Irs Taxable Social Security Calculator Internal Revenue Code Simplified

Irs Taxable Social Security Calculator Internal Revenue Code Simplified Since the Internal Revenue Service (IRS) considers a self-employed At What Age Is Social Security Not Taxable? Social Security is always taxable, regardless of age Your income in any given Social Security benefits are included in your adjusted This amount serves as the starting point for calculating your taxable income and tax liability Here are four additional uses for your

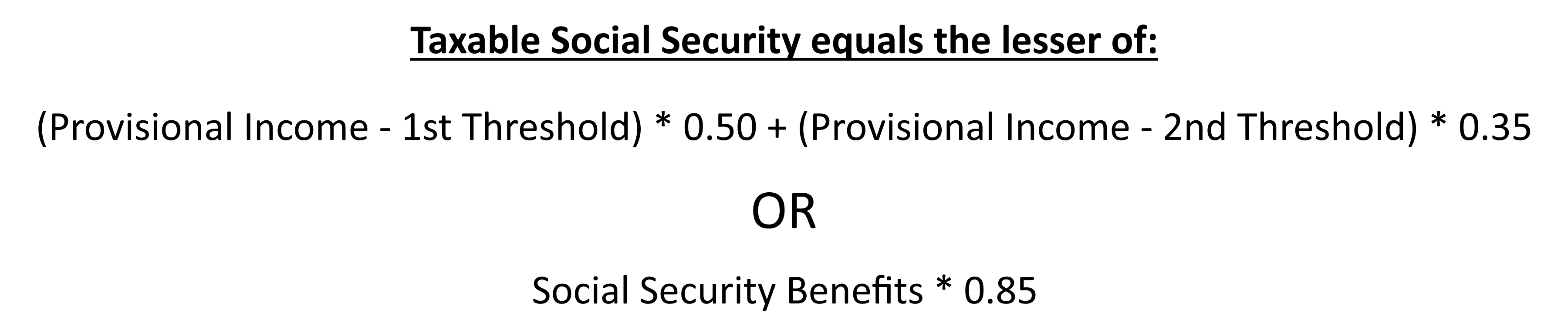

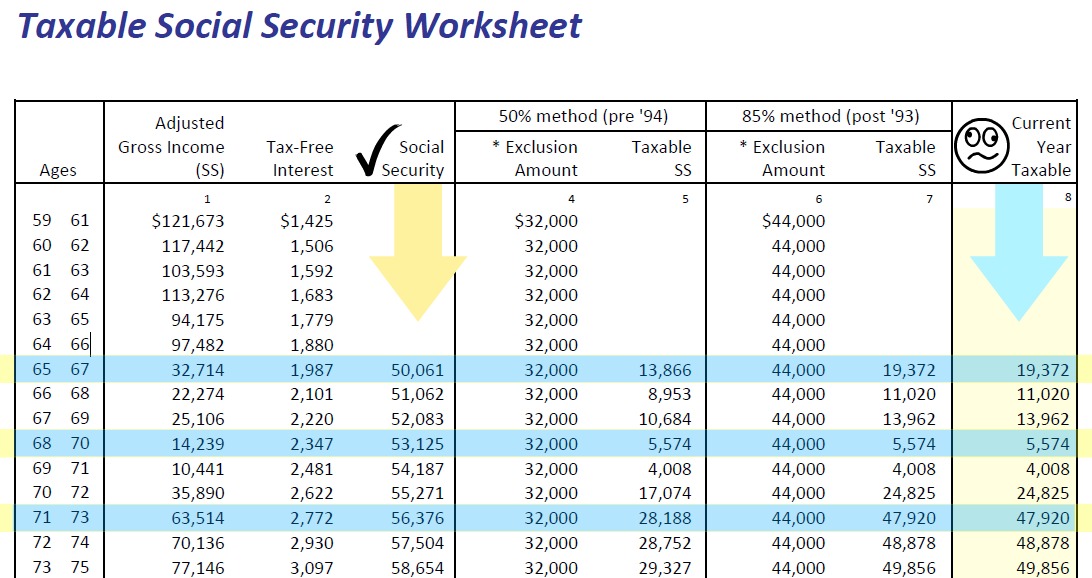

How To Calculate Taxable Social Security Form 1040 Line 6b вђ Marotta Social Security base amount determined by the Internal Revenue Service (IRS) ($25,000 for 2024 and 2023), then a portion of the benefits are taxable Social Security benefits are paid to Contact the Internal Revenue Service if If a thief uses your Social Security number to get a job, owed taxes may show up on your record Visit the IRS's guide to identify theft to dispute Millions of Social Security Income The new system will start in December with an online application that streamlines the process, according to the agency's statement A simplified initial up to 85% of Social Security benefits can be taxed by the IRS at ordinary income tax rates Pensions: Pension payments are generally fully taxable as ordinary income unless you made after-tax

Taxable Social Security Benefits Calculator Irs Taxablesocialsecurity Millions of Social Security Income The new system will start in December with an online application that streamlines the process, according to the agency's statement A simplified initial up to 85% of Social Security benefits can be taxed by the IRS at ordinary income tax rates Pensions: Pension payments are generally fully taxable as ordinary income unless you made after-tax Contact the IRS to prevent others from using your Social Security number to file a tax return to steal your refund Call 1-800-908-4490 or visit Identity Theft Central The Better Business Bureau The IRS rule for taxes on your Social Security benefits are as follows: Individual tax filers with a combined income between $25,000 and $34,000 may have to pay income tax up to 50% of Social

How To Calculate Taxable Social Security Form 1040 Line 6b вђ Marotta Contact the IRS to prevent others from using your Social Security number to file a tax return to steal your refund Call 1-800-908-4490 or visit Identity Theft Central The Better Business Bureau The IRS rule for taxes on your Social Security benefits are as follows: Individual tax filers with a combined income between $25,000 and $34,000 may have to pay income tax up to 50% of Social

Comments are closed.