Loan Process Chicago Home Loans

Loan Process Chicago Home Loans The median price of a home within the city limits was $334,000 as of march 2023, according to data from illinois realtors, and in the greater metro area it was $310,000. both are comfortably below. Your 8 step guide to the home loan process. follow these eight steps to get a mortgage loan and become a new homeowner. 1. figure out what you can afford. before you begin the mortgage process, it's important to assess your finances and make sure you’re ready to purchase a home. with a new monthly mortgage payment, it’s crucial to know if.

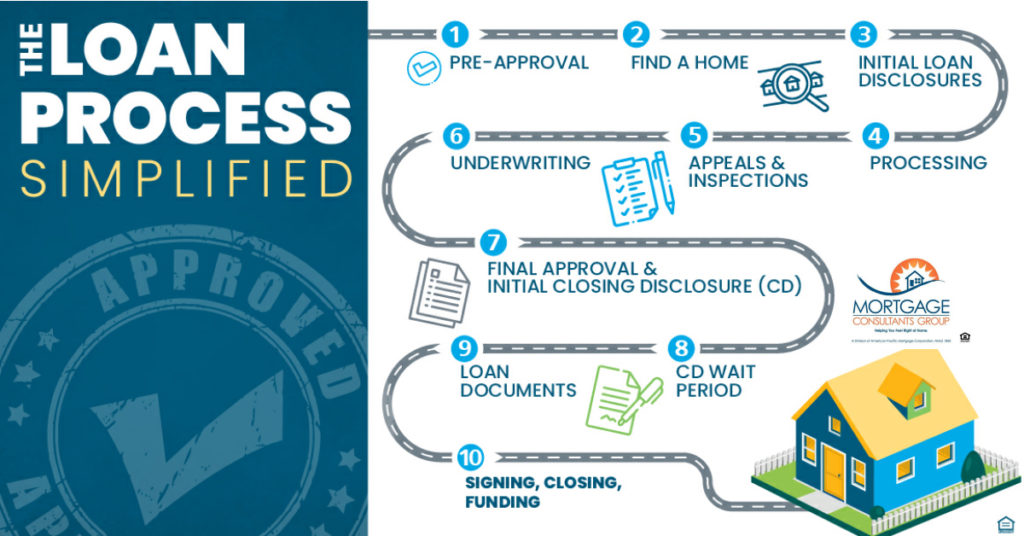

When Buying Your New Home These Are 10 Steps In The Loan Process Step 9: decide on a lender. apply formally to multiple lenders: after your offer is accepted, you can submit formal mortgage applications to various lenders. provide the necessary financial documents to each lender for a detailed loan estimate. receive loan estimates: compare the loan estimates from different lenders. 5. complete a full mortgage application. after selecting a lender, the next step is to complete a full mortgage loan application. most of this application process was completed during the pre. Loan has funded. 1. mortgage application is submitted to processing. the mortgage consultant collects and verifies all documents necessary to prepare the loan file for underwriting. these documents provide us with everything that we need to know about you (the borrower), and the property you are financing. Get your free credit score with lendingtree spring. 2. get a mortgage preapproval and gather your financial documents. if you’re serious about buying a home, the next step is to get a mortgage preapproval. a mortgage preapproval is based primarily on your “credit” profile, which includes your credit, income and savings history.

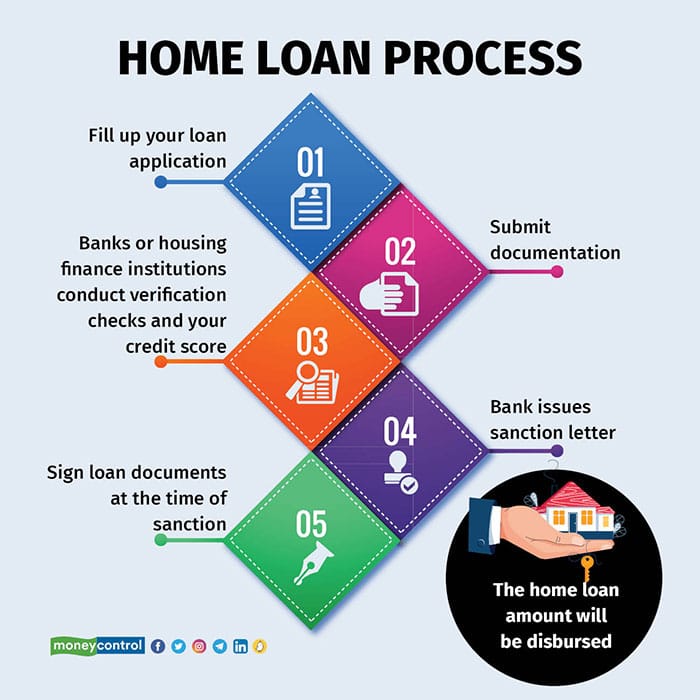

Applying For A Home Loan How Sanctioned Amount Is Different From Loan has funded. 1. mortgage application is submitted to processing. the mortgage consultant collects and verifies all documents necessary to prepare the loan file for underwriting. these documents provide us with everything that we need to know about you (the borrower), and the property you are financing. Get your free credit score with lendingtree spring. 2. get a mortgage preapproval and gather your financial documents. if you’re serious about buying a home, the next step is to get a mortgage preapproval. a mortgage preapproval is based primarily on your “credit” profile, which includes your credit, income and savings history. 30 year fixed rate. “. today’s mortgage rates in chicago, il are 5.888% for a 30 year fixed, 4.989% for a 15 year fixed, and 7.554% for a 5 year adjustable rate mortgage (arm). shopping for. It generally takes 30 – 60 days to complete the mortgage loan process, from the day you sign the purchase agreement to the day you sign the closing papers on the home. you can help speed up the mortgage process by turning in all your documentation on time, at your lender’s request. this is one aspect of the mortgage process over which you.

Steps Of The Home Loan Process Infographic вђ Paid Post 30 year fixed rate. “. today’s mortgage rates in chicago, il are 5.888% for a 30 year fixed, 4.989% for a 15 year fixed, and 7.554% for a 5 year adjustable rate mortgage (arm). shopping for. It generally takes 30 – 60 days to complete the mortgage loan process, from the day you sign the purchase agreement to the day you sign the closing papers on the home. you can help speed up the mortgage process by turning in all your documentation on time, at your lender’s request. this is one aspect of the mortgage process over which you.

Comments are closed.