Liability Vs Full Coverage Which Auto Insurance Do You Need

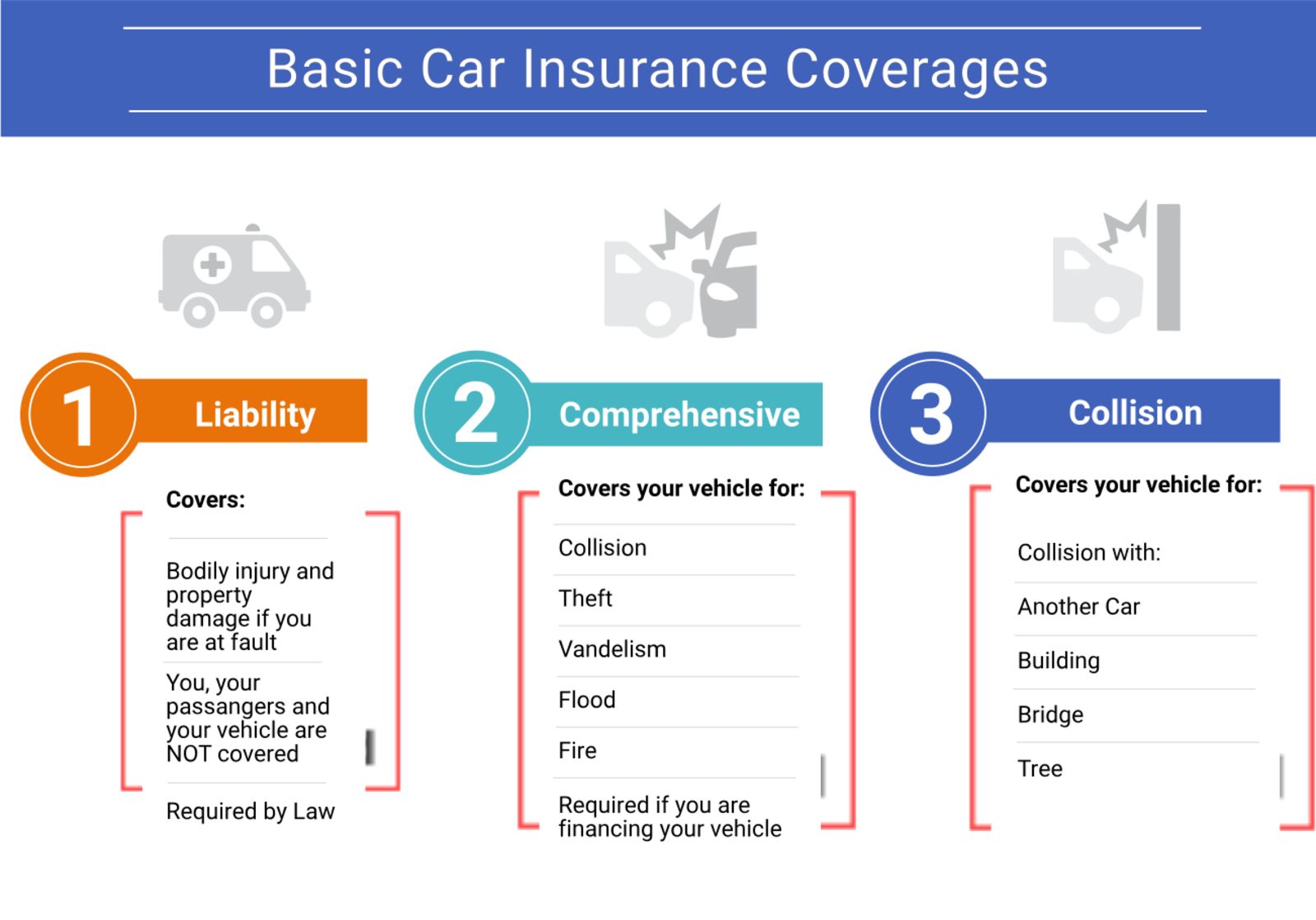

All The Different Types Of Car Insurance Coverage Policies Explained Here’s what that means: 25 represents $25,000 of bodily injury liability for one person per accident. 50 represents $50,000 of bodily injury liability total for one accident. 10 represents. The difference between liability and full coverage is that liability covers only injuries and damages to others for which you are responsible. full coverage includes liability but adds additional coverage to protect your car. last updated: sep 3, 2024 7 min read. compare quotes in less than 5 minutes.

Liability Vs Full Coverage Car Insurance Key Differences Full coverage car insurance typically includes a combination of protections: liability coverage: liability coverage for injuries and property damage that you cause. collision coverage: this covers. Liability insurance is almost always required, while full coverage is only required when you finance or lease a vehicle and a few other circumstances. the right amount of coverage for you will. Full coverage policies includes liability insurance and protection to cover damage to your own vehicle. in most states, you are required to have a minimum amount of liability coverage. full coverage includes your state's required liability coverage plus comprehensive and collision coverage. it's typically only required if you lease or finance. With liability, insurance will pay others when you’re at fault for an accident. full coverage ensures that you also can receive financial compensation to repair or replace your car. if you’re leasing your car, it’s still being paid on, or it’s quite valuable, then you probably need full coverage. but if you own your car free and clear.

If You Finance A Used Car Do You Need Full Coverage At Mar Full coverage policies includes liability insurance and protection to cover damage to your own vehicle. in most states, you are required to have a minimum amount of liability coverage. full coverage includes your state's required liability coverage plus comprehensive and collision coverage. it's typically only required if you lease or finance. With liability, insurance will pay others when you’re at fault for an accident. full coverage ensures that you also can receive financial compensation to repair or replace your car. if you’re leasing your car, it’s still being paid on, or it’s quite valuable, then you probably need full coverage. but if you own your car free and clear. When comparing the difference between "full coverage" and liability, keep in mind these basics: liability coverage is for injuries and damage to others when you're at fault. full coverage often refers to liability and other state required coverages plus damage to your car (comprehensive and collision), but it is not an actual insurance coverage. Liability only vs. full coverage insurance. simply put, liability only car insurance is a type of policy that only provides coverage for injury and damages you cause to another vehicle or another.

Liability Vs Full Coverage Car Insurance Key Differences When comparing the difference between "full coverage" and liability, keep in mind these basics: liability coverage is for injuries and damage to others when you're at fault. full coverage often refers to liability and other state required coverages plus damage to your car (comprehensive and collision), but it is not an actual insurance coverage. Liability only vs. full coverage insurance. simply put, liability only car insurance is a type of policy that only provides coverage for injury and damages you cause to another vehicle or another.

Comments are closed.