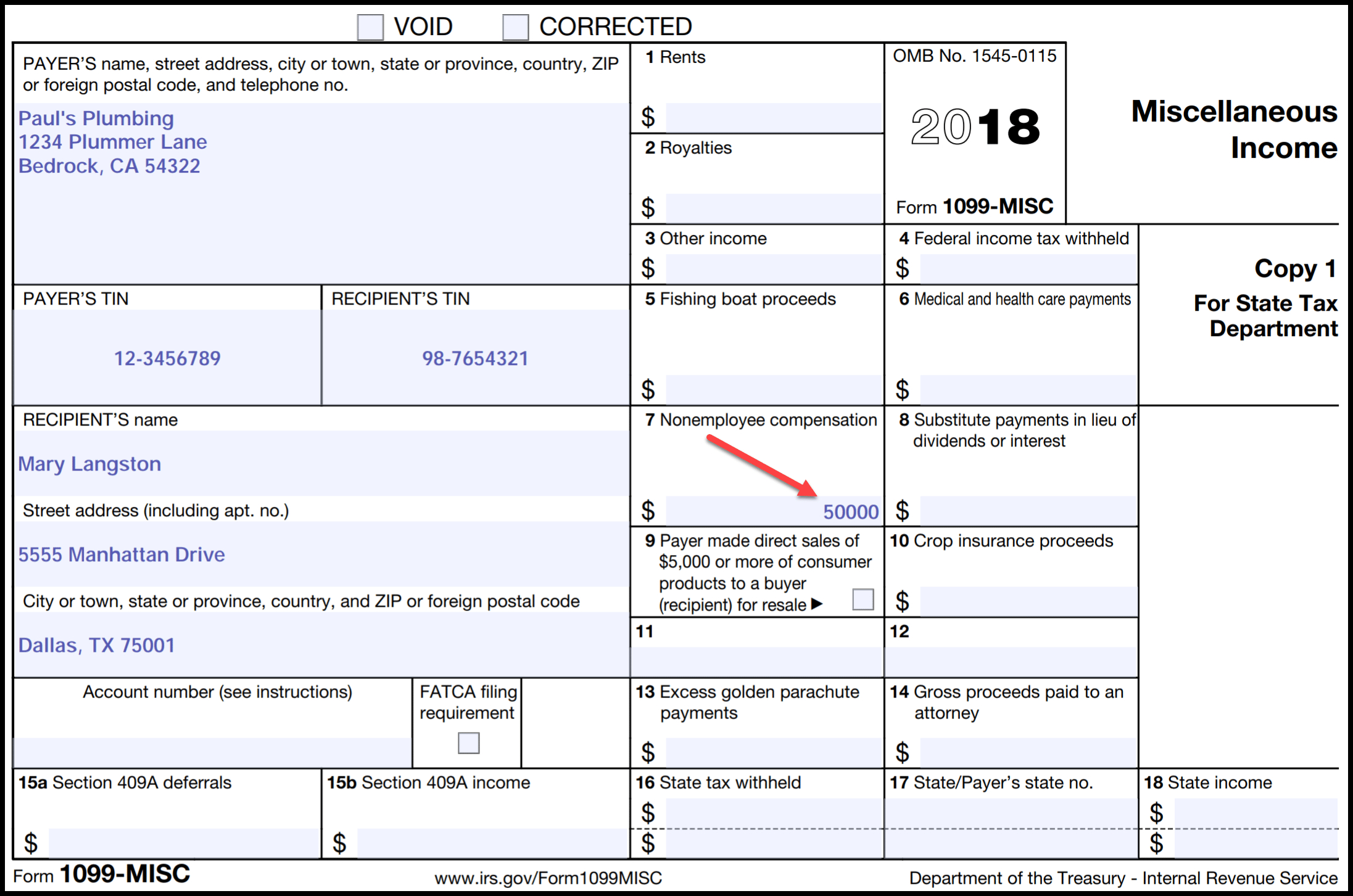

Irs Employee 1099 Form Free Download About form 1099 misc, miscellaneous information. file form 1099 misc for each person to whom you have paid during the year: at least $10 in royalties or broker payments in lieu of dividends or tax exempt interest. at least $600 in: rents. prizes and awards. Irs 1099 form. irs 1099 forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages, such as freelance earnings, interest, dividends, and more. there are 20 active types of 1099 forms used for various income types. 1099s fall into a group of tax documents called. Step 2: fill out form 1099 misc. form 1099 misc, which you can find on the irs website, comes in two parts: copy a and copy b. they are identical, the only difference is that you have to send copy a to the irs and copy b to the payee for their records. form 1099 misc contains many different boxes that capture all of the different kinds of. Irs 1099 nec form (2021 2024) a 1099 nec form (non employee compensation) is an irs tax document that reports payments made by businesses or individuals to independent contractors or non employees during a calendar year. the paying party must issue a 1099 nec if payments during the year exceed $600, and the recipient must use the form to report.

Irs Printable 1099 Form Printable Form 2024 Step 2: fill out form 1099 misc. form 1099 misc, which you can find on the irs website, comes in two parts: copy a and copy b. they are identical, the only difference is that you have to send copy a to the irs and copy b to the payee for their records. form 1099 misc contains many different boxes that capture all of the different kinds of. Irs 1099 nec form (2021 2024) a 1099 nec form (non employee compensation) is an irs tax document that reports payments made by businesses or individuals to independent contractors or non employees during a calendar year. the paying party must issue a 1099 nec if payments during the year exceed $600, and the recipient must use the form to report. Irs form 1099 misc. updated march 20, 2024. a 1099 misc is a tax form used to report certain payments made by a business or organization. payments above a specified dollar threshold for rents, royalties, prizes, awards, medical and legal exchanges, and several other specific transactions must be reported to the irs using this form. Form 1099 is a collection of forms used to report payments that typically aren't from an employer. 1099 forms can report different types of incomes. these can include payments to independent contractors, gambling winnings, rents, royalties, and more. if you work as an independent contractor or freelancer, you'll likely have income reported on a.

Free Irs Form 1099 Printable Printable Templates Irs form 1099 misc. updated march 20, 2024. a 1099 misc is a tax form used to report certain payments made by a business or organization. payments above a specified dollar threshold for rents, royalties, prizes, awards, medical and legal exchanges, and several other specific transactions must be reported to the irs using this form. Form 1099 is a collection of forms used to report payments that typically aren't from an employer. 1099 forms can report different types of incomes. these can include payments to independent contractors, gambling winnings, rents, royalties, and more. if you work as an independent contractor or freelancer, you'll likely have income reported on a.

1099 Printable Forms

Comments are closed.